The outbreak of the deadly coronavirus in China has been the primary topic circulating global media in the last few weeks. It is currently perceived to be the most significant impediment to the normal execution of processes in the global economy. As of today, the 4th of February 2020, there are more than 20 000 confirmed cases of reported infection and over 400 deaths. The rapid rate with which the virus spreads is the main reason for the uneasiness that has gripped Wall Street, as investors start to fear that if the situation continues to worsen, it could prompt a new selloff in the stock market, potentially even causing a new recession.

At the current moment, the Chinese government has issued a lockdown of Wuhan city, home to more than 11 million people, where it is believed that the virus originated from. Flying in and out of the city was restricted by local authorities in a bid to curb the rampant spread of the disease, which has had the negative side effect of limiting air travel at the time of the Lunar New Year Celebrations. Because of the necessary implementation of such unfavourable policies to the local economy, economists and market analysts have already started to weigh in on the potential long-term ramifications for the GDP growth expectations in China. They are also scrutinising the likely spillovers that can be exerted on the global economy from subdued Chinese growth.

As the virus continues to spread, with new cases being confirmed outside of China, the nature of the perceived threat is also being changed. It is now becoming a political issue as well as a healthcare crisis. While the WHO remains undecided as to whether it is necessary to declare international pandemic or not, the outbreak of the virus is starting to act as a catalyst for the US/China relationship.

The US government was among the first to recall its nationals from the Wuhan province. While the public praised these actions, China accused the US of ‘overreacting’ to the situation without providing any adequate assistance. The slamming of the US government by Chinese authorities for its alleged insufficient involvement is just the most recent episode in the on and off spats between the two economic powerhouses. It can, however, prompt retaliatory comments from the Trump administration, which is strident about its ‘America First’ policy.

In that sense, the escalated tensions across the world from the virus epidemic could take new political dimensions, as they can widen the gap between the two countries.

While the US would most certainly remain sympathetic with the Chinese plea in light of the healthcare crisis that has swept the Wuhan region and elsewhere in China, it remains unclear as to whether the US would be as appreciative of the economic side of the issue.

Some experts have expressed concerns that China might not be able to fulfil its purchasing commitments as per Phase One of the Trade Deal it signed with the US. Currently, China has promised to purchase more than $76 billion of American goods by the end of the year that goes beyond what it did in 2017. Due to the fact that many areas and industries remained closed over the past several weeks in a bid to curb the spread of the virus, some market experts estimate that more than 2/3ds of the Chinese economy remained closed in early January.

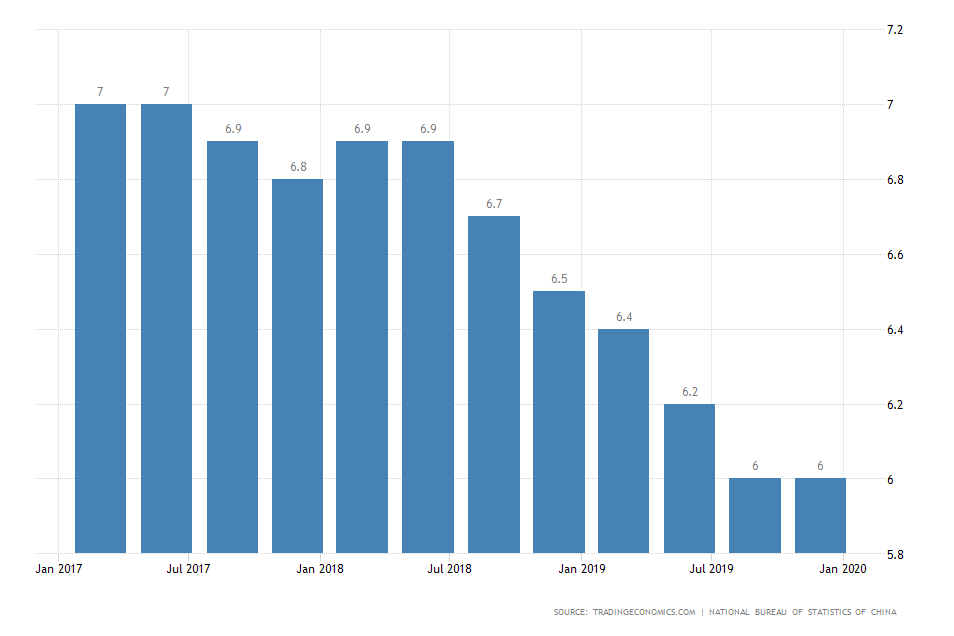

What is even more concerning is the fact that the aggregate demand was already subdued even before the outbreak of the coronavirus, which implies very pessimistic prospects for the future if such vast chunks of the economy remain closed indefinitely.

