FED Has to Implement More Drastic Measures to Curb Inflation

The economic calendar for next week is packed with top-tier events, most notably the January policy meeting of the Federal Reserve. This is likely to prompt an upsurge in volatility on the recuperating dollar. To learn more about the greenback's current state, have a look at our last detailed analysis of the EURUSD pair.

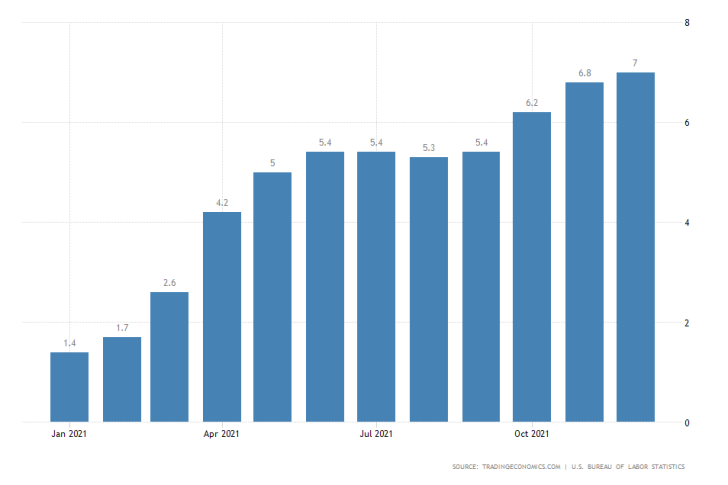

FED's January policy meeting is this week's most highly-anticipated event; it is scheduled for Wednesday. Jerome Powell and his colleagues from the Federal Open Market Committee (FOMC) are expected to implement measures to curb soaring inflation, which topped a four-decade peak in December.

The Federal Funds Rate is expected to be maintained at 0.25 per cent, though the FED is also expected to adopt drastically more hawkish rhetoric. Powell would likely delineate on the road ahead to at least one rate hike in 2022, following up on his testimony before the U.S. Senate last month.

Big Tech is Next in Line to Report Quarterly Earnings

The continuation of the earnings season is likely to bring about even more volatility to an already plunging stock market. This is owing to the fact that Big Tech is scheduled to report its quarterly performance for the three months leading to December next.

Production & deliveries in Q4 exceeded 300k vehicles https://t.co/xE7LnWG0va

— Tesla (@Tesla) January 2, 2022

Microsoft is scheduled to report on Tuesday after the market close, while Tesla is reporting on Wednesday after the market close. Apple will post its Q4 earnings numbers after the market close on Thursday. All three tech giants are forecasted to report growing earnings on a yearly basis, which is likely to provide a temporary respite for worried investors amidst the current stock market selloff.

U.S. Economy's Growth Rate Expected to Have More Than Doubled

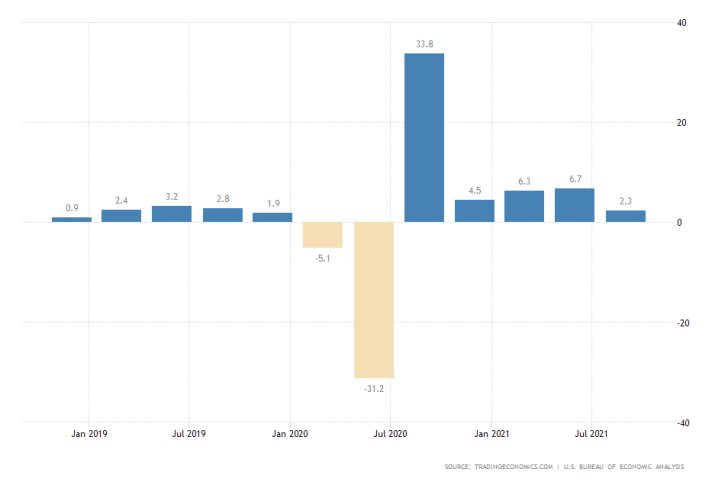

On Thursday, the U.S. Bureau of Economic Analysis is scheduled to release the advance GDP growth numbers for the fourth quarter of 2021. The market reaction to the news is likely to be significant owing to the fact that this would be the first report reflecting on the rate of economic expansion for the period.

The forecasts for solid growth are predicated on the recently recorded better-than-expected GDP numbers elsewhere, underpinning a sizable pick-up in global economic activity.

The U.S. economy is forecasted to have grown by 5.3 per cent in the last three months of 2021, measuring a sizable rebound from the 2.3 per cent growth rate that was observed in the previous quarter. If these forecasts are met, this would likely help the struggling dollar in the short term, though the currency remains under severe strain.

As can be seen on the 4H chart below, the greenback is currently attempting to recover against the Canadian dollar. The recent dip appears to signify the completion of the second impulse leg (2-3) of a broader 1-5 Elliott impulse wave pattern, which implies the possibility of a new correction.

A pullback in the form of an ABC correction is likely to develop next, representing the second retracement leg (3-4) of the bearish Elliott pattern. This is likely to head towards the previous swing low at around 1.26500 before the third and final impulse leg (4-5) could begin developing.

Other Prominent Event to Watch Out for:

Monday - French Flash Services and Manufacturing PMI Data; Germany Flash Services and Manufacturing PMI data; U.S. Flash Services and Manufacturing PMI; UK Flash Services and Manufacturing PMI.

Tuesday - Australia MoM Inflation Rate; Germany MoM ifo Business Climate; U.S. CB Consumer Confidence; American Express Co reporting BMO; General Electric Co reporting BMO; Lockheed Martin reporting BMO; Johnson & Johnson reporting BMO.

Wednesday - Canada BOC Policy Rate Decision.

Thursday - U.S. MoM Core Durable Goods Orders; Visa Inc. reporting AMC; Mastercard reporting BMO.

Friday - U.S. Core MoM PCE Price Index; Germany QoQ Preliminary GDP Growth Rate.

-----------------------------------------------------------------------------------------------------------------------

BMO - Before Market Open; AMC - After Market Close;