Big Tech is Likely to Jar the Stock Market This Week

Microsoft and Amazon, two out of the four blue-chip companies comprising the 'Big Tech' group, are scheduled to report their quarterly earnings this week.

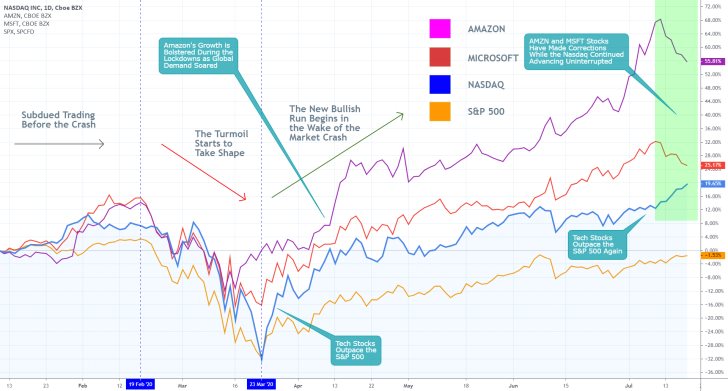

Even at the height of the coronavirus turmoil in the market, tech stocks demonstrated remarkable resilience to these external pressures, which is why investors are bracing for another volatile week during the current earnings season.

They are expecting Amazon and Microsoft to continue the trend of robust quarterly performance, and thereby to build on what was initiated in the wake of the stock market crash.

Microsoft is projected to deliver Earnings Per Share of $1.39, which, if realised, would surpass even the EPS of $1.37 that were generated during Q2 of last year. Meanwhile, Amazon is expected to deliver EPS of $1.70 vs $5.22 from a year prior.

Both stocks have eased their respective rallies last week ahead of the earnings data scheduled for this week – Microsoft is forecasted to report on Wednesday after the market close, and Amazon is anticipated to report on Thursday with no specified time.

The retail giant's stock is in a particularly favourable position to jump following the release of the earnings data. As can be seen on the chart below, Amazon consistently outperformed the market since its initial plunge, as it saw a sizable jump in its operations during the global lockdowns.

This trend is more than likely to be reflected in the data for the second quarter, which creates a perfect opportunity for the bulls to join the market at the current swing low.

Industrial Numbers from the Eurozone's Top Performers Scheduled for Release on Friday

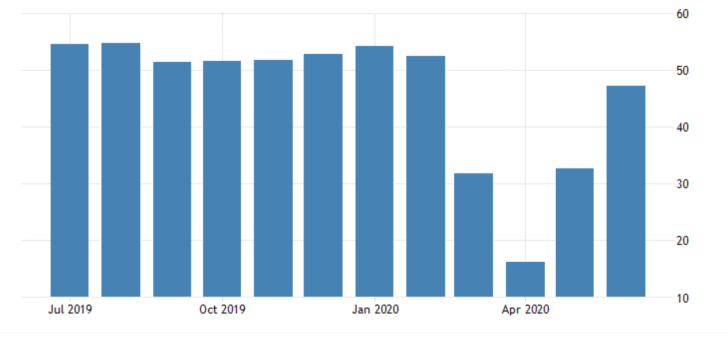

Pivotal Services and Manufacturing data from Germany and France – the largest and second-largest economies in the Eurozone, respectively – could underscore the sustainability of the ongoing recovery process in the bloc.

The industries of the two countries generated notable gains in June, and investors would be hoping to see a continuation of this trend. The consensus forecasts for July anticipate improvements in France and Germany's Services and Manufacturing sectors.

The most significant gains are expected to be registered in the German services sector, which grew to 47.3 points in June. It is projected to reach 50.2 points in July, which would manifest the expansion of the industry.

The European markets are currently being affected by the strained negotiations of European leaders in Brussels, and the simultaneous publication of the French and German industrial numbers is likely to trigger even more volatility on all currency pairs involving the euro.

Tesla's Stock Rally is Nearing a Critical Juncture

In less than a month, Tesla's shares managed to make a remarkable run. After Elon Musk's flagship broke out above the historic resistance at 1000.00, the bullish rally soared to just below the unprecedented 1800.00 level.

The tremendous jump of more than 800 points during this period can be attributed to a number of factors – from the solid advance of global tech stocks to heavy speculative trading on the part of day traders and small retail investors.

These contributing factors have made Tesla's shares quite erratic, which can be discerned from the 300-point retracement that took place in a manner of just a few days. At present, TSLA is trading close to the 1500.00 mark, which has significant psychological importance.

The company's earnings report, scheduled for release on Wednesday after the market close, is very likely going to catalyse the prevailing pressures and prompt the emergence of a new swing.

The direction of this new directional movement would depend heavily on whether or not Tesla manages to meet the initial market expectations.

Other Important Events to Watch for:

Tuesday - RBA Governor Lowe Speaks; Core Retail Sales m/m in Canada; Coca – Cola Co. reporting before the market open; Lockheed Martin Corp. reporting before the market open; Harley-Davidson Inc. reporting before the market open;

Wednesday – Nasdaq Inc. reporting before the market open;

Thursday – US Unemployment Claims; Intel Corp. reporting after the market close; Twitter Inc. reporting before the market open; Dow Inc. reporting before the market open;