The FOMC decided to cut the interest rate for the first time in 10 years

On Wednesday, the 31st of July 2019, the Federal Reserve in the US and more specifically the Federal Open Market Committee chaired by Jerome Powell, announced the first cut in the federal funds rate in more than a decade, by 25 basis points to 2.25 per cent. The decision was announced amidst slowing growth, both internal and global, and also intensifying protectionist policies in China and the US, which impede the free trade and unobstructed economic growth.

In his post-meeting statement before representatives of the media, Jerome Powell attributed three main factors which have ultimately compelled the FOMC to reach this decision. Firstly, subdued inflation pressures have deteriorated in the second quarter of the year and because of the crippling consumer spending environment, a more accommodative monetary policy is needed to support a more robust price setting. Jerome Powell argued that:

“[…] domestic inflation pressures remain muted, and global disinflationary pressures persist. Wages are rising, but not at a pace that would put much upward pressure on inflation. We are mindful that inflation’s return to 2 percent may be further delayed, and that continued below-target inflation could lead to a worrisome and difficult-to-reverse downward slide in longer-term expectations.”

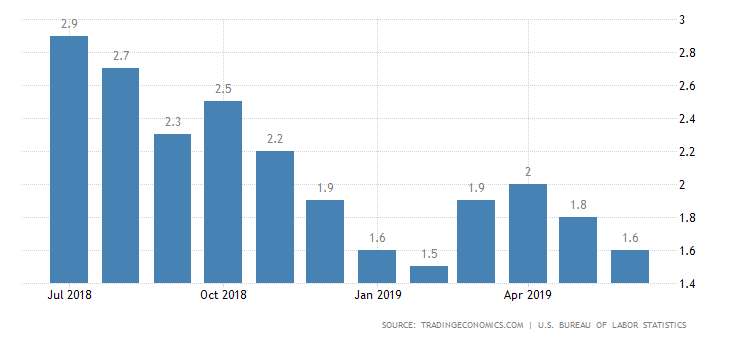

Thus, the most pressing issue for the FED at the present rate is to implement a monetary stance which has to drive inflation back towards the 2 per cent symmetric target level without allowing for any further deteriorations, which can be somewhat impeded by the ramifications from the other two listed reasons for the FOMC’s ultimate decision.

Secondly, global trade uncertainties stemming from the implications from Donald Trump’s so-called trade war with China and other allies have inhibited the steady rate of global economic growth and in doing so, these free-trade woes are starting to exert a heavy toll on the rate of American GDP growth as well.

In addressing a question imposed by Jeanna Smialek with the New York Times regarding the FOMC’s conviction in the sufficiency of just a 25 basis points reduction of the federal funds rate, Jerome Powell stated that:

“To ensure against downside risks, to provide support to the economy that those factors are pushing down on economic growth, and then to support inflation. So we do think it will serve all of those goals, but again, we’re thinking of it as essentially in the nature of a midcycle adjustment to policy”

Consequently, the FED recognizes the existence of the downside risks to economic growth resulting from heightened global trade tensions, but it also perceives them as a necessary condition to the otherwise common nature of this mid-cycle stage.

Thirdly, the Committee partially attributed the stagnating global growth to waning manufacturing in China and Europe, as well as rapidly falling rate of investment by frightened investors, who are discouraged by the prevailing uncertainty.

“But manufacturing output has declined for two consecutive quarters, and business fixed investment fell in the second quarter. Foreign growth has disappointed, particularly in manufacturing, and notably in the euro area and China. In response to this weakness, many central banks around the world are increasing policy accommodation or contemplating doing so."

With all of these factors in mind, the primary goal before the FOMC is to restore the growth momentum in the economy by incorporating a more accommodative monetary stance. The expectation is for the short-term mid-cycle stagnation to be replaced by a renewed sizable growth, especially after the trade tensions settle down eventually.

