The ECB Has to Become Proactive Once Again

The most important economic event that is taking place this week is undoubtedly going to be the monetary policy meeting of ECB's Governing Council, which is scheduled to take place on Thursday.

The European Central Bank did not implement any major changes or adjustments to its monetary policy stance the last time the Council convened, which is why many traders and investors would be eyeing at least partial interventions at the present rate.

These expectations are backed up by the fact that the Council had previously stated that it will examine the "new round of Eurosystem staff macroeconomic projections in December", and also that:

"On the basis of this updated assessment, the Governing Council will recalibrate its instruments, as appropriate, to respond to the unfolding situation and to ensure that financing conditions remain favourable to support the economic recovery and counteract the negative impact of the pandemic on the projected inflation path".

The initial market forecasts do not expect any changes to the Main Refinancing Rate, which is currently at 0.00 per cent. However, given the tanking consumer confidence and jolted industrial output in the Euro Area, the Governing Council is more than likely to bolster the underlying Asset Purchase Facility.

Any changes to ECB's quantitative easing programs are likely to correlate to heightened volatility for the single currency, which has experienced a considerable rally over the past several weeks.

BOC Faced with Similar Challenges

In the other monetary policy meeting of a major central bank scheduled for this week, the Governing Council of the Bank of Canada is gathering on Wednesday. The near-negative Overnight Rate is expected to be kept unchanged at 0.25 per cent.

Unlike the ECB, the BOC recalibrated the overall scope of its quantitative easing programs in late-October, which puts it in a precarious position of having to deal with downwardly revised economic conditions.

" The Bank is recalibrating the QE program to shift purchases towards longer-term bonds, which have more direct influence on the borrowing rates that are most important for households and businesses. At the same time, total purchases will be gradually reduced to at least $4 billion a week."

The Governing Council will have to decide whether the dampened epidemic conditions in the country necessitate any further interventions by means of scaled-up QE at the present rate.

US Consumer Prices Set to Grow Marginally in November

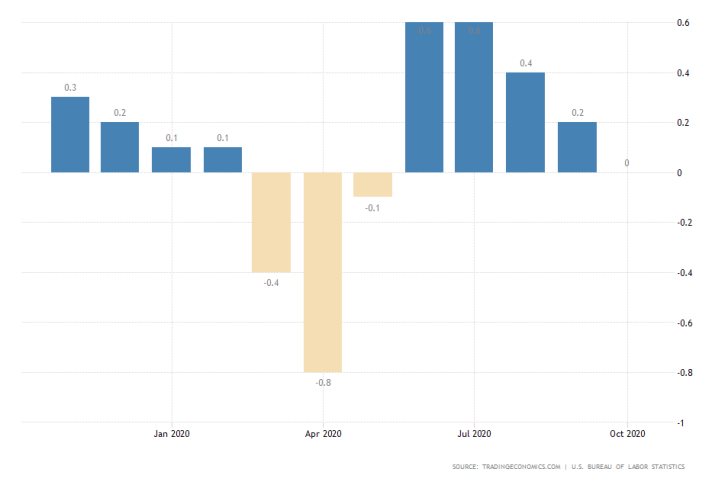

On Thursday, the US Bureau of Labour Statistics is scheduled to release the Consumer Price Index data for November. According to the consensus forecasts, the CPI is expected to grow very marginally by 0.1 per cent.

If these initial projections are realised, this will mark the first improvement in five months, albeit a very subdued one. The moderate growth of consumer prices is subject to the stabilising energy prices.

Headline inflation needs to grow above FED's symmetric 2 per cent target rate before the FOMC can cut the Federal Funds Rate and reduce the scope of its own QE programs.

Meanwhile, this inflationary data in the US, coupled with ECB's monetary policy decision, are likely to bolster the underlying volatility currently affecting the EURUSD. As can be seen on the 4H chart below, the pair reached a multi-year peak last week, which is why the market bears are expecting to see a minor correction soon.

The Bollinger Bands are tightening at present, which underscores diminishing levels of adverse volatility. The underlying traded volume is also diminishing, whereas the MACD indicator demonstrates a bearish crossover.

Other Prominent Events to Watch for:

Monday – GDP q/q Japan.

Tuesday – GDP q/q EU.

Wednesday – CPI m/m in China.

Thursday – GDP m/m UK.

Friday – PPI m/m US; Michigan Consumer Sentiment in the US.