On the 7th of March, the European Central Bank announced a decision to keep the interest rate level at a historical low at least until the end of 2019. This policy was defended by the bank's President Mario Draghi as being both reactive and proactive in nature, in order to address the present global issues and overcome domestic difficulties in the Eurozone.

The decision to keep the interest rate of the main refinancing operations at 0,00% was anticipated by the market, but it was the drastically more dovish outlook the bank expressed in light of the recent global economic events, which surprised traders and investors alike.

Mario Draghi delineated a new program for targeted longer-term refinancing operation (TLTRO-III), that is to be launched in September 2019 and ended in March 2021, which is one of the biggest points of concern for traders owing to the arguable efficiency of the first two implementations of the program.

As a result, the Euro immediately depreciated against all of its major counterpart currencies with about 1% in a day of heavy trading, with traders speculating on the news that a new round of liquidity to the European economy is going to extend the low-interest rates to 2020 as well.

Therefore, in regards to the policy decision of the ECB and the statement from the press conference following the decision, the biggest question that remains is how will this adjusted monetary policy going to affect the Euro in the long term.

Which factors led to the ECB's interest rate decision?

In his press conference, Mario Draghi stated that the decision to keep the interest rate at the current level is dictated by both internal and external circumstances, which were taken duly into consideration. On the one hand, the President of the ECB indicated one of the main reasons for the global economic slowdown as being the deteriorated global trade discussions and the resulting economic slowdown in China, as well as a potential slowdown in the US output.

Draghi added that this environment of limited conversation and protectionist policies had lessened investor confidence in global trade. On the other hand, two of the major internal factors for the European slowdown in output remain to be the sluggish auto industry in Germany and the shaken banking sector in Italy.

According to Eurostat, Germany's GDP growth slowed down from 2.2% in 2017 to 1.5% in 2018, which is mainly attributed to weakening export growth. Furthermore, "high-frequency indicators point to a continued deterioration in business sentiment in the manufacturing sector”. Meanwhile, Italian growth has slowed down with 0.6% to 1.0% in 2018, which is sufficient enough to label the Italian economy as being in a recession.

Also, “the recent slackening of economic activity is more attributable to sluggish domestic demand, particularly investment, as uncertainty related to the government’s policy stance and rising financing costs took its toll”, which is why the announcement of a new TLTRO's was perceived as a much-needed boost for Italian debt financing. As a result, the country's banking sector registered an immediate 1% growth in the aftermath of the ECB's policy statement.

What is the role of inflation level for the underlying monetary policy?

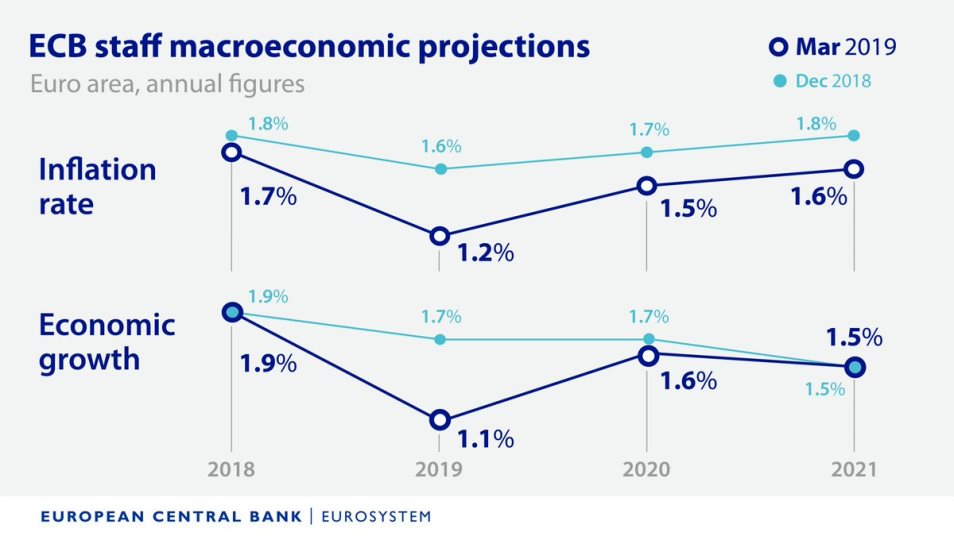

Inflation is a major determinant for the success of the central bank's monetary policy, as higher prices in the retail sector are a necessary condition to sustained growth in output for the private sector, which is the end goal for the ECB's policy of `easy money` into the economy. Yet, the inflation rate is disappointing at present, with the projection for 2019 misfiring from the desired 2.00% level with 0.8% to only 1.2%.

