Optimism Prevails Ahead of the August NFP Release

The most prominent event taking place this week is going to be the US Non-Farm Payrolls publication in the US, which is scheduled to take place on Friday. As per usual, the release of the NFP report will coincide with the publication of Canadian employment data, which is likely to stir heightened volatility on the USDCAD pair.

The consensus forecasts project another decrease in the US unemployment rate, which would be welcoming news for FED Chair Jerome Powell and his colleagues at the Federal Reserve.

During his pivotal speech on monetary policy last week, Mr Powell emphasised on the readiness of the Federal Reserve to use all available tools to facilitate maximum employment in the US, hinting that interest rates are likely to remain low for quite a long time.

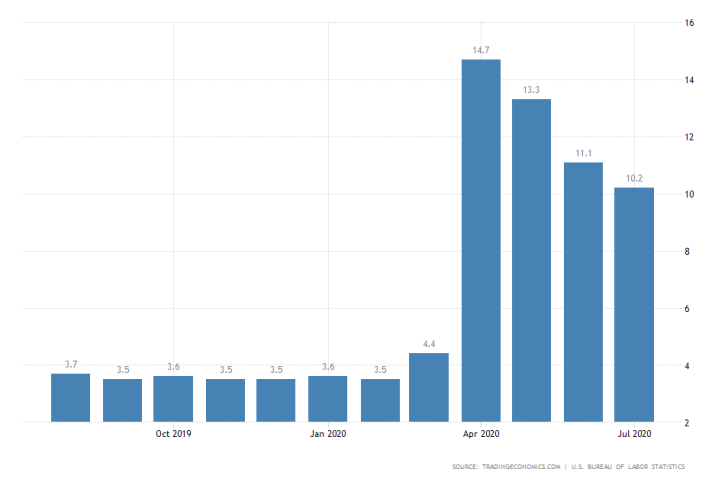

Headline unemployment was measured at 10.02 per cent in July, and the initial market forecasts project another depreciation in the rate by 0.4 per cent to be recorded in August.

If the unemployment rate does indeed depreciate to 9.8 per cent, this drop will represent the fourth consecutive fall since May. Such a performance would allude to the robustness with which the US labour market is recovering from the initial hit of the coronavirus crisis.

The surprising jump in initial benefits claims in late-August could have hurt the prospects for jobs creation, potentially resulting in a weaker-than-expected reduction in headline unemployment.

At any rate, the simultaneous publication of employment numbers in the US and Canada is likely to prompt massive fluctuations on the USDCAD pair's price action, which tends to happen every month.

This time perhaps even more so, given the emphasis that Jerome Powell placed on jobs creation and his remarks concerning the seemingly broken correlation between inflation and unemployment. Traders and investors are now likely to examine employment figures with even more interest than usual.

US Non-Manufacturing PMI Data Expected to be Revised Down in August

The ISM is scheduled to release important industry numbers concerning the US economy this week. The August Non-Manufacturing PMI data is going to be released on Thursday, whereas the Manufacturing PMI numbers are scheduled for publication on Tuesday.

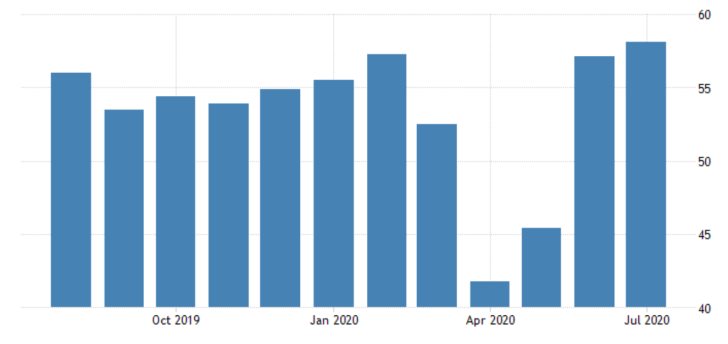

The services sector is expected to have contracted since last month's climb to 58.1 index points. The consensus forecasts anticipate a drop in industrial activity to be recorded in spite of eased government restrictions from a month prior.

The ISM Non-Manufacturing PMI is therefore likely to be revised down by 0.6 index points to 57.5.

Such a minor deterioration is going to be at odds with the ongoing recovery process, though it is unlikely to pose a bigger threat to the longer-term trends of stabilisation in the broader US economy.

If the findings of Thursday's report meet the initial expectations, this would mean that overall industrial activity in the US services sector would consolidate around its pre-crisis levels – a significant signal of normalisation. This would be positive news given that US consumer confidence dropped in August.

Markets Brace for a Likely Dovish RBA to Remain on Course in August

The Board of Directors of the Reserve Bank of Australia is going to meet this Tuesday to deliberate on the most recent developments in the global economy, and to adjust its monetary policy stance if it deems it necessary.

The Monetary Policy Committee (MPC) adopted a more dovish outlook at its last meeting compared to its more forward-looking rhetoric in July. This was due to the increased likelihood of a second economic downturn by the end of the year, coupled with a resurgence of COVID-19 cases in Australia.

The RBA is unlikely to alter its position from a month prior, especially given the comments of Jerome Powell at the Jackson Hole symposium concerning the applicability of monetary policy to induce growth during a pandemic.

The MPC is therefore almost certainly going to maintain the Cash Rate unchanged at 0.25 per cent, as the Australian economy continues to struggle with the ripples from the coronavirus.

Market participants would be looking for signals from MPC's monetary policy statement that the RBA is considering scaling up its asset purchase facility in order to address the persisting threat from new blows to the Australian financial system.

Moving on, look at the USDCAD daily chart below. As was mentioned earlier, the pair is likely to experience a sudden surge in volatility around the time when the US and Canada release their labour market findings for August.

As can be seen, the price action is nearing the historic support level at 1.30000, which also bears significant psychological importance.

Furthermore, this particular level served as the lower boundary of the last Accumulation range, which is why a rebound from it is very probable to take place if the price action sinks to the support.

The likelihood of this happening will be increased if Friday's NFP data exceeds the initial expectations. However, it should also be duly noted that the broader market sentiment remains ostensibly bearish, and it would likely take some time before the bulls manage to regain complete control.

Other Prominent Events to Watch for This Week:

Wednesday – Quarterly GDP in Australia; ADP Non-Farm Employment Change in the US; Crude Oil Inventories in the US.

Thursday – Trade Balance in Canada; Unemployment Claims in the US; BOE Governor Bailey Speaks in the UK.