British Consumer Prices Expected to Ease in July

This week's economic releases in the UK and the U.S. are set to cause additional volatility to the undecided GBPUSD. The cable consolidated in a range last week in anticipation of the next big directional price movement.

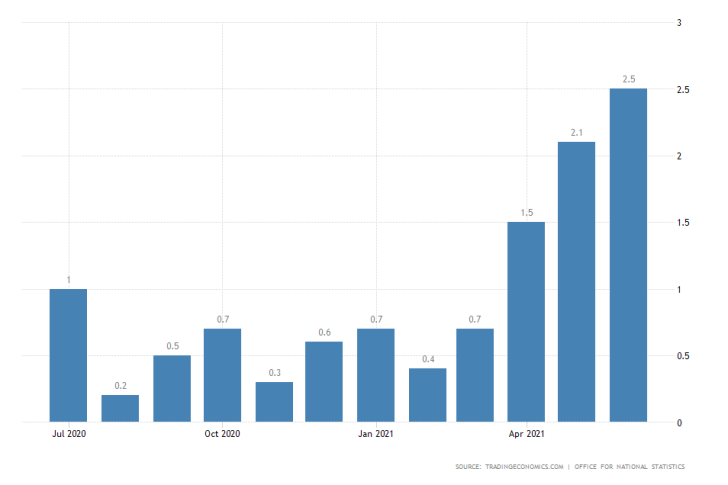

In arguably the most impactful event scheduled to take place this week, the Office for National Statistics in the UK is due to release the latest inflation data on Wednesday.

According to the preliminary forecasts, headline inflation is likely to decrease for the first time in four months. Such a performance would reflect global tendencies of easing demand pressures.

The consumer price index (CPI) was reported at 2.5 per cent in June, the highest level since August 2018, reflecting BOE's accommodative monetary policy stance. The market forecasts anticipate a marginal drop of 0.2 per cent in July, driving the index to 2.3 per cent.

The drop is projected despite the British economy's accelerating pace of growth that was observed in the second quarter. If these forecasts are met on Wednesday, this would likely pressure the sterling in the short term.

This same kind of dynamic was observed on the dollar last week, following the publication of the latest consumer prices data in the U.S.

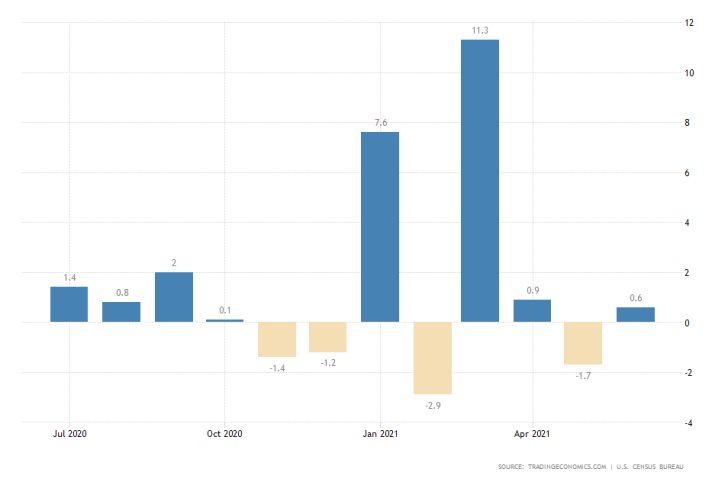

U.S. Retail Sales to Continue Seesawing in July

The U.S. retail sales are expected to take another sizable downturn in July, following a positive 0.6 per cent rebound a month prior. The index is forecasted to contract by 0.2 per cent. The Census Bureau will release the survey findings on Tuesday.

In July, demand for goods took a hit juxtaposed to a stark increase in the aggregate demand for services. This change in the equilibrium was reflected by the sharp downturn in the price of crude oil over the same period.

As retail sales in the U.S. continue to seesaw over the summer months, so the dollar is likely to be affected by swift changes in demand, causing even more volatility on all currency pairs involving the greenback.

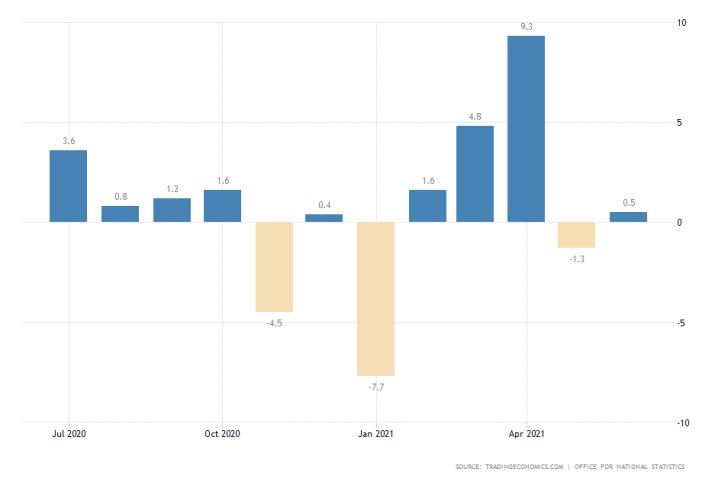

UK's Retail Sector to Show More Resilience

The latest retail sales data in Britain is also scheduled for publication this week, on Friday. However, the Office for National Statistics is forecasted to post much more robust numbers compared to the U.S. Census Bureau.

The market forecasts expect the index to remain flat at 0.5 per cent, recording no changes from a month prior. Even still, the anticipation surrounding the event is still likely to cause temporary fluctuations on the GBPUSD ahead of the closing of this weeks' trading session.

As can be seen on the 4H chart below, the underlying price action is already at a crucial turning point. It is concentrated just below the upper boundary of the descending channel, which is currently converging with the 50-day MA (in green) and the 100-day MA (in blue).

Additionally, these three resistances are also positioned quite close to the 23.6 per cent Fibonacci retracement level at 1.38857, meaning that a sizable breakout above the four is improbable in the foreseeable future.

This is further substantiated by the fact that the underlying buying pressure has already climaxed, as underpinned by the Stochastic RSI indicator.

However, the price action has also rebounded from the 38.2 per cent Fibonacci at 1.38255 on the two occasions that it probed this major support level, which means that the continuation of the broader downtrend is also far from certain.

Other Prominent Events to Watch Out for:

Tuesday - FED Chair Powell Speaks; Australia RBA Meeting Minutes; UK MoM Unemployment Rate; EU Preliminary QoQ GDP Growth Rate.

Wednesday - New Zealand RBNZ Interest Rate Decision; Canada MoM CPI; FOMC Meeting Minutes.

Thursday - Australia MoM Unemployment Rate.

Friday - Canada MoM Retail Sales.