Marginal Increase in U.S. GDP Growth Rate Expected

The economic calendar for the next several days looks mostly uneventful. The lack of many top-tier economic releases means that trading activity would likely diminish, leading to decreased levels of adverse volatility. These conditions would probably cause a temporary consolidation on the currently trending EURUSD pair.

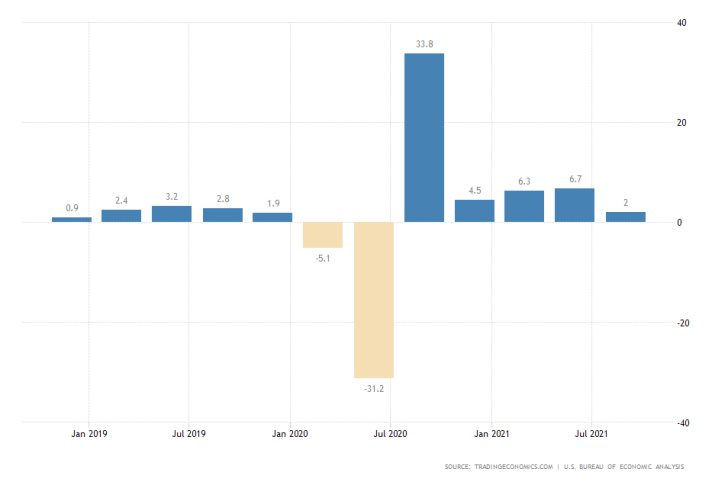

The most significant event this week will be the publication of the latest U.S. growth data. The Bureau of Economic Analysis is scheduled to post the quarterly GDP numbers on Wednesday.

According to the preliminary forecasts, the rate of expansion of the U.S. economy is expected to have accelerated marginally by 0.2 per cent in the three months leading to September. This would measure an increase by 2.2 per cent compared to the 2.0 per cent expansion that was recorded in Q2.

If these projections are realised, this would bolster the trend of positive economic data that has been observed recently, including the release of better-than-expected consumption and employment numbers.

Germany's Industry to Continue Shrinking in November

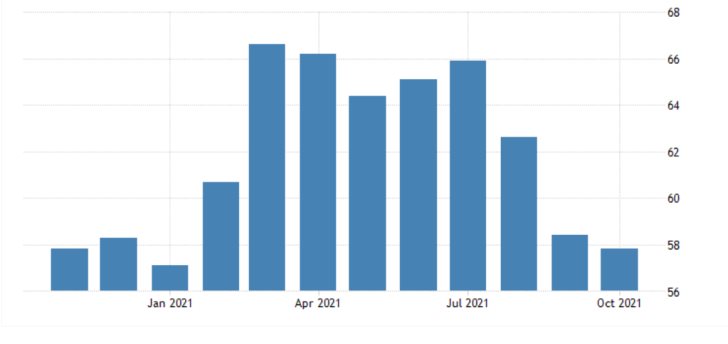

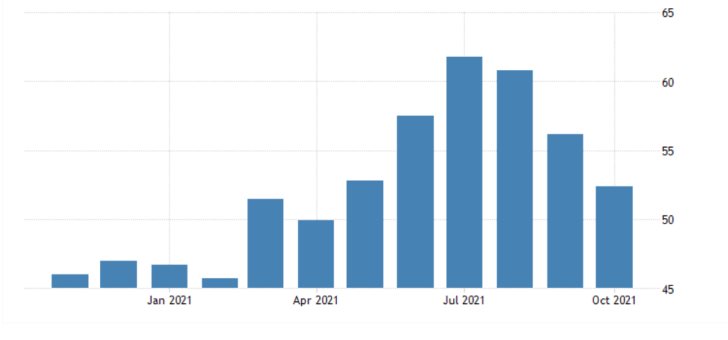

On Tuesday, Eurostat is scheduled to release the newest industrial numbers for the Eurozone as a whole, but the most impactful ones will be the German services and manufacturing PMI data.

Factory activity is expected to decline moderately to 56.6 index points from the 57.8 index points that were recorded in October. This would mark the weakest performance since January, despite the sizable uptick in economic activity in the Euro Area that was observed recently.

The services PMI, in turn, is forecasted to fall to 51.4 index points from the 52.4 index points that were recorded a month prior. Such a performance would run opposite to the recent improvement in economic sentiment in the Eurozone's biggest economy.

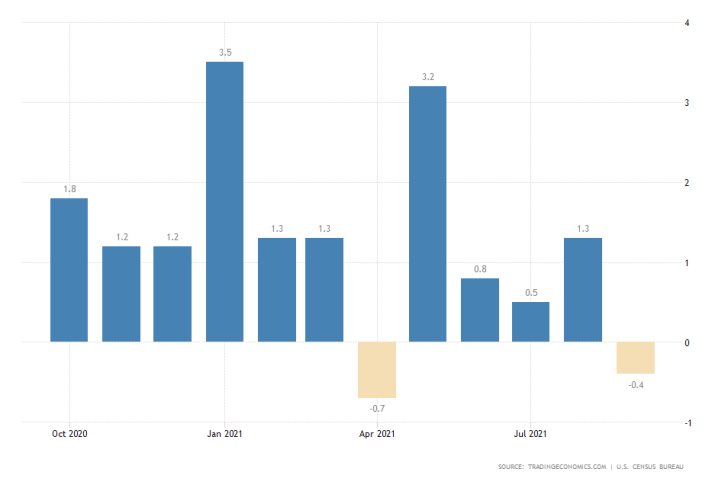

U.S. Factory Orders to Continue Seesawing

On Wednesday, the U.S. Census Bureau will post the October factory orders. According to the preliminary forecasts, the durable goods orders will increase marginally by 0.2 per cent compared to the 0.4 per cent contraction a month prior. This would represent a sizable rebound in aggregate demand over the last month.

Such a performance is likely to have a positive impact on the gaining dollar in the short term. Nevertheless, the rather uneventful week ahead would probably prompt a temporary drop in the underlying liquidity levels. Under such conditions, the price action of the EURUSD could consolidate in a temporary range.

As can be seen on the 4H chart below, the price action has been developing a major Markdown, as postulated by the Wyckoff Cycle theory, over the last few days. The expected drop in trading activity could therefore catalyse a new Accumulation range near the bottom of the downtrend.

The range is likely to span between the major support level at 1.12700, underpinned by the recent Hammer candlestick, and the 23.6 per cent Fibonacci retracement level at 1.13532. The waning bullish momentum, as underscored by the declining histogram of the MACD indicator, corroborates these expectations.

Other Prominent Events to Watch Out for:

Monday - Eurozone MoM Preliminary Consumer Confidence.

Tuesday - French MoM Flash Services and Manufacturing PMI; Eurozone MoM Flash Services and Manufacturing PMI; UK MoM Flash Services and Manufacturing PMI; U.S. Flash MoM Services and Manufacturing PMI.

Wednesday - New Zealand RBNZ Bank Decision; Germany MoM ifo Business Climate; U.S. MoM Core Price Index; U.S. FOMC Policy Minutes.

Thursday - Germany QoQ GDP Growth Rate; Germany MoM Consumer Confidence; Australia MoM Retail Sales; Japan MoM Consumer Price Index.