German Services Expected to Bounce Back in February

This week's industrial data in Europe and the U.S. is likely to prompt heightened trading activity on the EURUSD. To learn more about the current state of the most popular currency pair in the world, have a look at our newest detailed analysis of the EURUSD.

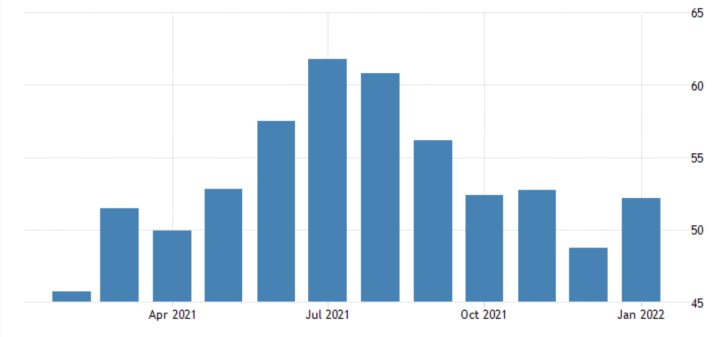

On Monday morning, Markit will publish the latest industrial numbers in Germany, the biggest economy in the Eurozone, and the UK. Arguably, the most impactful section of the report would reflect the German services sector, as activity is expected to have bounced back up marginally from a month prior.

According to the preliminary forecasts, the German services sector is expected to grow by 53.2 index points compared to the 52.2-point rate of expansion that was recorded in January.

Such a performance would be a positive development following the somewhat disappointing economic sentiment data for the same period. If these projections are met tomorrow, this is likely to strengthen the recuperating euro.

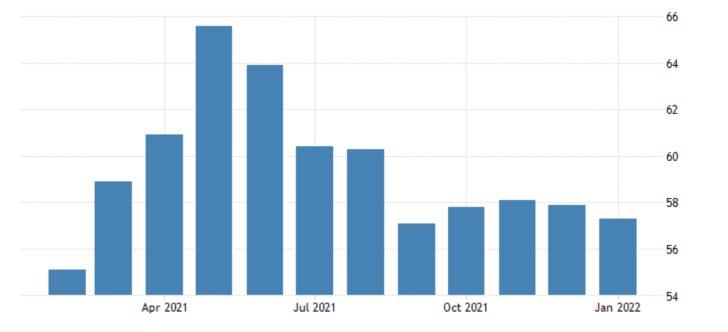

UK Factory Activity to Contract Marginally

A little bit later on Monday, Markit will release the UK manufacturing PMI data for February. Factory activity is projected to drop by 0.1 to 57.2 index points, which would represent the third consecutive month of decreasing manufacturing.

Economic conditions continue to be tight in the UK as headline inflation climbs, while the labour market appears to have reached a new plateau.

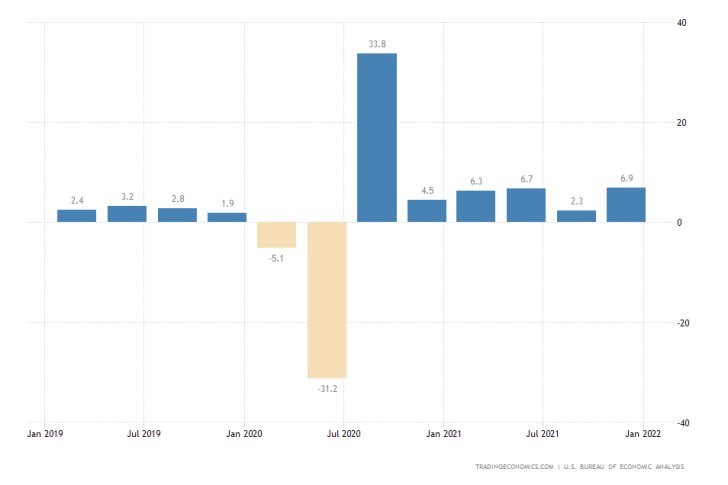

U.S. GDP Growth Rate for Q4 Likely to be Revised Upwardly

The Bureau of Economic Analysis in the U.S. is scheduled to publish the preliminary GDP growth rate report for Q4 on Thursday. The advance report underscored a rate of expansion of 6.9 per cent in the three months to December, which is now expected to be upwardly revised to 7.1 per cent.

If these projections are realised, this would represent the second-strongest growth rate since the beginning of the pandemic.

The rallying dollar is thus probably going to be underpinned by additional bullish pressure this week, adding to the positive momentum that was prompted last week following the release of the better-than-expected consumption numbers for January.

As can be seen on the 3H chart below, the dollar looks poised to continue rallying against the euro in the short term. The market appears to be developing a new downtrend under the expectations of the Wyckoff method.

The emergence of a new Markdown followed the recent Distribution range. There was a temporary break in the trend underpinned by the Flag pattern. However, given the recent breakdown below the 38.2 per cent Fibonacci retracement level at 1.13524, this break is now probably finished.

If the price action manages to penetrate below the 500-day MA (in blue) decisively, the Markdown is likely to head towards the previous swing low at 1.11400. The only intermittent obstacle is the 61.8 per cent Fibonacci at 1.12642.

Other Prominent Events to Watch Out for:

Monday - Germany MoM Manufacturing PMI; UK MoM Services PMI.

Tuesday - Germany MoM Ifo Business Climate; U.S. MoM Flash Manufacturing PMI; U.S. MoM Flash Services PMI; U.S. MoM CB Consumer Confidence.

Wednesday - New Zealand RBNZ Cash Rate.

Friday - U.S. MoM Core PCE Price Index; U.S. MoM Durable Goods Orders; UK MoM GfK Consumer Confidence; Germany QoQ GDP Growth Rate.