Thus, Jerome Powell pointed out that the implemented changes to the federal funds rate are structured in such a way as to serve partially as a ‘management point’, which is introduced with the intention to counter the downside risk from trade uncertainties. He also assured the media that the recent changes are not as drastic as one might think, and they represent more of ‘mid-cycle adjustments’ as opposed to a major transformational transition from the recent monetary stance of the FED.

Conversely, the FED’s primary goal is to support a pick-up in consumer spending so that inflationary pressures can start to appreciate once again, and respectively, the inflation rate can return to near the 2 per cent symmetric target level. As regards employment, the FED would undoubtedly like to observe a continuation of the strong performance of the US labour market, which currently operates at full-employment, meanwhile the monetary policy is expected to continue supporting rising employee earnings, which is a factor of pivotal importance for achieving sustained consumer spending.

The FOMC has outlined clear and decisive policy-goals for itself, which have to be achieved in the mid-term in order for the FED to classify the recent monetary interventions as being ultimately successful. However, the question is how would the FED evaluate the efficiency of the policy as the resulting effects start to take place, and what projections can be derived now about the future prospects for growth of the American economy?

The illusion of a strong labour market

At first glance the employment numbers have been consistently strong in the past quarter, however, there are certain hidden dangers to the US labour market and a failed monetary policy now can lead to detrimental ramifications for US workers in the future.

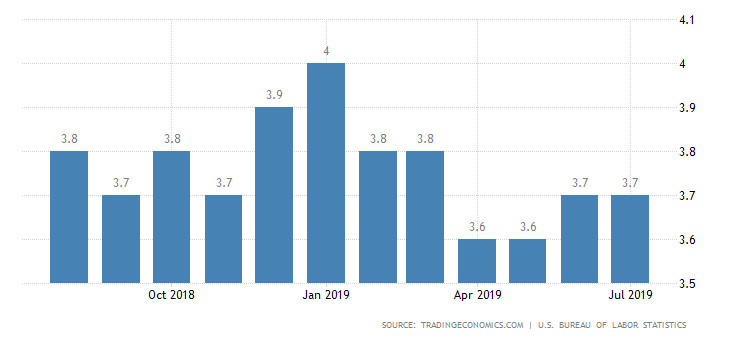

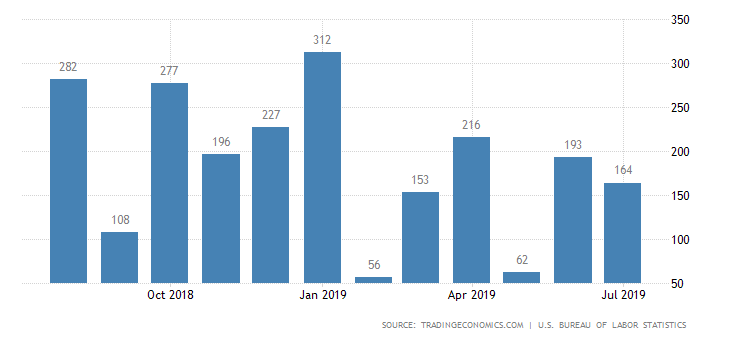

The overall unemployment rate has jumped only slightly with 0.1 per cent from 3.6 per cent in April to 3.7 per cent in July and observably the US economy has been able to consistently create new job openings for the same period. The non-farm payrolls data reveals that the total employment numbers have increased with more than 600 000 since April, which under different circumstances would be perceived as a very strong performance.

