The German economy has had yet another disappointing week as the incoming data of significant financial and economic indicators present a very gloomy outlook on the prospects for future growth. Last Friday it was announced that the economic growth has remained flat at 0.00 per cent in December, which implies that Germany is on the verge of entering into a structural recession.

These economic woes for the biggest economy in the Eurozone are unsurprisingly caused by the prevailing uncertainty that is currently weighing down on the global capital markets. This uncertainty is prompted by fears of the novel coronavirus – COVID-19. The Germany economy is primarily dependent on the uninterrupted operations of the global supply networks, which is why even small ripples in those can have a devastating cascade effect on German growth. Therefore, the country's economy is considerably susceptible to sporadic episodes of heightened trade uncertainty, such as the case now owing to the COVID-19 epidemic and the global society's attempts to curb its spread.

The reeling German economy is undoubtedly going to raise investors’ concerns in the country, which can be expected to be felt across the stock market. This raises the primary question of this analysis – how is the DAX index going to react to these investors’ concerns and the headwinds that are currently impeding the German economy?

1. Long-Term Outlook:

The DAX opened today’s trading session with a sizable gap from Thursday’s close and is currently trading around 13632.500. Nevertheless, the price is still threading very close to the all-time high of 13795.240, which means that the long-term price action has barely registered any of the aforementioned ripples and external pressures, as can be seen on the weekly chart below.

All of this begs the question – is the DAX due for a bearish correction, that could potentially turn into a new downtrend, or is the index going to recover promptly and continue rallying into uncharted territory?

The Average Directional Index (ADX) demonstrates that the current bullish movement is a relatively week one – the ADX has been threading below 25 points since May of 2019. Even so, the bullish channel above shows that the price has managed to appreciate with more than 3000 points in a little bit more than one year. This means that the price could very likely continue to advance north at such a moderate pace, however, due to the unremarkable strength of the current bullish trend, the price action could fairly quickly establish a new correction at any time.

The stochastic RSI (Relative Strength Index) illustrates the gradually increasing number of short-selling orders over the last several weeks, which is demonstrative of investors’ belief that a bearish correction is due to form soon. Despite the increasing selling pressure, however, the price action has not established any significant downswings. Quite the contrary, the price has consolidated around the aforementioned record level. This means that even though the bears are attempting to enter the market on the expectation for the formation of a short-term correction, the long-term sentiment in the market remains prevailingly bullish.

As can be seen, the price is currently consolidating just above the middle line of the bullish channel, after having broken into the upper part of the regression channel just last week. The price action had previously gained strong support from the 23.6 per cent Fibonacci retracement level at 12997.519. Two crucial assertions can be drawn about the behaviour of the price action based on these observations.

First of all, the 23.6 per cent Fibonacci retracement level at 12997.519 has been tested as a support level on multiple occasions since November of 2019, and it has always managed to hold back the price action above it. This means that any new bearish correction is likely to be held above set level yet again. The importance of 12997.519 as a support level is further accommodated by its close proximity to the psychological barrier at 13000, which is owing to the three zeroes in the number. Thereby, this level should be considered to be a major support, which is unlikely to be broken down by the price action unless there is a significant change in the underlying market sentiment.

Second of all, the value of the 12997.519 as a support level is further bolstered by the regression channel’s middle level, which currently coincides with the 23.6 per cent Fibonacci retracement. When examined in conjunction with each other, these two levels represent not only a major support but also a potential turning point in the direction of the underlying price action. Consequently, the anticipated correction in the price action is likely to have a size of around 200 index points (the difference between the current market price and the aforementioned support).

