The economy of the territory is likely to record negative yearly growth, according to its leader.

Carrie Lam, the Chief Executive of Hong Kong, was speaking to reporters yesterday and argued that the continuing protests are exerting a heavy toll on the strained local economy. She was quoted by The Guardian as saying that:

“Many Hong Kong people … may have some unhappiness and grievances about the government policies, about the government handling of this major crisis but the time now is really to put in all our efforts to say no to violence.”

Her remarks are intended to soften up the tensions, as multiple economic sectors are already suffering from the ongoing social upheaval and intensifying street violence.

Protestors are becoming increasingly more violent and resolute in their demands, and correspondingly, the riot police feel compelled to use more drastic measures to deter them, such as employing tear gas.

The protests were initiated in mid-2019, as organised demonstrations against the introduction of the Fugitive Offenders and Mutual Legal Assistance in Criminal Matters Legislation Amendment by the Hong Kong Government.

The extradition Bill, in short, was initially intended to establish a judicial mechanism for the transferring of local fugitives and dissidents into mainland China and other neighbouring countries.

During the last few months, the protests have grown more violent as the number of injured and arrested demonstrators has exceeded four thousand, including a total of 10 suicides. The rampant escalation of the tensions is attributed to the changing demands of the protestors.

As it was mentioned above, the demonstrations were initially organised as an outcry against the Extradition Bill. Yet, recently the focus has been shifted away towards demanding additional freedom for Hong Kong from the rest of China.

Hence, as the social dissent resumes, Hong Kong’s economy continues to suffer increasingly from the inhibition of the normal economic processes as the city remains virtually blocked for most normal activities.

Tourism and transportation are two of the sectors that have been hit the hardest from the social unrest, as foreign tourists prefer to avoid the clashes of the protestors with police which also unequivocally impedes the proper transportation within the city.

Consequently, the Gross Domestic Product of Hong Kong is expected to shrink further by the end of the year owing to the suffering of these various industries. Paul Chan, the Financial Secretary of Hong Kong, also commented on the situation:

“The blow to our economy is comprehensive. The Government will be announcing its advance estimates for the third quarter on Thursday. After seeing negative growth in the second quarter, the situation continued in the third quarter, meaning our economy has entered technical recession. […] It seems it will be extremely difficult for us to reach full-year economic growth of 0 to 1%. I would not rule out the possibility that the full-year economic growth will be negative”

The Government was recently forced to add a quarter of a billion dollars to the current $2.4 billion relief package, to accommodate the sectors, hit the hardest from the protests.

Heightened government spending in such critical situations, often has a positive short-term effect of economic stress alleviation; however, in the long-term, increased spending also leads to currency devaluation.

GDP growth rate forecasts and the impact on the stocks market

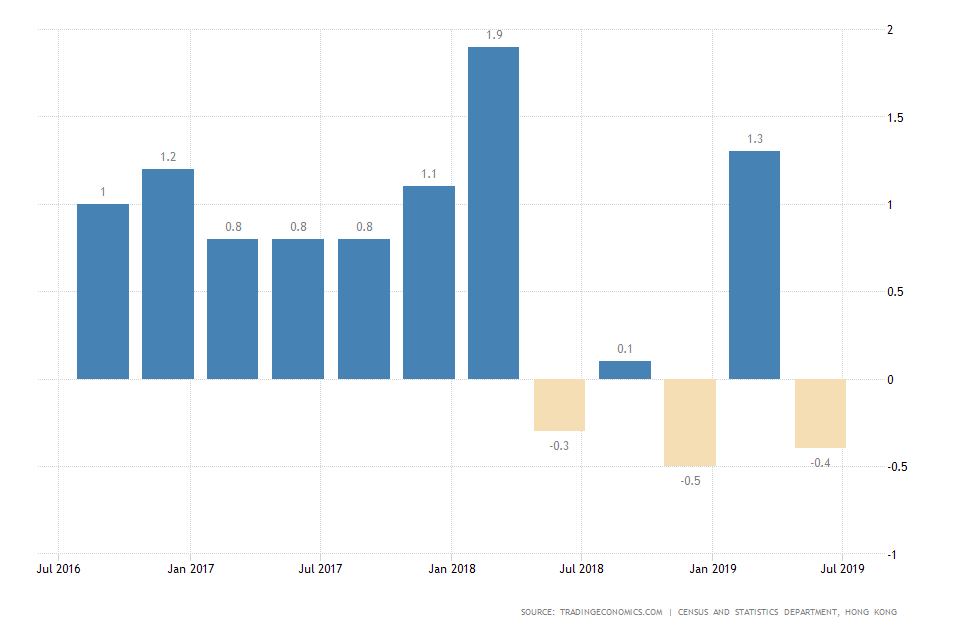

The short-term economic slowdown is already evident given the recorded 0.4 contraction of the GDP growth rate in the second fiscal quarter of 2019.

In comparison, from 1990 until 2019, the rate averaged 0.91 per cent, which is exhibitive of the protests’ immediate negative impact on the economy. Additionally, the GDP growth rate is expected to further contract by 0.2 percentage points for Q3 to -0.6 per cent. The data will be announced this Thursday.

The stock market in Hong Kong, too, is not exempt from being hindered by the protests. The most significant stocks index in the region – the Hang Seng – is suffering from shaken investors’ confidence.

Its' price is currently finding a strong resistance from the downward sloping trend line, and the bearish momentum is once again building up in anticipation of tomorrow's economic data release.

