U.S. Inflation Set to Continue Rising in February

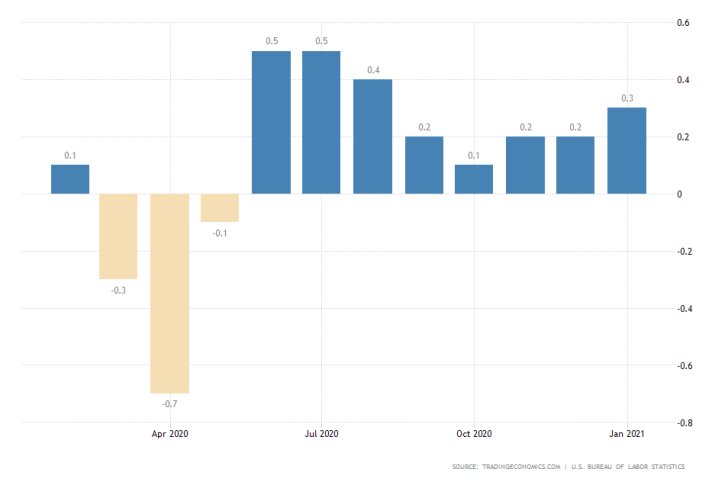

This week's most impactful event will be the publication of the U.S. inflationary data for February, which is going to be posted by the Bureau of Labour Statistics (BLS) on Wednesday.

According to the preliminary market forecasts, the Consumer Price Index is expected to grow by 0.4 per cent in February, continuing the positive trend from a month prior. At present, headline inflation is at 1.40 per cent, which underpins a noticeable improvement, but still remains below FED's longer-term goals.

All eyes are focused on U.S. price stability, as headline inflation remains a primary benchmark for setting FED's monetary policy stance. Investors are somewhat concerned that rising inflation would prompt Jerome Powell and his colleagues to revise the Federal Reserve's accommodative stance.

As a consequence of these concerns, U.S. yields have recently started to pick up, which is exerting pressure on stocks. While the economic conditions are undoubtedly improving, the underlying recovery remains quite tentative, which means that it is unlikely that the FED would consider tightening the level of support by the end of next year.

Overall, Wednesday's data will probably support the recuperating dollar, while the observed volatility in the stock market is likely to continue appreciating.

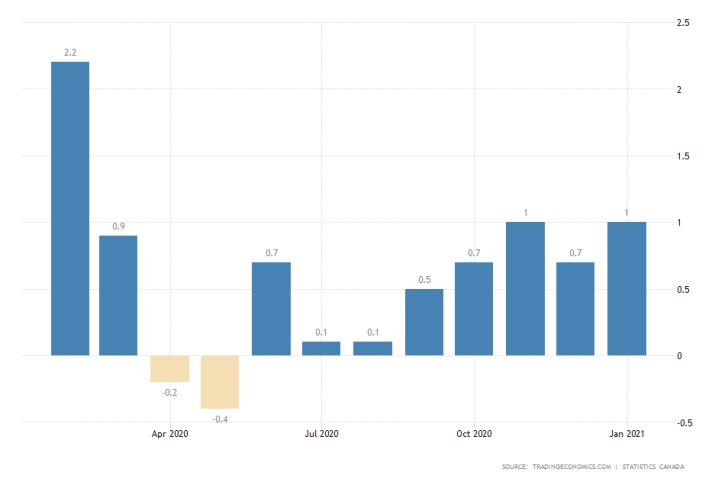

Bank of Canada to Remain Cautious

Also on Wednesday, the Governing Council of the Bank of Canada is scheduled to meet and deliberate on its current monetary policy stance. The Council is almost certainly going to keep the near-negative Overnight Rate unchanged at 0.25 per cent.

Inflation in Canada is also rising, but the pace of recovery is slower than what is observed in the U.S. The rate of stabilisation is still bumpy and uneven. That is why the BOC is expected to maintain its accommodative monetary policy stance unchanged, which will be inlined with what the Council stated at its previous meeting.

" Bank of Canada will hold current level of policy rate until inflation objective is achieved. […] The Bank is maintaining its extraordinary forward guidance, reinforced and supplemented by its quantitative easing (QE) program, which continues at its current pace of at least $4 billion per week."

Meanwhile, the rallying crude oil prices in the energy market continue to support the strong demand for the Loonie, which, for the time being, manages to resist the strengthening greenback.

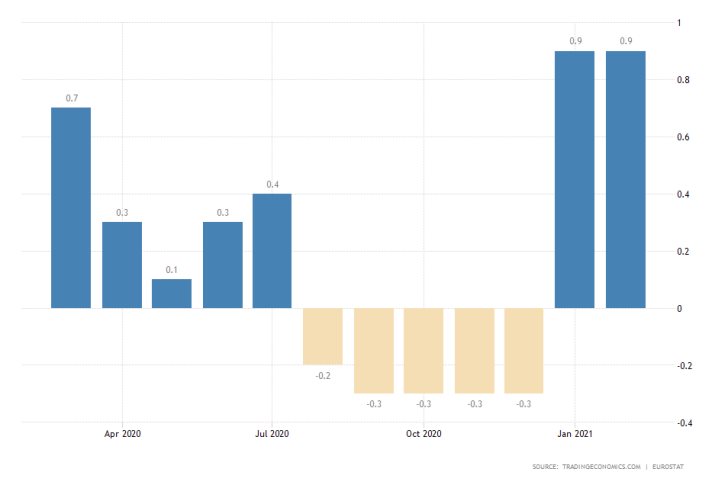

ECB Flirts with the Idea of Negative Rates

In yet another monetary policy meeting scheduled for this week, the Governing Council of the European Central Bank will be gathering on Thursday. Similarly to what was already said about the FED and BOC, the ECB is expected to keep the Main Refinancing Rate unchanged at 0.00 per cent.

Euro Area's recovery continues to be the most uncertain and fragile out of the three listed economies, which is what compels the ECB to maintain the most accommodative MP stance.

Inflation in the Eurozone is still quite subdued, noticeably lagging behind the general pace of global recovery. That is why the ECB is the central bank that is most likely to ramp up its underlying QE (quantitative easing) programmes.

The EURUSD looks poised to have quite a volatile week ahead owing to the U.S. inflationary data and ECB's monetary policy decision.

As can be seen on the 4H chart below, the pair is currently depreciating steadily. The underlying price action appears to be in the process of establishing a Falling Wedge pattern, which underpins the presently rising bearish bias.

This increasingly more pronounced sentiment is further elucidated by the MACD indicator and the fact that the price action is concentrated below the 50-day MA (in green), which is trading below the 100-day MA (in blue).

A minor bullish pullback could test the 1.19500 resistance (previous swing low) from below before the broader downtrend continues with its development.

Other Prominent Events to Watch for:

Monday - BOE Governor Bailey Speaks; Japan GDP q/q Final.

Tuesday - RBA Governor Lowe Speaks; EU q/q GDP Revised.

Wednesday - China CPI y/y.

Friday - Canada Unemployment Rate m/m; US Michigan Consumer Sentiment Index Preliminary.