It looks as though the almighty greenback is bound to finish 2020 on a sour note, in what has been a real rollercoaster ride for the king dollar throughout the year. The EURUSD continues to advance steadily as the greenback reels from heightened vaccine optimism. The world's most easily convertible currency is swiftly losing appeal amongst traders and investors, who eye the end of the coronavirus crisis next year.

This trend is unlikely to be altered significantly in the next several weeks because the levels of general market liquidity are expected to drop. Overall trading activity tends to falter each year around the Christmas Holidays, which usually prompts unpredictable trading environments characterized by sporadic price action. That is why the time seems appropriate to ask what 2021 might hold for the US dollar.

Breaking the Trend Line

The bullish rally of the EURUSD is so significant indeed that it is about to test breaking away from a multi-year trend. As can be seen on the monthly chart below, the price action is currently attempting to break out above the downwards-sloping trend line (in red) for the first time in over a decade. The trend line itself was established in the wake of the 2008 credit crunch, which is what makes it so important.

Another major development that signifies the shifting market sentiment is the emergence of a new ascending trend line (in green). The pair, thus, looks poised to penetrate within the support-turned-resistance area (in light blue) into 2021.

Given that the price action is currently concentrated close to such a significant make-it-or-break-it point, the next couple of months are going to be of crucial importance for the longer-term future of the pair. That is why it is worthwhile examining the likely behaviour of the price action at the outset of 2021.

New Year Resolutions

As regards the aforementioned trading activity, commonly there is a noticeable seesawing effect that takes place in January. Following on the subdued activity during the Festive Period, traders and investors tend to return to the market in early January on a high note, filled with optimism about the new year. Their eagerness to start off well typically causes the stock market to soar, as traders and investors scramble for bluechip stocks.

This process tends to have a positive impact on the greenback, which benefits from increased interest from international investors. Essentially, the demand for the dollar grows as foreign investors seek exposure to the American stock market. That is so because they need dollars in order to purchase US stocks. The stock market can do only as much for the greenback, however, because even more subtle considerations need to be made.

Joe Biden Steps In

On January 20th, President-Elect Joe Biden will become the 46th President of the United States. By all initial accounts, his policies look bound to be starkly different compared to Donald Trump's strident approach to protectionism and foreign trade. The Democrat would most likely seek to negate the trade tensions between the US and China, thereby scaling down the impact of the protectionist agenda that was implemented by Mr Trump.

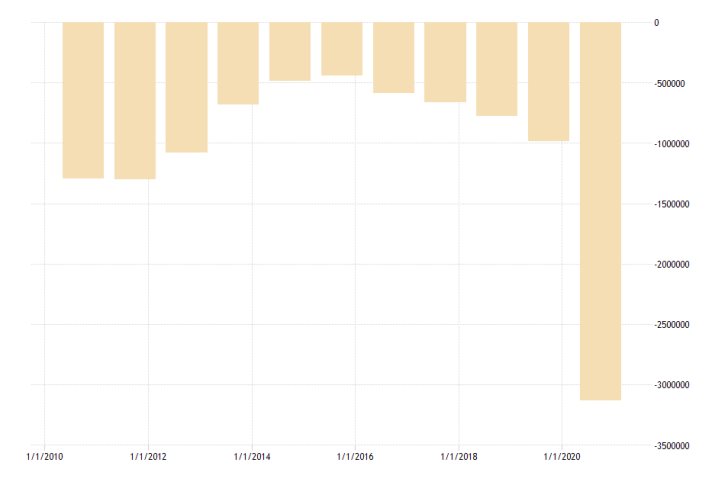

Furthermore, Mr Biden would have to deal with the enormous Government Deficit that his cabinet will inherit from the previous administration, which underlines the need for cutting expenditures by means of higher taxes even more.

The Federal Deficit reached a record low in September 2020, which interestingly enough marks exactly 20 years from the record high Federal Surplus that was reached in September 2000.

President Biden will have to deal with this enormous gap in the budget through a comprehensive tax policy, which would, unfortunately, stifle foreign investments. The US would become less appealing to foreign investors, thereby resulting in an adverse spillover effect on the value of the dollar.

Emerging Markets and New Horizons

Finally, the dollar is likely to continue reeling in the wake of the pandemic as well. Once a sufficient number of the world population is vaccinated against coronavirus, the global economic activity would likely start returning to its pre-crash levels from early-2020.

This means that the developing economies, particularly in South-East Asia, and their emerging markets will start attracting foreign investments once again. Consequently, such a trend would only exacerbate the woes for the greenback in conjunction with Mr Biden's anticipated tax policy. Thus, the future of the dollar does not look particularly bright, even in a post-COVID 19 world.