FED's Highly Politicised June Meeting Will be the Most Important Event this Week

The Federal Open Market Committee (FOMC) of the Federal Reserve is meeting this Wednesday to deliberate on its monetary policy.

The prevailing market expectations project the Committee to maintain its near-negative interest rate unchanged at 0.25 per cent. It remains to be seen whether the FOMC would choose to follow the example of the ECB and bolster its asset-purchasing programs as the global economic recovery speeds up.

FED's role has been somewhat changed over the last several months because of the coronavirus pandemic and the raging protests, which commenced in the wake of George Floyd's murder.

The Central Bank now has to 'calm' the markets, which continue to be stirred by such external political factors. Thus, the focus of the FOMC is no longer centred solely on economic factors.

This means that the FOMC has to consider unusual factors when deciding whether or not to ramp up its monetary policy, which makes projecting the ultimate outcome from Wednesday's meeting much more complicated and uncertain.

Nevertheless, there are now many indications manifesting the ongoing economic recovery, which could be enough to convince the FED to remain vigilant without implementing any transformational changes to its monetary policy stance at the present rate.

The most substantial indication of recovery is the robust employment numbers that were released last Friday. The US labour market's resilience in spite of the ongoing coronavirus crisis is illustrative of the efficiency of FED's monetary policy so far.

Even still, the ambiguity surrounding FED's next meeting is a likely precursor to heightened speculative trading on Wednesday, which, in turn, is expected to bolster the volatility on the US dollar.

Christine Lagarde to Appraise the Efficiency of the Overall Response in Europe to the Crisis

The Chair of the European Central Bank Christine Lagarde is scheduled to testify before the European Parliament Economic and Monetary Affairs Committee later today.

Unlike other times, her speech is not going to be focused as much on what the ECB aims to achieve with its monetary policy in the foreseeable future, but rather on what has already been accomplished to mitigate the economic fallout from the coronavirus crisis.

Her appraisal of the overall efficiency of the underlying monetary policy, which was recently bolstered, coupled with the EU Commission's expanded fiscal policy, are likely to affect the value of the Euro positively.

That is so because the prospects for growth in Europe are now increased, and Lagarde's statements are probably going to reflect on this positive outlook. Consequently, investors in Europe are going to be ensured of the ongoing recovery's robustness.

That is why the impact on the single currency from Lagarde's speech is likely to be much more concise and easily discernible compared to the muddled situation that is faced by the FED.

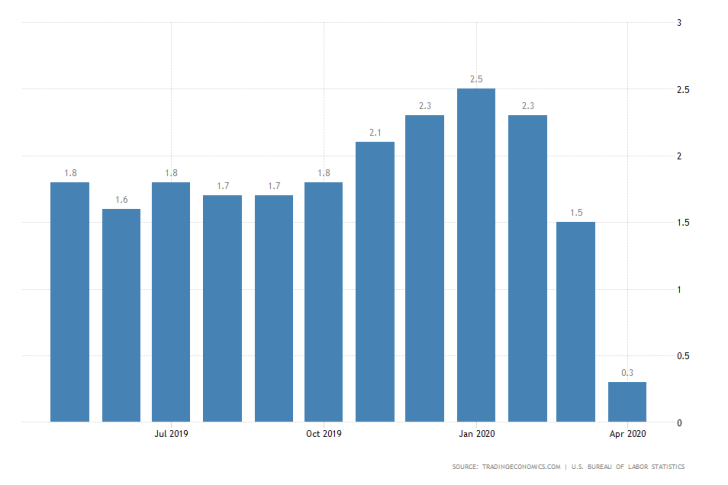

Inflation in the US is Expected to Have Remained Near-Negative in May

Few hours before FED's monetary policy meeting, the US Bureau of Labor Statistics (BLS) is scheduled to release its Consumer Price Index (CPI) report for the previous month.

The consensus forecasts do not project any significant changes to be recorded on Wednesday, which means that the inflation rate is likely to remain unchanged at 0.3 per cent.

If the final data meets these initial expectations, this would be bad news for the already strained value of the US dollar. The global demand for the greenback has been consistently waning in light of the ongoing economic recovery.

Conversely, a sharp rebound in headline inflation is going to be an equally undesirable outcome. Due to the already loose monetary policy in the States, soaring CPI is going to represent a future issue for the post-pandemic economy.

Ideally, inflation should start rising towards the 2 per cent target level, but gradually and steadily. A sudden jump would mean that the FED could have overextended its QE programs, which, in turn, could lead to hyperinflation.

Such an undesirable scenario would mean that the price stability in the country would remain jeopardised from reversed risks. In other words, the present threat of deflation would be substituted with spiralling out of control inflation.

Meanwhile, the EURUSD has neared the major resistance level at 1.14000, and the price action is likely to test the level's strength, as the Euro continues to be bolstered by the underlying fundamentals.

However, in case of a hawkish-sounding FED on Wednesday, a minor bearish correction (potentially a full trend reversal) could occur, with the first significant target level being the 38.2 per cent Fibonacci retracement at 1.11529.