U.S. Consumption to Seesaw in January

Given the vitally important U.S. retail sales and production inflation numbers that are scheduled for release this week, the positive momentum on the dollar is likely to be boosted. To read more about what is causing the upsurge in demand for the greenback, check out our last EURUSD analysis.

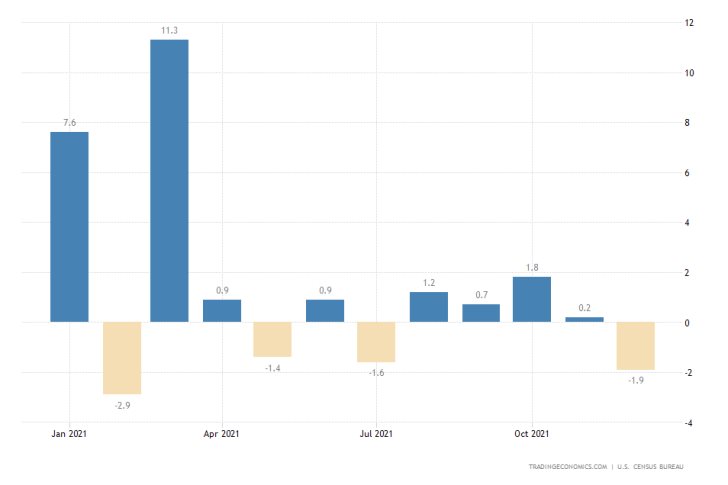

The highlight in the economic calendar for this week will be the U.S. retail sales for January, which are scheduled for publication on Wednesday by the Census Bureau. According to the market forecasts, a massive 1.8 per cent rebound is expected to follow the 1.9 per cent crunch that was recorded a month prior.

These forecasts for seesawing consumption are owing to a number of contributing factors. December's sharp decline was owing to early holiday shopping because of supply chain fears, a trend that is now likely to be reversed as consumer demand is once again on the rise. Robust labour market growth is also likely to foster strong demand.

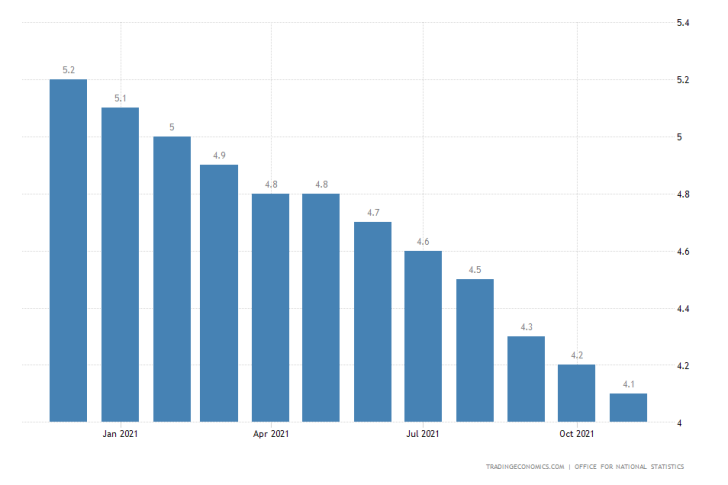

UK Unemployment Rate to Remain at a Pre-Pandemic Low

The Office for National Statistics in the UK will post the latest labour market data on Tuesday. Unemployment is expected to remain unchanged at 4.1 per cent in December, the lowest level on record since the beginning of the coronavirus crisis. Meanwhile, the number of people claiming unemployment benefits is projected to decline by 36.2 thousand from November.

This will be the first major economic release since last week's revelation that economic activity grew at a slower pace in Q4 than initially anticipated. That is why the labour data could strongly impact the recovering pound in the short term.

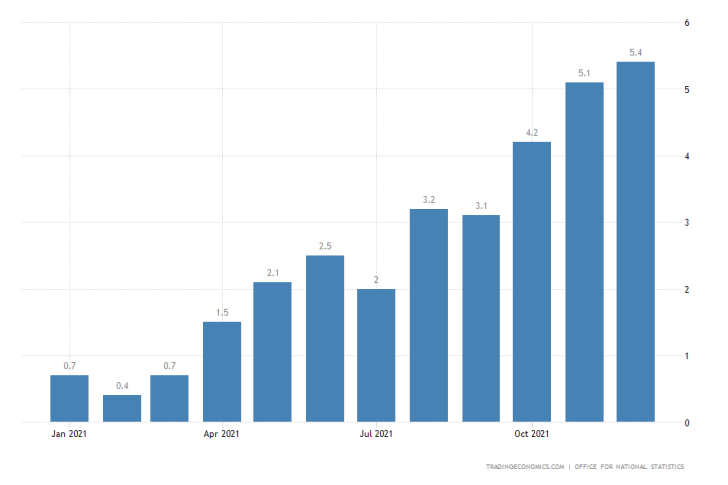

UK Headline Inflation Still at a Three-Decade Peak

The other prominent release in the UK for this week will be the inflation rate numbers for January. The report will once again be compiled by the Office of National Statistics, and it's going to be published on Wednesday.

Headline inflation is expected to remain at 5.4 per cent in January, the same as last month. This is the highest level in thirty years, underpinning the persisting impact of global supply bottlenecks.

The report itself would likely prove to have the most significant effect on the recuperating pound, which is likely to continue consolidating in a tight range against the equally strong dollar.

As can be seen on the 4H chart below, the GBPUSD started consolidating following the completion of the previous downtrend, as underscored by the descending channel. The current range spans between the 23.6 per cent Fibonacci retracement level at 1.36121 and the 38.2 per cent Fibonacci at 1.35260.

The price action is likely to continue fluctuating between the two extremes in the short term for as long as there is no decisive market commitment towards either of the two currencies.

Notice also that the 100-day MA (in blue) is currently converging with the 38.2 per cent Fibonacci while the price action is also concentrated above the 50-day MA (in green). This makes it even less likely for the emergence of any significant breakdowns any time soon.

Other Prominent Events to Watch Out for:

Tuesday - Eurozone ZEW Economic Sentiment; U.S. MoM PPI; Eurozone QoQ GDP Growth Rate.

Wednesday - Canada MoM Inflation Rate.

Friday - UK MoM Retail Sales.