2. GDP Growth Rate, Economic Sentiment and Manufacturing PMI:

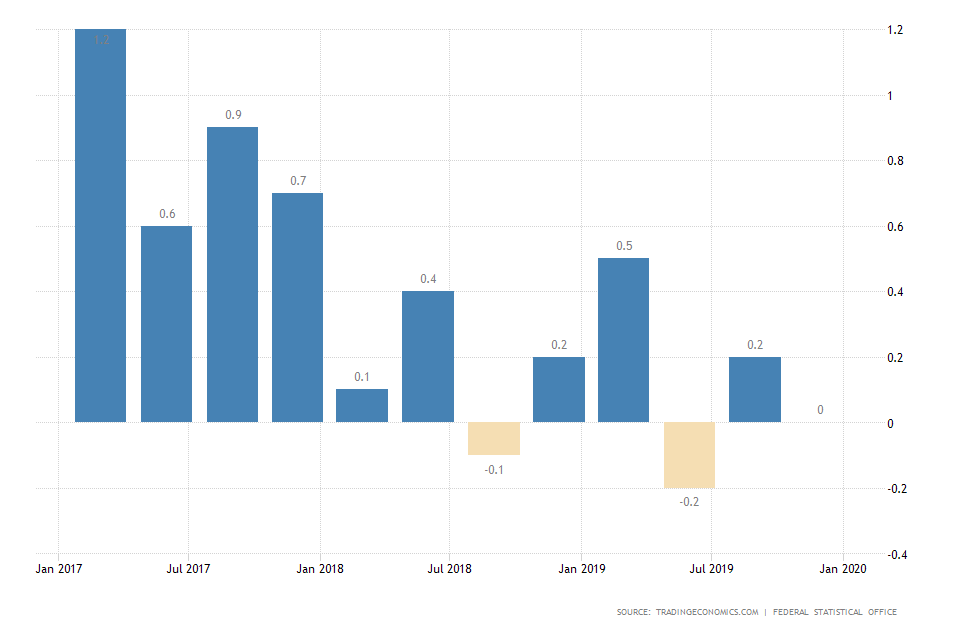

- On GDP Growth Rate. The advanced readings on the Gross Domestic Product data in Germany projected a contraction of the economy’s output to 0.00 per cent in February, which implies a very gloomy outlook for the broader economy as a whole.

This is arguably the most substantial indication that Germany might enter into a structural recession by the end of the first fiscal quarter of 2020 unless something more is done to counter the headwinds that are currently weighing down on the broader economy of the Eurozone as well. Arguably, the biggest issue is that there is a considerable discrepancy between the accommodative monetary policy of the ECB, which is providing enough liquidity in the markets by keeping tight interest rates, and Germany's fiscal policy.

The German government is running a relatively high budget surplus of 1.5 per cent, which means that it has the necessary tools to counter the adverse trends in the economy by boosting its aggregate spending, however, for the time being, it refrains from doing so. As Christine Lagarde argued recently in the European Parliament, expansionary fiscal policy by means of heightened government spending is especially effective at times when the underlying monetary policy is accommodative. Thus, even though the German economy is experiencing some difficulties in the short term, it has the necessary tools to bolster the overall economic activity and thereby stimulate growth.

A structural recession seems imminent because of the prevailing conditions on the market; however, Germany has the capacity to thwart such a scenario. It is because of this trust in the economy's resilience that the DAX is currently consolidating even though the bearish sentiment has been marginally increased over the last few weeks.

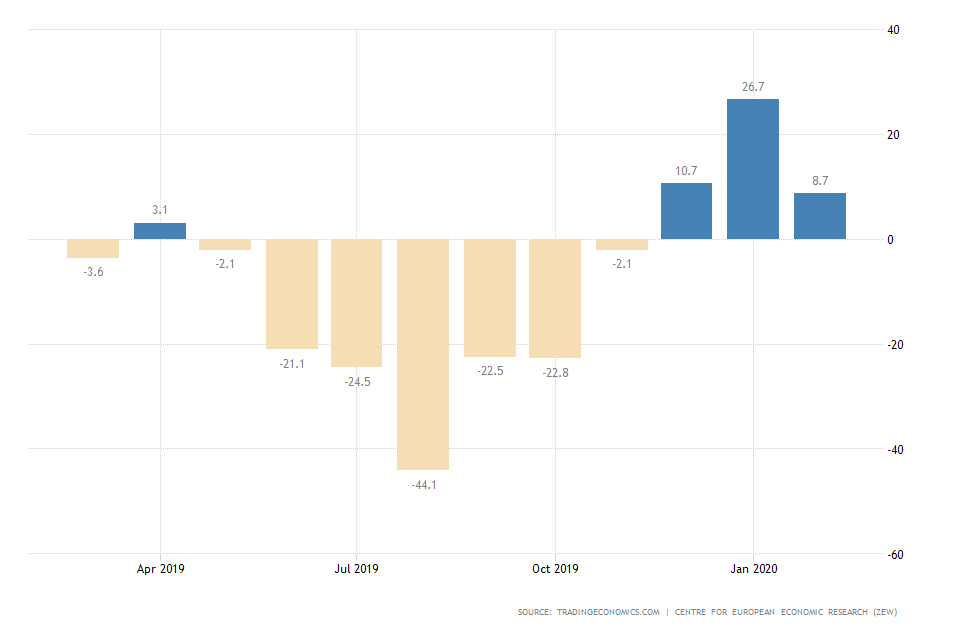

- On Economic Sentiment. The ZEW index measuring the economic sentiment in Germany tumbled nearly three times in February, by falling to 8.7 points from January’s 26.7.

This decline is owing mostly to investors’ fears stemming from the spread of the coronavirus in China and elsewhere. The fall in the index encapsulates the uncertainty that is currently caused by the outbreak of COVID-19 and the lack of proper gauges to measure its real impact on the global economy. Nevertheless, the overall sentiment remains threading markedly positive compared to the disappointing performance that was recorded in August of last year. Hence, despite the downwards revision that was recorded in the index in February, it would be too premature to attribute this fall to the likely beginning of a new selloff of the DAX.