As a point of comparison, the actual interest rate for 2018 was sitting at 1.7%. Apparently, this reduction in inflation with a half per cent is owing to the global stagnation of economic out, however, the ECB's determination to change the trend is looking promising. Mario Draghi pointed out that new jobs are being opened in the bloc's labour market and the wage growth rate is exceeding expectations and beating the performance for the fourth quarter of 2018, which are both indications of the monetary policy working in the right direction.

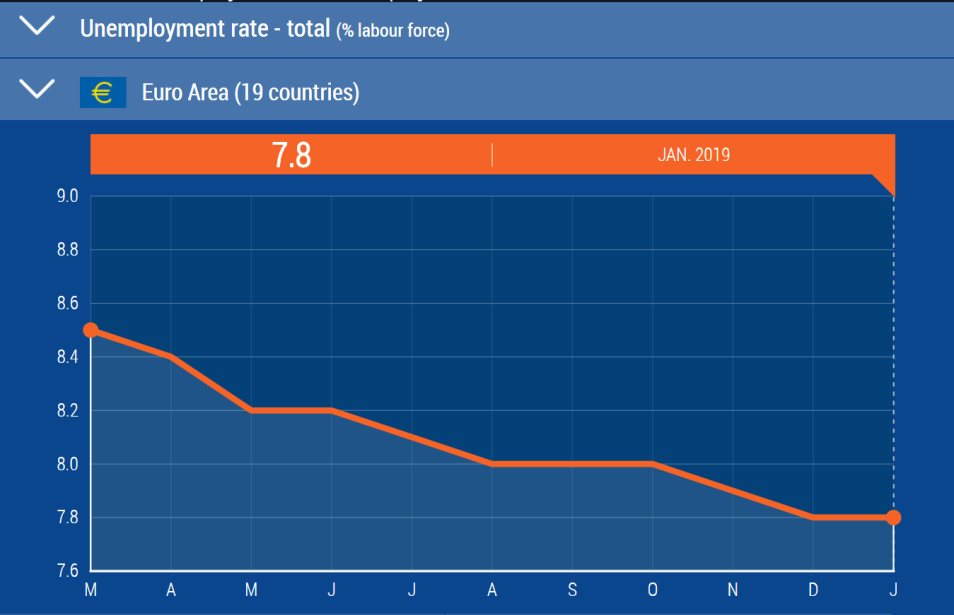

However, it would take time for the monetary policy to catch up to the rampant developments in global affairs and adjust the prices accordingly, which is the main reason why Mario Draghi advised investors to be patient and allow the market to adjust itself. This disparity between the rising nominal wages and the decreased prices at the private sector can also be attributed to foreign influences, stemming from the global economic sphere. The European Area labour statistics showcase a steady rate of decline in unemployment levels, which is an indicator of the resilience of the European economy:

Draghi has also argued that “the structural process of relating higher wages to higher prices has changed”, which is why the President of the ECB urged for more patience until the rate of inflation finally catches up to the pace of decreasing unemployment.

Breakdown of TLTRO's and what makes them effective?

As previously stated, TLTRO is a monetary program of the EU's central bank for increasing the liquidity levels in the bloc, by allowing easy lending of capital from the central bank to smaller commercial banks with better terms and conditions than those banks could get by going directly to the market, according to Draghi. TLTROs are a targeted form of lending of capital, as the desired beneficiaries at the end of the line are small business and entrepreneur individuals at the private sector.

In that sense, TLTRO is a program that is designed not only to aimlessly pump up the flow of capital into the economy and hope for the best, rather it is supposed to promote growth at the lowest level of the economic pyramid, which is to be directly supported by the central bank itself.

For that reason, the third series of the TILTRO initiative, that is supposed to be commenced in September of this year, is an attempt by the central bank to stimulate European economic growth by further supporting the growth of the labour market. The assumption is based on classical economic theory and relates to the Philips curve, which has been a guiding point for global policymakers and top economics since before the inception of the European Union itself.

The premise behind the curve is to highlight the alleged inverse relationship behind inflation and unemployment rates, where decreasing one of them is going to increase the other and vice versa. Hence, the logic behind the ECB's overall monetary policy, and to that extent, the TLTRO program as well, is to prioritize labour market expansion and therefore decrease the unemployment rate, so that as a consequence the inflation rate can increase as well and reach the desired 2% level.

