Muted Expectations for the US Retail Sector in September

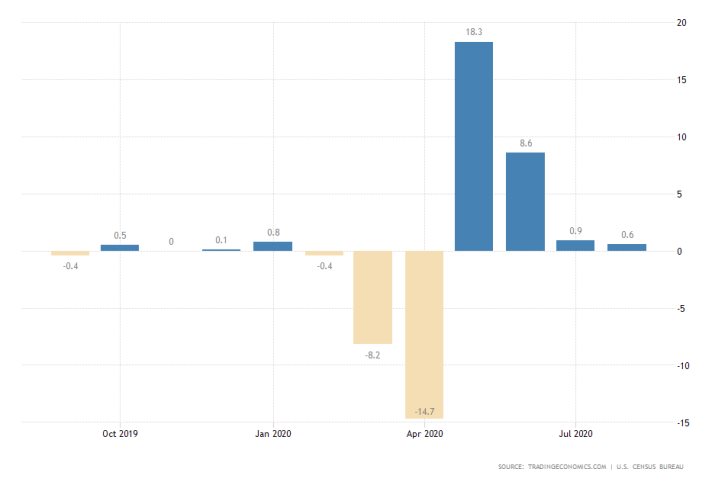

The most important economic release this week is going to be the publication of the US retail data by the Census Bureau, which is scheduled to take place on Friday. The report is going to cover the recorded change in retail sales for the previous month.

According to the consensus forecasts, the index is expected to grow marginally by 0.1 per cent, up from the 0.6 per cent that was observed in August. Potentially dampened results would elucidate stymied pace of recovery as the overall economic activity continues to suffer from a recent uptick of coronavirus cases.

The data is going to be published amidst growing investors' concerns stemming from the tumultuous presidential debates in the US. Additionally, the sudden and unexpected changes in Donald Trump's policymaking have made the markets quite reactive to all news, causing erratic volatility outbursts.

In the immediate aftermath of the retail data's publication, the findings of the report are likely to catalyse even more fluctuations in the markets, especially pertaining to the value of the dollar.

The greenback has been on a wild ride over the past several weeks, being influenced by the continuously changing supply and demand pressures currently affecting most safe-havens.

That is why traders need to remember that proactive trading on the news would entail huge risks, which is why it is inadvisable. Meanwhile, reactive trading, while somewhat safer, still can lead to losses due to the aforementioned levels of uncertainty that are currently weighing down on the global capital markets.

Projections for Deteriorating Labour Conditions in Great Britain Impeding the Pound

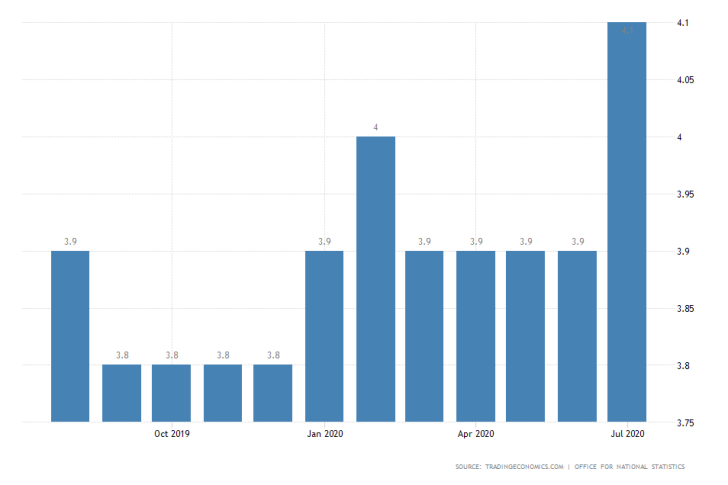

The Office for National Statistics in the UK is scheduled to release the latest unemployment rate data on Tuesday. The leading economic indicator is going to reflect on the recorded changes in the British labour market over the previous three months.

The initial market forecasts anticipate another upsurge in the overall unemployment rate by 0.2 per cent, which would mean that the jobless rate would jump to 4.3 per cent.

This would mark the worst quarterly performance of the British labour market since Q1 of 2018.

The expected uptick in the number of unemployed persons in the UK is resulting from the protracted Brexit woes for Boris Johnson's cabinet, chiefly the stalling negotiations with the EU, but also from the coronavirus fallout.

The catalyst of all of this – the weakening employment conditions in the UK – is, therefore, likely to compound the underlying pressure currently weighing down on the value of the sterling.

Columbus Day to Cause a Sharp Drop in Liquidity at the Beginning of the Week

Most trading activity in the US and Canada is likely to fall drastically on Monday and Tuesday, as the two countries celebrate Columbus day.

Most exchanges are going to remain closed on the Bank holiday, which, in turn, would result in greatly lessened levels of liquidity at the outset of the week.

Traders should keep that in mind when planning their trades, as the diminished levels of liquidity could create unfavourable market conditions. These are underpinned by poor prospects for precise trade execution and erratic price fluctuations.

Even still, there are some interesting developments to monitor. The EURUSD chart below is chosen because of the significance of the US retail data, which could have short-term implications for the value of the greenback.

As can be seen, the pair started advancing in a bullish channel recently, which entails further gains in the immediate future. This is further substantiated by the fact that the price rebounded from the 100-day MA (in blue) prior to the latest upswing.

Minor consolidations around the psychologically significant support level at 1.18000 are also possible, especially today and tomorrow because of the expectations for reduced trading activity.

Other Prominent Events to Watch for:

Monday – Speech by BOE Governor Bailey; Speech by ECB President Lagarde.

Tuesday – German y/y CPI index; Core CPI y/y in the US.

Wednesday – m/m PPI in the US; RBA Governor Lowe speaks.

Thursday – Australian Unemployment rate; US unemployment claims; Chinese y/y CPI data.

Friday – US Preliminary Consumer Sentiment Index.