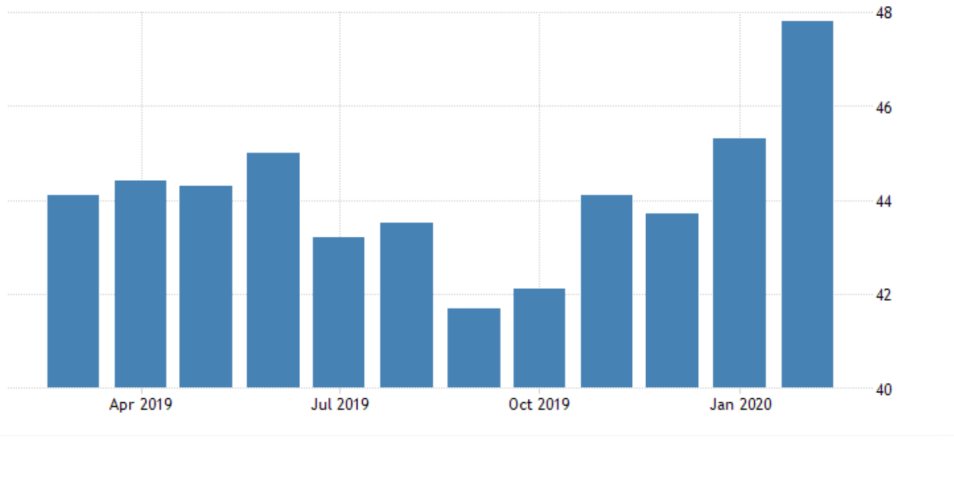

- On Manufacturing. The one decisive factor comprising the German economy that registered a noticeable improvement in February is Markit’s Manufacturing PMI, which rose to 47.8 from 45.3 in January, thereby beating the consensus forecasts.

The manufacturing sector is the most significant part of the German industry, which is why its solid performance is so important for the broader economy's wellbeing. Nevertheless, this positive performance should not be taken at face value, as one of the reasons for the jump in the recorded manufacturing is owing to the coronavirus itself. According to trading economics:

“Almost half of the index’s gain in February was attributable to a deterioration in supplier delivery times, linked to coronavirus-related disruption in China.”

Despite the recorded improvement in the manufacturing PMI index, the findings of the report do not paint a perfect representation of the current state of the German industry. Overall, the German economy is showing signs of weakness that perhaps could be strong enough to prompt a short-term correction in the DAX's price. However, the situation is not as detrimental as some investors fear, which means that the broader economy would likely survive the coronavirus panic, and a structural recession would be ultimately averted.

3. Short-Term Outlook:

Turning to the daily price chart below, it can be asserted that the price action might be due for an ABC Elliott correction given that the 1-5 impulse wave seems to be now fully developed.

The Stochastic RSI, too, is illustrating the current ‘Overbought' extreme of the price action, which confirms the anticipation for the formation of a new correction. A major impediment to such a correction will be the regression channel's middle line, which is currently acting as a support level. Regardless, if the price manages to break down below it, its next target would be the 23.6 per cent Fibonacci retracement at 12997.519 and the support level there.

The 4H chart above further confirms the rising bearish momentum in the short term. The price has managed to break down below the Bollinger Bands (BB) middle line and the 10-day moving average – the latter has crossed under the former – which is a significant indication that the market is going south in the short-term.

Moreover, the price has also closed below the lower BB band in the last 4 hours, which is yet another cue highlighting the likely initial stages in the formation of a new bearish correction towards the aforementioned target-level. The final evidence in support of this assertion is the MACD, which has turned negative and is thereby confirming the prevalence of the bearish momentum in the short-term.

4. Concluding Remarks:

Overall, the DAX looks set to form a new bearish correction, which is being influenced by the resulting uncertainty from the coronavirus’ spread. However, this correction is very unlikely to turn into a major bearish trend, which is why the bears should not become reckless and should not apply trend reversal strategies.

The market setup can be utilised by bulls as well, as they can wait for the price action to reach a new dip before reverting back north, which would allow them to enter long at a discount.

- Despite being correct in some aspects leading to profits, the analysis should be viewed quite critically. Indeed, the failures of the analysis far outweigh its benefits, even if these mistakes did not lead to incurred losses. The biggest mistake was the perception that the DAX was due only for a minor bearish correction, which concurrently dismissed the possibility for the formation of a new downtrend. This faulty logic eventually resulted in the enormous missed opportunity (the area in grey), whereas the collected profits (area in green) are much smaller in comparison. The second, far lesser mistake of the analysis was the failure to recognise the threat to German stocks at that time from the evolving coronavirus crisis. The biggest takeaway here is that traders should be critical of their short-term judgement of the market, because on rare occasions this could cause them to lose sight of the big picture. Additionally, sometimes a missed opportunity could be just as detrimental to a trader as incurred losses.

Disclaimer: Your capital is at risk! Trading and investing on the financial markets carries a significant risk of loss. Each material, shown on this website, is provided for educational purposes only. A perfect, 100% accurate method of analysis does not exist. If you make a decision to trade or invest, based on the information from this website, you will be doing it at your own risk. Under no circumstances is Trendsharks responsible for any capital losses or damages you might suffer, while using the company’s products and services. For more information read our Terms & Conditions and Risk Disclaimer.