However, more and more economists are starting to debate on the relevance of the Philips curve and whether the assumptions behind this inverter relationship still hold sway in economics today.

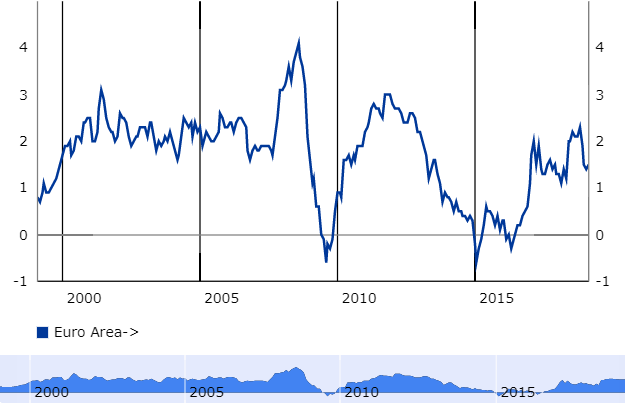

For this reason Draghi's comments about having patience resonate with so many critics of the policy, who want to know whether this new round of economic stimuli into the bloc's economy is going to have any noticeable long term effects. According to the ECB data, the inflation rate has experienced a sizable increase since the inception of the first TLTRO program, which was in mid-June of 2014:

Mario Draghi also said that there are times when it is not enough to be reactive and you have to take a more proactive stance in conducting economic policy while weighing on the effect of pervasive uncertainty in global affairs and definite worsening in economic projections as two reasons for the ECB's residual monetary policy.

He continued to defend the central bank's actions by comparing them to walking in a dark room, where you walk with tiny steps and you do not run, but you do keep on moving. In that sense, the ECB is being proactive despite the global climate of political and economic uncertainty, however, investor concerns loom over the future of the bloc and more precisely the future for the single currency:

By examining the weekly chart for the EURUSD it becomes evident that the first round of easy money to the banking sector marked a significant turning point for the EUR and the beginning of a new substantial downturn. By the time the second round in the TLTRO series was announced, the inflation rate had already increased above the 0% threshold, which was also a sign of the effectiveness of the program and was welcomed by investors as a sign of the resilience of the European economy.

However, despite the evident optimism on the market, the EUR was still on the losing side until early 2017. So, what can we expect about the future of the EUR based on this information?

The EURUSD daily chart sheds more light on the current situation for the bloc's currency:

The EURUSD is currently trading in a bearish channel, which began in early April of last year and is continuing to develop at present. When the central bank's announcements were released on the 7th of March, the initial reaction by the market sent the currency pair tumbling down with 1% to 1.11894, where the price found support at a major Fibonacci retracement level. There are three important things to be considered, given the present circumstances:

1. The market is already in a bearish downwards movement and the announcement of a fresh dosage of liquidity from the ECB is likely to flood the market and support the Euro's losing streak. The central bank's commitment to keeping the interest rates at the current level at least by the end of 2019 showcases that the EUR is unlikely to find any major fundamental support until then.

2. If the EUR/USD breaks below the aforementioned support level and does not correct itself afterwards, then the short sellers are going to have one more reason to believe that the bearish momentum hasn't run its course yet and therefore, we can anticipate more selling orders to be executed at that level.

3. From an economics perspective, the success of the third TLRO program is going to boost the inflation rate to the desired 2%, which is going to bring more stability to the European economic stage at the expense of the Euro's strength, which can only be supported only after the ECB's monetary policy's success becomes evident.

Overall, the bearish momentum on the market for EUR/USD looks strong enough to remain relevant past the second fiscal quarter of 2019, so the long term trend is still looking bearish. However, the recent developments in the US/China trade relationships and the promise of resolve to the trade disputes is bringing optimism to investors, as such a turn of events is going to support European exports and consequently boost the output growth.

Finally, one of the last major stumbling blocks that prevent the sustained growth of the European economy remains to be the political fragmentation in the bloc. As Mario Draghi points out:

"ECB can only advise, but governments need to push forward the common economic agenda"

The European monetary union remains to be a project of great importance for the future of the European economy. At any rate, the facilitation of a top-down political channelling of economic policy from the ECB down to the national governments level is going to support the Euro area's growth performance.

Currently, any monetary policy of the European Central Bank is strained to a certain extent by the divisiveness of national governments, and for that reason, the monetary union remains fragile and it will remain so, until economic policy can be pushed through on the national level just as easily as it is currently done in the ECB.