Labour Conditions in the U.S. Expected to Recoil in December

The most important economic event taking place this week will be the publication of the December Non-Farm Payrolls in the United States. The Bureau of Labour Statistics (BLS) is scheduled to release the employment findings this Friday.

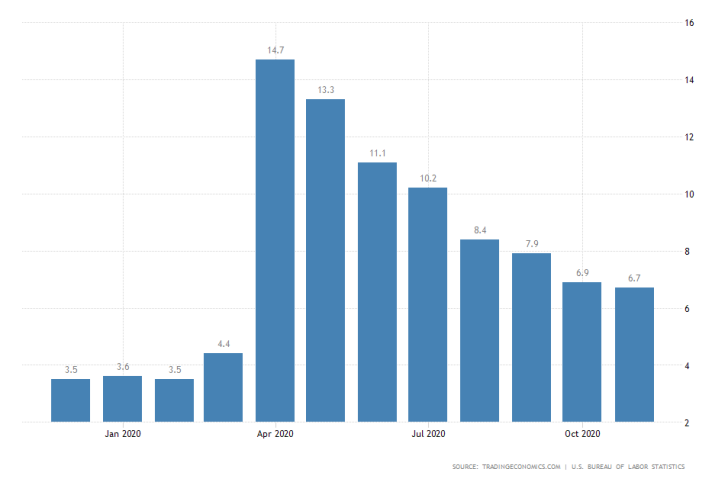

According to the consensus forecasts, headline unemployment is likely to jump marginally by 0.1 per cent from November's 6.7 per cent. If these projections are realised, this will mark the end of seven months of consecutive contractions in headline unemployment.

Thus, the American labour market is anticipated to have added just 69 thousand new jobs over the last month of 2020, which would represent a stark plunge compared to the 245 thousand new job openings that were recorded just a month prior.

Despite the fact that the U.S. has already commenced the Pfizer vaccine roll-out, the rate of distribution amongst the general population is missing the initial mark.

The Trump administration had pledged to get up to 20 million people vaccinated by the end of 2020, but less than 3 million people have actually received the jab so far. This discrepancy is inlined with our initial projections for potential problems with the logistics of administering the vaccine on a mass-scale.

Thus, the labour market growth is likely to have suffered somewhat in December in the midst of continual record-breaking climbs in the number of people diagnosed with coronavirus.

Canadian Employment Projected to Tank in December

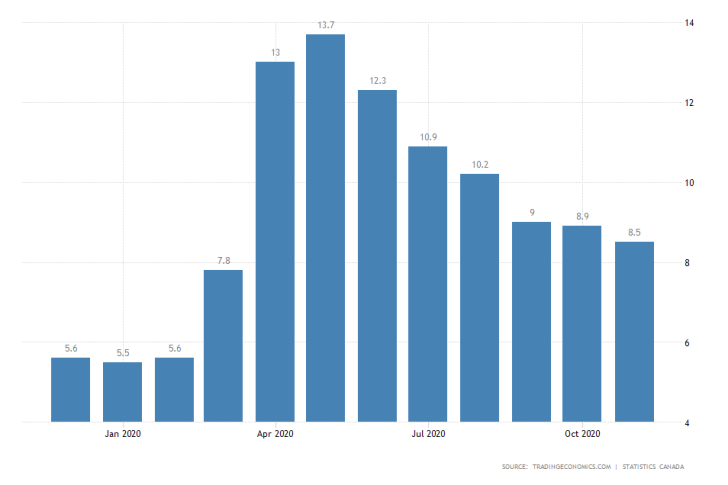

Statistics Canada is also scheduled to release its own Non-Farm Payrolls findings for December simultaneously with the U.S. Bureau of Labour Statistics on Friday. According to the initial market forecasts, the Canadian unemployment rate is projected to rise moderately by 0.1 per cent to 8.6 per cent.

More worrisome, the Canadian labour market is anticipated to have lost five thousand jobs over the previous month, compared to the 62 thousand new jobs created in November.

Even though Canada's epidemic situation seems more timid compared to the deteriorating conditions in the U.S., the local labour market remains more susceptible to sudden ripples from the pandemic. This means that the Canadian recovery process remains less robust when contrasted against the situation in Canada's southern neighbour.

Woes for the Hindered U.S. Manufacturing to be Exacerbated in December

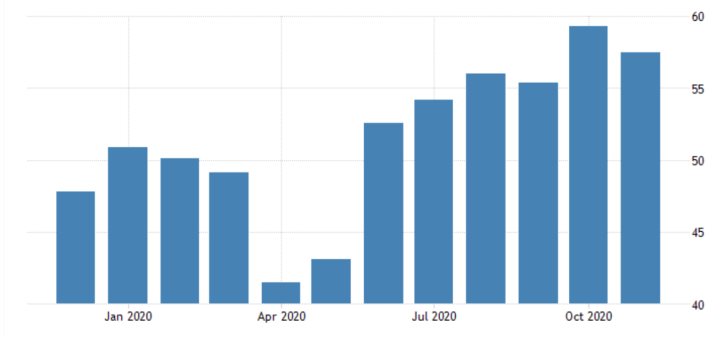

The third most impactful economic release that is taking place this week will be the U.S. manufacturing PMI data release, which is scheduled for Tuesday. Due to the aforementioned economic circumstances in the U.S., the preliminary market expectations are not quite optimistic.

The trend of deteriorating manufacturing output that was initiated in November is expected to continue in December as well. Thus, the Institute for Supply Management (ISM) is anticipated to revise down the index from November's 57.5 points to a new low of 56.6 index points.

Despite these pessimistic projections, however, there are reasons to remain hopeful for the reeling dollar. With the beginning of the new year, the enthusiastic traders returning to their workplaces typically tend to drive the stock market north in January.

The consequences of this market seasonality factor usually pan out to be supportive of the greenback, oftentimes resulting in new rallies for the king currency.

As can be seen on the 4H chart below, the U.S. dollar is currently attempting to consolidate against the Loonie after having recently reached a new multi-month low.

The emergence of this new Accumulation range, as postulated by the Wyckoff Cycle theory, from the preceding Markdown trend, represents a major indication of the presently changing market sentiment.

Despite the fact that the price action failed to break out above the 1.29000 resistance and head towards the psychological barrier at 1.30000, it remains concentrated above the 1.27000 support, which for the time being constitutes a bullish signal.

This, however, should not be perceived as an indication for an immediate buy as the MACD indicator preserves its ostensibly bearish reading. Nevertheless, this changing market bias constitutes an evolving opportunity for future trading.

Other Prominent Events to Watch for:

Monday - OPEC-JMMC Meetings - All Day; Manufacturing PMI Canada.

Tuesday - Retail Sales Germany.

Wednesday - Harmonized Index of Consumer Prices in Germany (Preliminary); ADP Employment Change in the U.S.; FOMC Minutes; BOE Gov Bailey Speaks.

Thursday - U.S. Unemployment Claims; ISM Services PMI US; Trade Balance Australia; Retail Sales E.U.; Consumer Price Index E.U.;