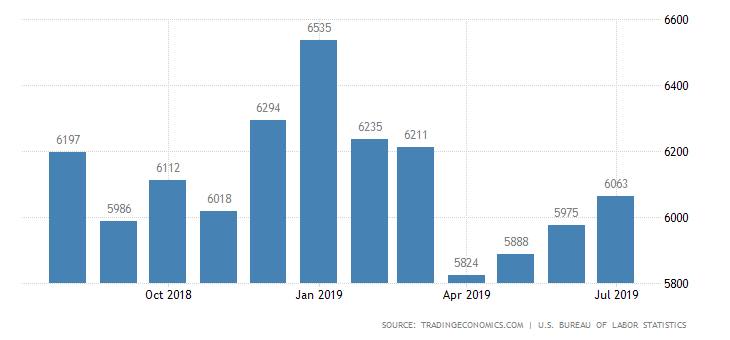

The hidden issue stems from the fact that those 600 000 thousand new job openings have been mostly filled by workers who have left their previous jobs. The US economy has been observing heightened transitions of workers from one sector to another, which admittedly could be advantageous to the overall labour market, provided that those workers are specialists who have moved to new careers in sectors that are closer to their own field of expertise. However, while such adjustments have been occurring throughout the second quarter of the year, the aggregate number of unemployed people has been steadily rising as well.

Consequently, the number of unemployed persons in the US has risen from 5.8 million in April to more than 6 million in July, and while these numbers do not constitute any serious threats at the moment, if the current trend of gradually appreciating unemployment is allowed to persist then in the future the labour market would no longer be sustainable, and the unemployment rate might divert from the current state of full-employment.

Another somewhat worrisome factor is the rate of wage growth, as it was pointed above. Earnings have been rising but at an arguably slow pace, which in turn hinders the price setting in the US economy, as consumers remain cautious and thus the aggregate demand remains subdued.

The dangerous game of cat and mouse that Trump and Powell play with each other

In his post-decision speech, Powell argued that it is not the FOMC’s job to review and assess the efficiency of the country’s foreign trade policy, and yet, the FED has to address the current economic uncertainties resulting from the global trend of imposing trade tariffs and restrictions, both of which are encapsulating the protectionist economics as practiced by Donald Trump.

Steve Liesman from the CNBC asked Powell to comment on the current resulting situation of monetary policy resembling a ‘sort of an insurance cut and not a data-dependent cut', and the FED Chair implied that:

“Trade is unusual. We don’t, you know, the thing is, there isn’t a lot of experience in responding to global trade tensions. So, it is a, it’s something that we haven’t faced before and that we’re learning by doing”

Realizing the potential ramifications from possibly implying the existence of irregularities in the trade policy, he was quick to add:

“I want to be clear here. We play no role whatsoever in assessing or evaluating trade policies other than as trade policy uncertainty has an effect on the U.S. economy in the short and medium term. We’re not in any way criticizing trade policy. That’s really not our job."

Subsequently, Jerome Powell and the rest of the FOMC have to acknowledge the resulting hampering impact on the US economy from the trade restrictions, while at the same time remain placid and distant from the political arena. Tactfully, Powell decided to indirectly attribute the current scramble by major central banks to cut their respective interest rates, which subsequently creates low-currency related tensions as a bi-product, at least partially to the impeded free trade and the resulting uncertainties.

“You see manufacturing being weak all over the world. Investment, business investment is weak, and I wouldn’t lay all of that at the door of trade talks. I think there’s a global business cycle happening with manufacturing and investment, and that’s been, you know, definitely a bigger factor than certainly we expected late last year. I think global growth started to slow down in the middle of last year, but that has gone on to a greater extent. And by the way, trade policy uncertainty has also been, I think, more elevated than we anticipated”

Donald Trump, on the other hand, refuses to see this as a countermeasure to waning global growth and instead decides to perceive the global trend of falling interest rates as an expression of an unfair currency war that these central banks decide to wage against the US.

It is for that reason that Trump is more likely to perceive the recent rate cut in the US as a retaliation by the FED, giving US producers the desired competitive advantage. Arguably, that could also be perceived as a contributing factor to his decision to introduce new tariffs to Chinese products just two days after the monetary policy decision of the FED.

Finally, Powell and the FOMC find themselves in a tight spot as they want to see subdued trade tensions but at the same time are forced to play “catch up” to Trump’s actions. At this point in time, the views of the two respective leaders diverge – the FED wants to use monetary policy to promote economic growth in addition to full- employment and inflation close to the 2 per cent symmetric target, whereas Trump wants to use the FED and the monetary policy as a weapon in his trade wars.