The US Services Sector is Expected to Recoup in June

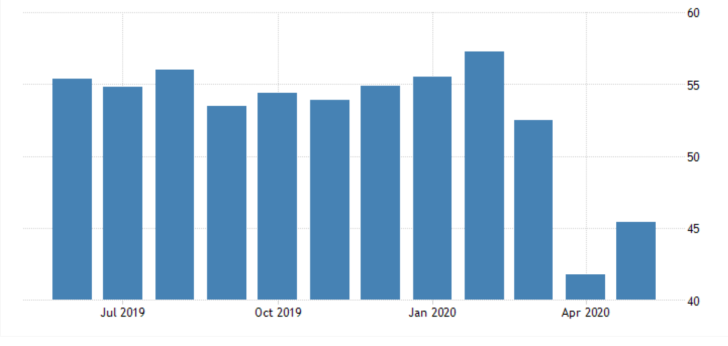

In arguably the most important economic release from this week, the Institute for Supply Management is scheduled to publish the most recent changes in the US non-manufacturing PMI later today.

The consensus forecasts anticipate the index to continue the positive trend that was established in May by climbing an additional 4.6 points. If the actual data meets the market's projections of 50.0 index points, this would mean that the services sector is once again expanding at a steady pace.

Investors and US monetary policymakers would be scrutinising today's data carefully. A potential reading of the non-manufacturing PMI of 50 points or more would be evocative of robust economic recovery following the Government's decision to ease its containment restrictions.

At present, the biggest challenge for the FED and the US Government is to protect the tentative recovery process by carefully easing set restrictions. At the same time, the two institutions need to ensure that a potential second wave does not jolt the economy yet again.

If the findings of ISM's report meet the consensus forecasts, this would likely strengthen the value of the dollar, which is greatly affected by the contemporary state of the services sector.

Conversely, if the readings of the non-manufacturing PMI survey fail short of the 50.0-point mark, the opposite is likely to occur. This would mean that the services sector is still reeling from the coronavirus fallout despite the protracted easing of restrictions.

The RBA Has to Decide Whether to Cut Rates Once Again

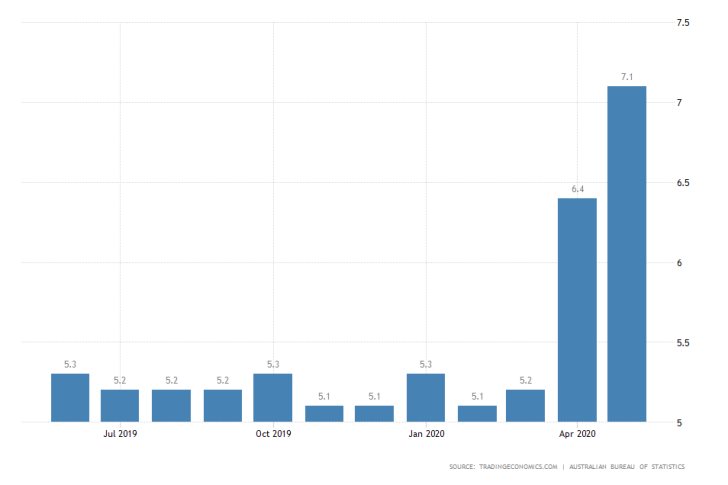

The Governing Board of the Reserve Bank of Australia is scheduled to gather this Tuesday for one of its regular monetary policy meetings. The primary topic of discussion would be whether or not to cut the Cash Rate.

While the consensus forecasts anticipate the underlying interest rate to be maintained unchanged at 0.25 per cent, certain recent developments could compel the Board to action.

The unemployment rate in Australia jumped to 7.1 per cent in May, which is the highest reading of the indicator since October 2001. This is the primary determinant that might force the RBA to adopt an even looser monetary policy stance in order to cushion the blows to the labour market.

Nevertheless, cutting the Cash Rate below 0.25 basis points implies adopting a negative interest rate, which could potentially have an even more detrimental impact on the Australian economy in the longer-term.

That is why the RBA might yet decide to remain vigilant and resume monitoring the monetary developments in the global financial markets.

The primary factor that might compel the Board to refrain from adjusting its policy at the present rate is the robust growth in China's industry, which was recorded in June.

The world's second-largest economy remains Australia's biggest trade partner, which is why a positive spillover effect could be anticipated to support Australia's economy. This, in turn, would negate to a certain extent the need for policy action at present.

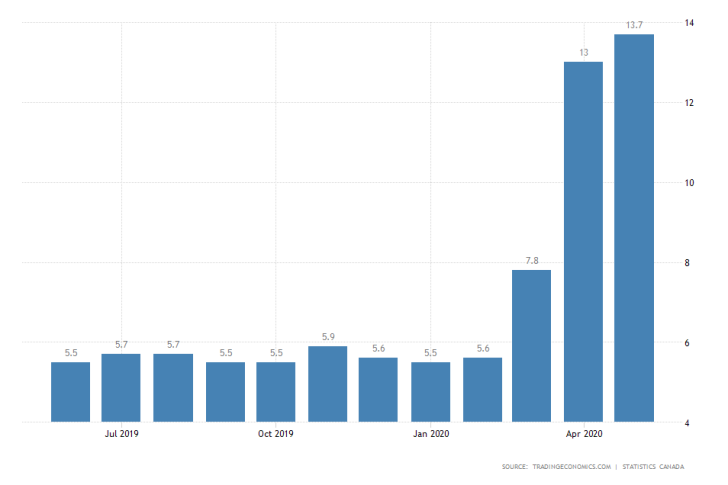

Canada's Unemployment Rate is Expected to Fall in June

On Friday, Statistics Canada is going to release its most recent labour force survey. The general market expectations project a moderate depreciation of the rate by 1.2 per cent. Such results would correlate to a drop to 12.5 per cent from the 13.7 per cent that was recorded a month prior.

If the employment conditions in Canada do indeed improve this would be the first positive news for the country's economy, which shrank considerably in April. As a consequence, the Canadian dollar is likely to be strengthened.

As can be seen on the 4H chart below, the loonie is once again advancing against the greenback. The USDCAD broke down below the ascending channel's lower boundary, which is a type of behaviour that is quite reminiscent of a bearish flag pattern's development.

The latter entails a further dropdown towards the major support level at 1.33150. Nevertheless, there is still hope for market bulls. The price action could rebound from the current major support level at 1.35200, and attempt getting back within the area of the ascending channel.

This could happen on the condition that the ISM non-manufacturing data beats the initial estimations later today, whereas the Canadian economy records yet another jump in its unemployment rate.