Germany's Industrial Output Expected to Continue Faltering in October

The next five days will reveal whether the U.S. dollar's freefall will pick up from last week or the greenback will manage to recover. This will be the prime concern for FX traders, as the greenback's performance will also affect other currencies. Most importantly, traders would want to know whether the pound would continue to break fresh highs or the time for a new correction is now.

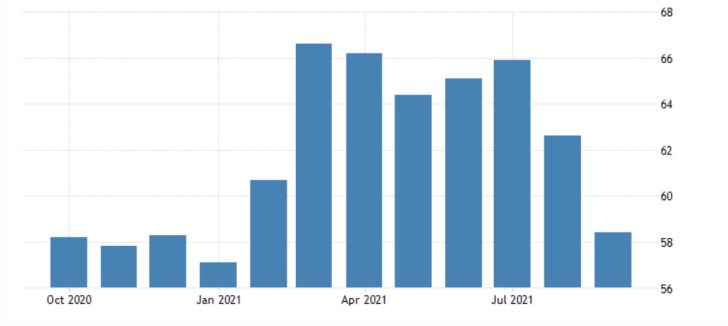

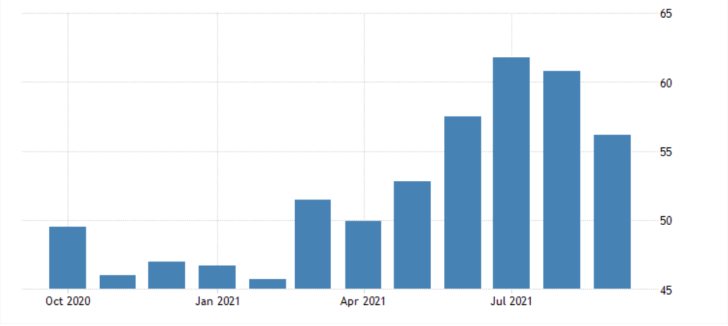

The most impactful releases this week will be the German services and manufacturing PMI numbers on Friday. They would reveal whether the global energy crisis has exacerbated the slump in German economic output.

According to the preliminary forecasts, German manufacturing is expected to continue shrinking below the dip that was recorded a month prior. Factory activity growth is expected to sink to 56.8 index points from September's 58.4. If realised, this would be the weakest reading since the beginning of the year.

As regards the services sector, the services PMI is forecasted to decline by 1.0 index points from the 56.2-point expansion that was recorded in September. The 55.2 index points that are projected for October would mark the weakest industrial expansion since May 2021.

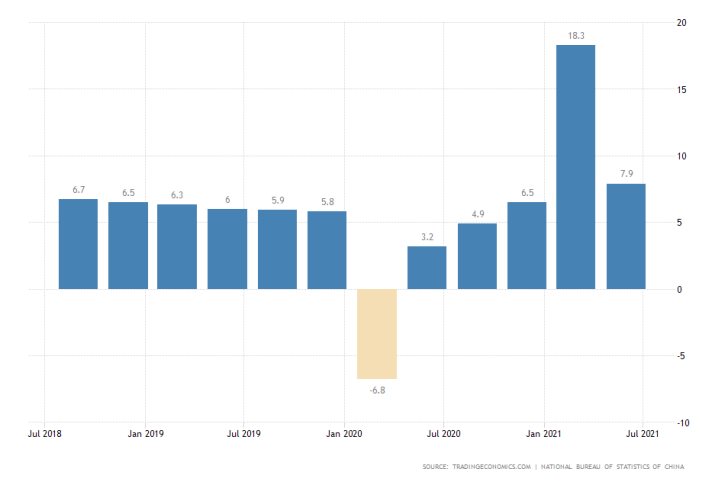

Chinese GDP Growth Rate Projected to Decline by Nearly 3 per cent

During the Asian session on Monday morning, the National Bureau of Statistics of China (NBSC) is scheduled to publish the GDP growth numbers for the third quarter. The Chinese economy is expected to have grown by 5.0 per cent in the three months leading to September.

Despite the sizable increase, this would mark a 2.9 per cent decline in the pace of economic growth from the second quarter.

The world's fastest-growing economy was not left unscathed by the global economic turmoil. The fact that China's manufacturing sector contracted for the first time since the beginning of the pandemic is demonstrative enough of the adverse impact of the global fallout on Chinese activity.

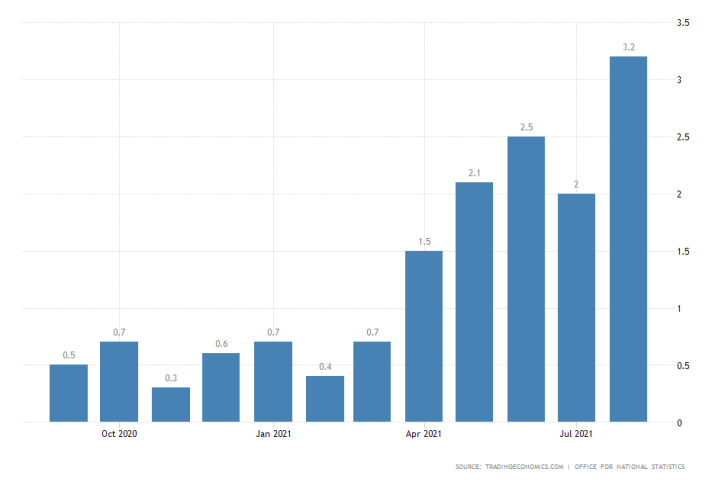

British Inflation Expected to Remain Unchanged in September

On Wednesday, the Office for National Statistics in the UK will post the latest Consumer Price Index (CPI) numbers. The market forecasts for September project no changes in headline inflation, which is thus expected to remain at 3.2 per cent.

These estimations are derived despite the solid growth in employment numbers that was observed over the same period and the sizable increase in consumer prices elsewhere.

Given the significance of Germany's industry numbers and the UK's CPI data that are scheduled for release this week, the EURGBP pair is likely to register significant price swings over the next five days.

As can be seen on the 4H chart below, the price action is contained within the boundaries of a descending channel. This underpins the significant bearish bias that corresponds to the recent rally of the pound.

The strength of the underlying downtrend can also be inferred by the fact that the price action recently broke down below the previous swing low at 0.84500. The MACD indicator picked up on this resurgence of selling pressure.

Additionally, the price action keeps a perfect descending order with the three moving averages. It is concentrated below the 20-day MA (in red), which is positioned below the 50-day MA (in green), which, in turn, is positioned below the 100-day MA (in blue).

Other Prominent Events to Watch for:

Monday - China MoM Retail Sales; U.S. MoM Industrial Production; Canada MoM BOC Business Outlook Survey.

Tuesday - Australia RBA Monetary Policy Meeting Minutes; UK BOE Governor Bailey Speaks.

Wednesday - Canada MoM CPI; China PBOC Interest Rate Decision.

Thursday - EU European Council Meeting; UK MoM gFk Consumer Confidence; Japan MoM CPI.

Friday - UK MoM Retail Sales; France MoM Services and Manufacturing PMI; U.S. MoM Services and Manufacturing PMI; UK MoM Services and Manufacturing PMI.