U.S. Inflation Growth Rate Expected to Fall for the Third Consecutive Month

In what looks poised to be quite an uneventful week, lacking many market-movers in the economic calendar, the overall trading volume is likely to decrease significantly. This would provide assets that have been struggling lately a chance to recuperate. Check out our newest Bitcoin analysis to read more about those prospects.

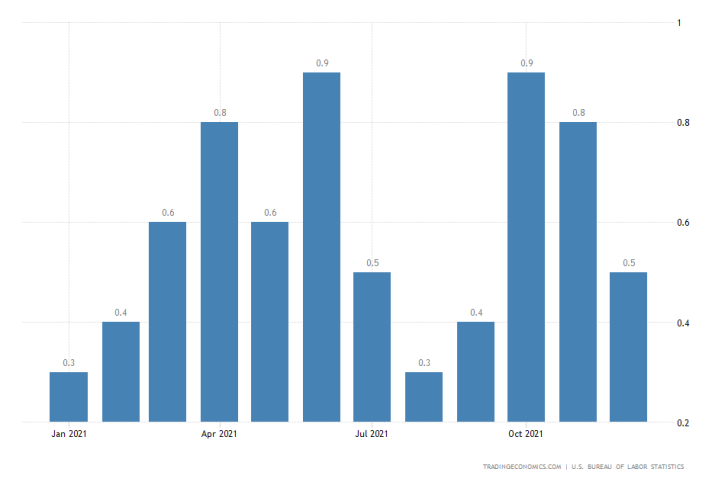

The only top-tier economic release scheduled for this week will be the U.S. inflation numbers for January. The Bureau of Labour Statistics (BLS) will post the latest inflation growth rate numbers on Thursday.

According to the preliminary forecasts, inflation is expected to have accelerated 0.4 per cent in January, measuring a small decline from the last month of 2021 when prices grew by 0.4 per cent.

If these projections are realised, this would mean that the pace of inflation growth would have decreased for the third consecutive month. Meanwhile, headline inflation remains at 7.0 per cent, the highest level in forty years.

Overall, investors have plenty of reasons to be optimistic regarding the current state of U.S. recovery. The economy expanded more than expected last quarter while bubbling inflation shows early signs of deceleration following FED's last policy meeting.

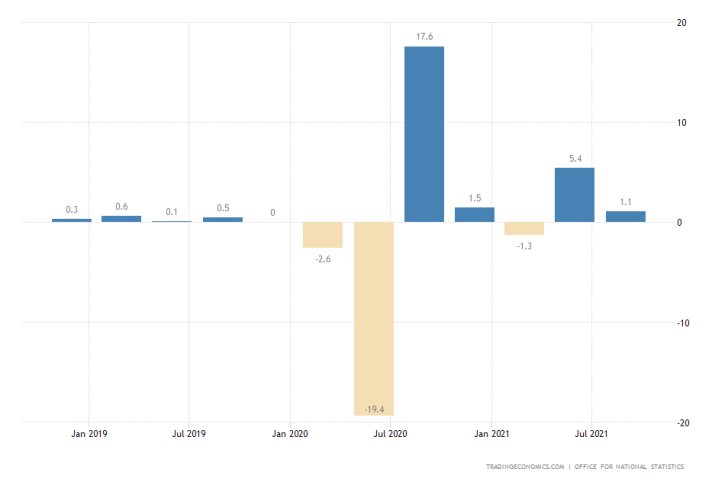

No Changes Expected in UK's Rate of Economic Expansion

On Friday, the Office for National Statistics is scheduled to publish the GDP growth rate numbers for the last quarter of 2021. No changes are anticipated from the previous quarter, underpinning the same rate of expansion measuring 1.1 per cent.

Despite the fact that no massive changes in overall activity are expected, the BOE adopted a decidedly more hawkish policy stance last week by lifting the main interest rate by 0.25 percentage points. The decision was predicated on the desire of the bank to curb soaring inflation in the UK.

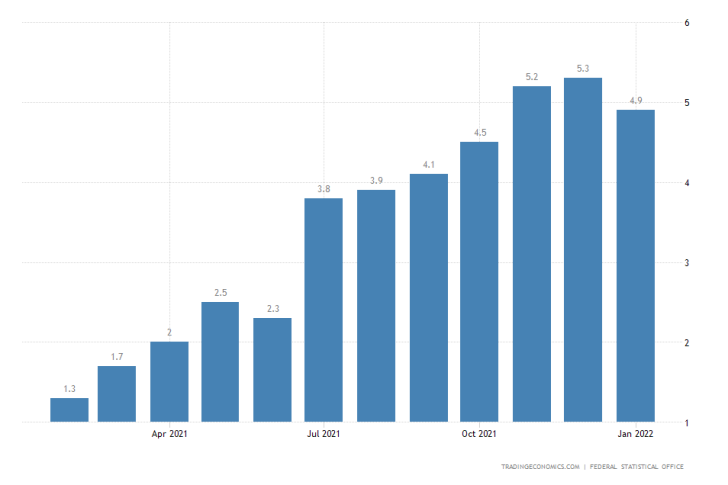

German Inflation Expected to Remain Unchanged from Last Month

Again on Friday, Destatis will release the latest inflation numbers for the biggest economy in the Eurozone. According to the market forecasts, headline inflation in Germany will remain unchanged at 4.9 per cent from a month prior.

Similarly to the UK, no considerable changes in the underlying economic activity in the Eurozone were observed on a quarterly basis. Meanwhile, the ECB showed a lot more cautious restrain in augmenting its policy stance last week.

This similarity in the underlying economic conditions in Britain and the Eurozone as a whole is likely to foster some interesting trading set-ups on the EURGBP pair in the near future. As can be seen on the 4H chart below, the euro gained significant ground against the pound last week in the wake of ECB's January policy meeting.

The upswing is currently drawing near the 61.8 per cent Fibonacci retracement level at 0.84804, which is where a minor bearish pullback could emerge. Such a correction could fall to the major resistance-turned-support area (in red), underpinned by the 300-day MA (in purple) and 38.2 per cent Fibonacci at 0.84060.

Even still, the underlying sentiment looks ostensibly bullish.