U.S. Consumer Prices Growth Expected to Slow Down Moderately

The economic calendar for next week looks mostly uneventful, though the top-tier releases are likely to have the most significant impact on the EURUSD. The price of the pair is currently consolidating around a crucial support, which is expounded upon by our comprehensive analysis of the pair.

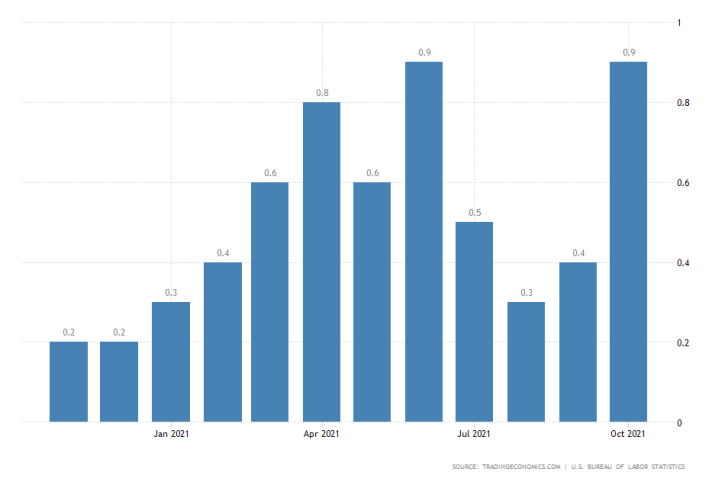

The most impactful economic release taking place this week will be the U.S. inflation numbers for November. The Bureau of Labour Statistics (BLS) will post the latest consumer price index (CPI) data on Friday.

According to the preliminary forecasts, inflation will rise by 0.7 per cent in November, measuring a marginal depreciation in the pace of prices surge from the remarkable 0.9 per cent that was recorded a month prior.

The event will garner significant investors and traders' interest owing to FED Chair Jerome Powell's new take on inflation during his testimony before the U.S. Senate last week.

The report's significance is further bolstered by the fact that the November non-farm payrolls disappointed, which is the second most important gauge of economic stability used by the Federal Reserve.

The Pace of Economic Expansion in the Eurozone to Remain Flat

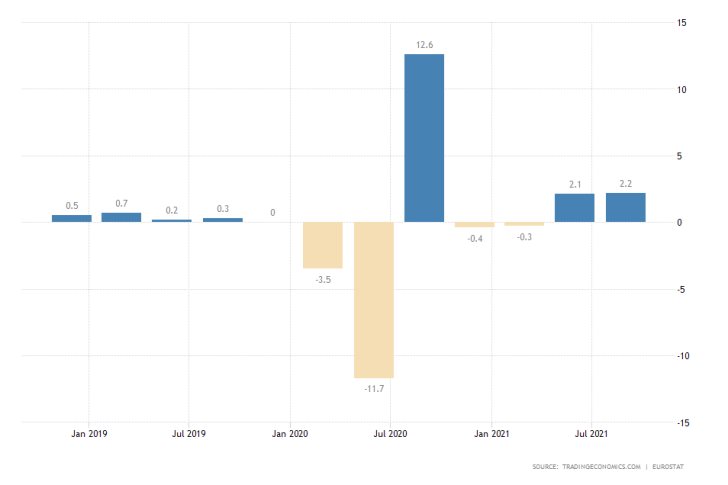

Eurostat will publish the revised GDP growth rate in the Eurozone for the third quarter on Tuesday. The market forecasts do not anticipate any changes to the 2.2 per cent expansions that was reflected by the advance report.

These projections are predicated on the robust industry expansion that was recorded in the three months leading to September, elucidating the resilience of the Euro Area's recovery before the spread of the Omicron variant.

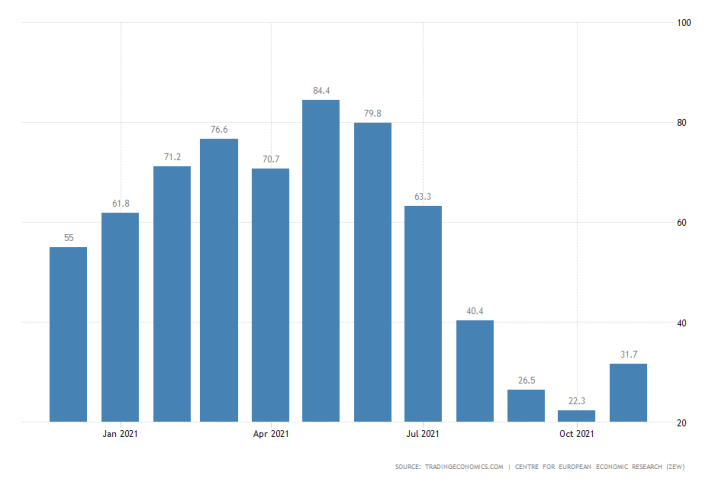

Drastic Drop Anticipated in German Economic Sentiment

Again on Tuesday, ZEW will release the recorded change in the German economic sentiment in November. A significant crunch is projected from the moderate improvement of 31.7 index points that was underpinned in October.

The index is expected to falter to 25.9 points owing to the above-mentioned upsurge in investors' fears owing to the Omicron variant.

These projections are also based on the fact that consumption in the biggest economy in the Eurozone remained subdued over the same period. Despite all of these factors, the euro is still attempting to recuperate against the greenback in the short term.

As can be seen on the daily chart below, the price action is currently consolidating above the 61.8 per cent Fibonacci retracement level at 1.12936, which could spell the termination of the existing downtrend.

It was initiated following the completion of the Double Top pattern, underpinned by the breakdown below the major support-turned-resistance area.

However, the price action also remains concentrated below the 20-day MA (in red), which serves as a floating resistance. Failure to break out above it could represent just a temporary break in the downtrend as opposed to a decisive trend reversal.

That is why it is so vitally important to continue monitoring the behaviour of the price action within this emerging bottleneck - spanning between the 20-day MA and the 61.8 per cent Fibonacci - over the next several days.

Other Prominent Events to Watch Out for:

Tuesday - China MoM Trade Balance; Australia RBA Cash Rate Decision.

Wednesday - Canada BOC Overnight Rate Decision; Japan QoQ GDP Growth Rate.

Thursday - China MoM Inflation Rate.

Friday - UK MoM GDP Growth Rate; Germany MoM Inflation Rate.