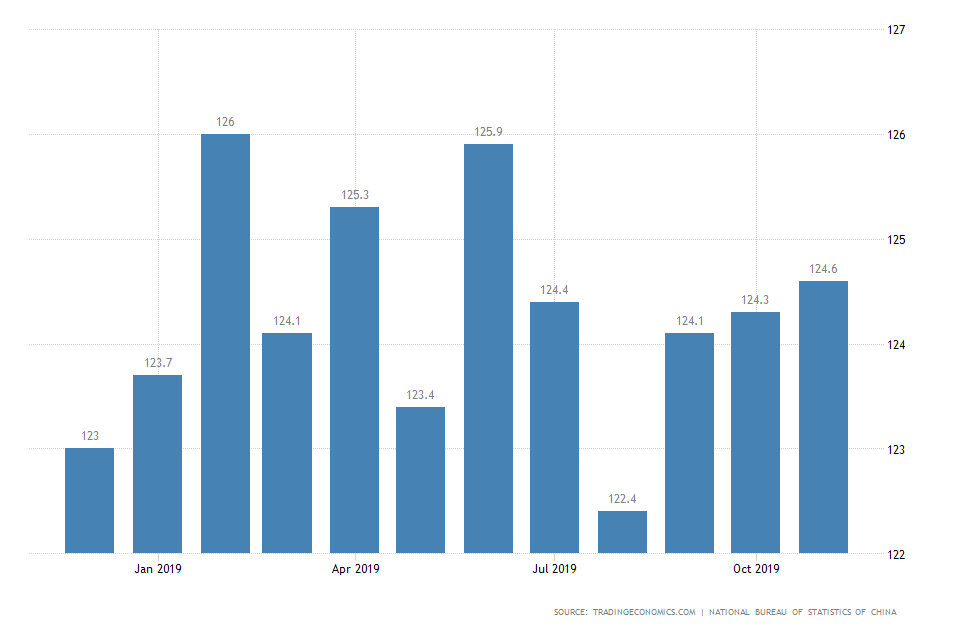

As can be seen from the chart above, consumer confidence remains threading below the high-levels that were registered in the first half of 2019. In light of the recent developments, the headline consumer confidence is more than likely to be shattered back to or below the dip that was registered in August last year.

This diminished consumer confidence is already weighing down on the Chinese stock market, as a short-term selloff has occurred on the SSE Composite index after the Shanghai exchange was reopened, for the first time after the outbreak, earlier this week on Monday.

The chart below illustrates the stark contrast between the performance of the two biggest indices in China and the US. On the one hand, the S&P 500 (in blue) is steadily appreciating, driven by the solid earnings performance of the most substantial companies in the US tech industry. On the other hand, the SSE Composite (in green) took a steep nosedive in early January, which is already prompting significant losses for Chinese investors and is the primary reason for concern.

China is hoping for some leniency from the US and more specifically from Donald Trump and his administration, in case that it fails to live up to its commitment for bolstered purchase of American goods over the new year.

The gloomiest forecasts anticipate severe distortions in the Chinese Gross Domestic Product’s growth rate in 2020, which could potentially be affected negatively with more than 2 per cent. If these fears are realised, the Chinese GDP growth rate could fall to 4 per cent – this would be the weakest performance on record in over three decades.

As regards the strained relationship between the two countries, the worst-case scenario seems to be one in which the US refuses to lower it is trade demands from China, despite its current economic predicaments. If China does indeed fail to live up to its purchases commitment, Trump might decide to resume imposing tariffs on Chinese exports, as a sort of punishment. Such an action would only make the situation for the already strained Chinese economy even direr. Ultimately, this could lead to the breakoff of the Phase One Deal and potentially curbing future deals indefinitely. Meanwhile, risks to global trade would once again be tilted to the downside, as uncertainty begins to creep up the international markets once more.

Such a scenario seems unlikely at the present moment; however, investors remain wary. Central banks globally have only recently begun to revise down the risks to growth in their own countries. However, if the coronavirus does indeed prompt a new economic spat between China and the US, the recovering global economy could very likely be hit by new rounds of uncertainty. This would likely influence renewed investors' interest in safe-haven assets such as gold in addition to sparked demand for Government treasuries. Subsequently, the yields in the bonds market could be anticipated to weaken once again, likely resulting in new fears for a potential global recession.