With respect to the overall economic situation in Hong Kong that is still deteriorating, the HIS is more than likely to continue its long-term selloff, and test the historically significant support at 25000 index points.

Bleak inflationary prospects for price stability in Hong Kong

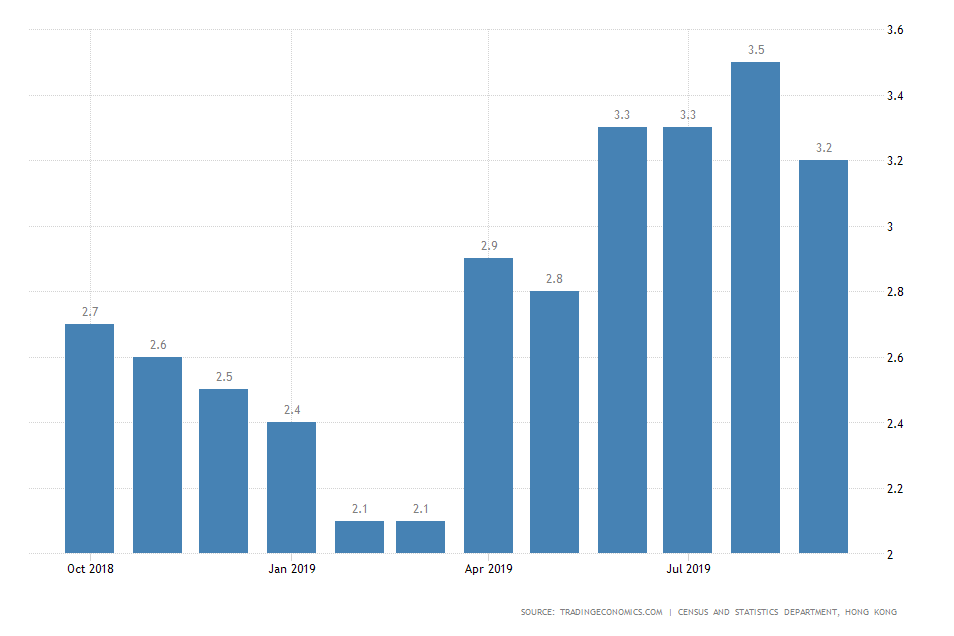

An early sign of the forthcoming currency woes for Hong Kong is represented by the soaring inflation that has been recorded since April 2019.

Even though yearly CPI of 3.2 per cent that was recorded in September is not yet devastating, the long-term ramifications for the local economy could manifest in obstructed price stability and further lessening of the GDP growth rate, in a self-supporting process of economic contraction.

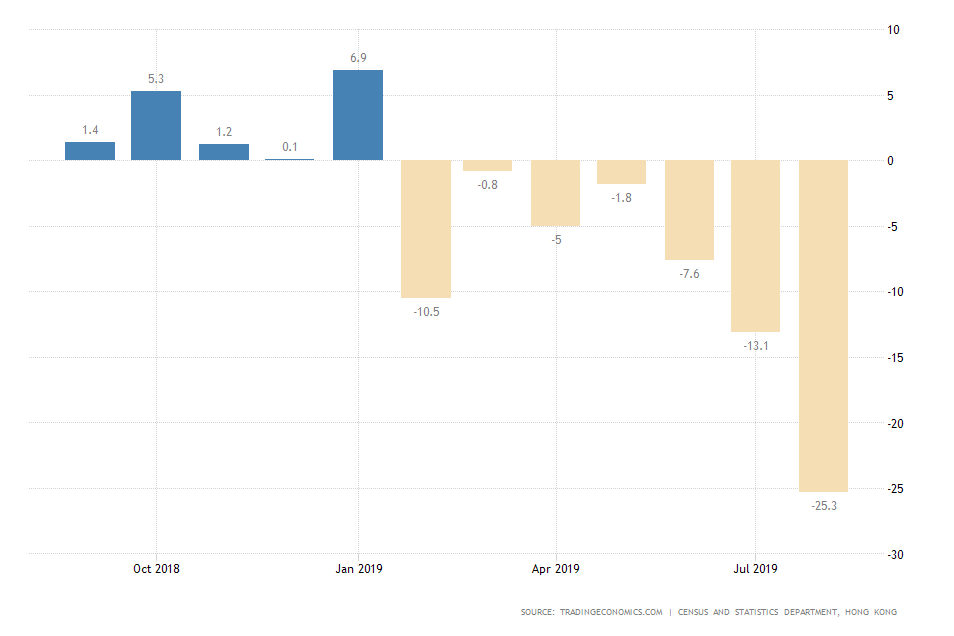

Moreover, retail sales have been subsiding consecutively since May of this year, which is an additional example of the waning price stability in Hong Kong, and a point of concern for the Government.

What follows next?

Carrie Lam gave clear indications on Tuesday that the Government would pursue a quick resolution to the ongoing crisis by all means necessary so that the economic situation can be quickly stabilised.

Lam argued that she and the rest of the Government are interested in ending the struggle in the streets as soon as possible by 'tackling the violence head on', which implies more strident police actions to calm down the protestors.

“The situation we are now facing is anti-government violence. So the most effective solution is to tackle the violence head on. For the Government to resort to measures that will appease the violent rioters, I don't think that is a solution.”

The positive effect of such a divisive stance would be the normalisation of the economic activity in Hong Kong. However the alternative is correspondingly precarious – failure of the police forces to manage the situation, resulting in more injuries, heightened civil unrest and even possibly fatalities.