More Reasons for Optimism at the Federal Reserve

The Federal Open Market Committee (FOMC) of the Federal Reserve meets this Wednesday to deliberate on FED's current monetary policy stance. According to the initial market expectations, the near-negative Federal Funds Rate will almost certainly be maintained unchanged at 0.25 per cent.

Jerome Powell and his colleagues had to grapple with massively adverse uncertainty at the end of 2020, but now that Joe Biden has finally stepped into the Oval Office, tensions have started to subside.

The 46th President nominated Janet Yellen, a popular Ex-FED Chair, to Treasury Secretary's position, which would help link FED's already massively accommodative policy with Biden's fiscal stimulus plans and allow them to function together.

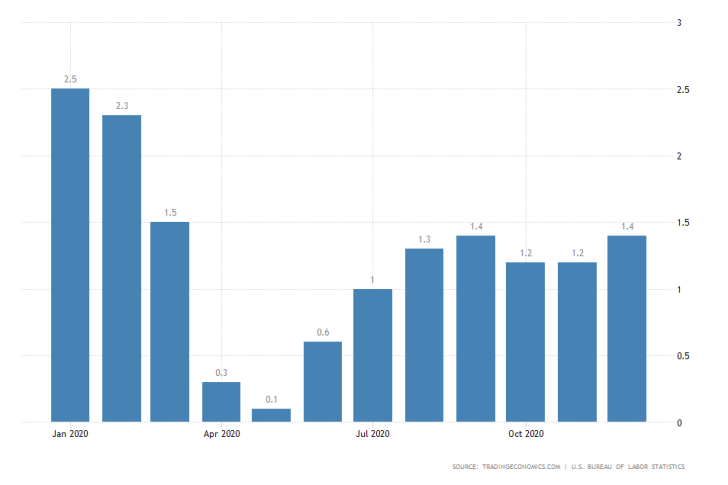

In addition to these changes, the recently observed rise of inflation towards FED's mid-term goals represents a welcoming development and a sign that the substantial levels of liquidity that the FED has pumped into the economy since the beginning of the coronavirus crisis are doing their job.

While inflation alone is not enough to prompt the Committee to implement any changes at the present rate, it could be perceived as a very early indication of potential future hawkish interventions.

Should the FOMC refrain from scaling up its quantitative easing programs on Wednesday, this would be received by the market as a likely confirmation of the above-mentioned assertions.

This could, in turn, strengthen the U.S. dollar in the short-term and boost investors' optimism while the ongoing earnings season is picking up steam.

Silicon Valley' Earnings Reports in the Limelight this Week

All eyes are focused on Microsoft, set to kick off this week's earnings schedule on Tuesday after the market closes. Big Tech's quarterly performance will then be resumed on Wednesday when Apple is expected to deliver its best quarterly performance to date.

Microsoft is projected to beat its performance for the same period last year when the software giant delivered Earnings Per Share of $1.51, by reporting EPS of $1.64 this time.

Meanwhile, the earnings generated from Apple's common stock are expected to nearly double from the $0.73 per share that were recorded in the third quarter to $1.39 in Q4.

Such a performance would surpass the previous EPS record of $1.25 that was achieved in 2019's final quarter, possibly serving as a massive boost for Apple's share price.

Tesla's Unprecedented Rally Might Be Due for a Reality Check

Also scheduled to report on Wednesday after the market close, Tesla will probably garner the most investors and traders interest of all the companies. That is so because the current value of its stock price has been inflated markedly by both speculation and hopes for sustained growth.

According to the consensus market forecasts, Tesla can also deliver its best quarterly performance to date. These forecasts project the car manufacturer's earnings per share to reach $0.63, despite the company's ongoing struggles with global shutdowns and stifled supply and demand dynamics.

Much anticipation has been built as of recently because Tesla's share value far exceeds other blue-chip companies, including the S&P 500.

As shown on the 4H chart below, Tesla's stock price is outpacing the S&P 500 by a margin of over 80 per cent. Once a bearish correction does occur, it could wipe out between 30 to 40 per cent of the existing rally before it bottoms out.

Meanwhile, Apple continues to be the only other major stock to outperform the S&P, albeit much less decisively than Tesla.

Other Prominent Events to Watch for:

Monday - BOJ Monetary Policy Minutes.

Tuesday - Australia Quarterly CPI; 3M Unemployment Rate U.K.; General Electric Co BMO; American Express Co. reporting BMO; Lockheed Martin Corp. reporting BMO; Verizon Communications Inc. reporting BMO; Starbucks Corp. reporting AMC; Johnson & Johnson reporting AMC.

Wednesday - Australia q/q CPI; U.S. Durable Goods; AT&T Inc. reporting BMO; Boeing Co. reporting BMO; Facebook Inc. reporting AMC; Nasdaq Inc. reporting BMO.

Thursday - U.S. Advance GDP q/q; American Airlines Group Inc. reporting BMO; McDonald's Corp. reporting BMO; Visa Inc. Reporting AMC; Mastercard Inc. Reporting BMO.

Friday - GDP q/q Germany; Caterpillar Inc. Reporting TAS; Chevron Corp. Reporting BMO;