Federal Reserve to Stay on Course in September

In light of the upcoming policy decisions of the Bank of Japan and the Bank of England, it is worth checking out the currently evolving setup on the GBPJPY. As was pointed out in our previous analysis of the pair, the price action is establishing a major reversal.

In a week filled with monetary policy decisions of major central banks, the gathering of the Federal Open Market Committee (FOMC) of the FED on Wednesday is the one that garners the most interest. The Committee is expected to maintain the near-negative Federal Funds Rate unchanged at 0.25 per cent.

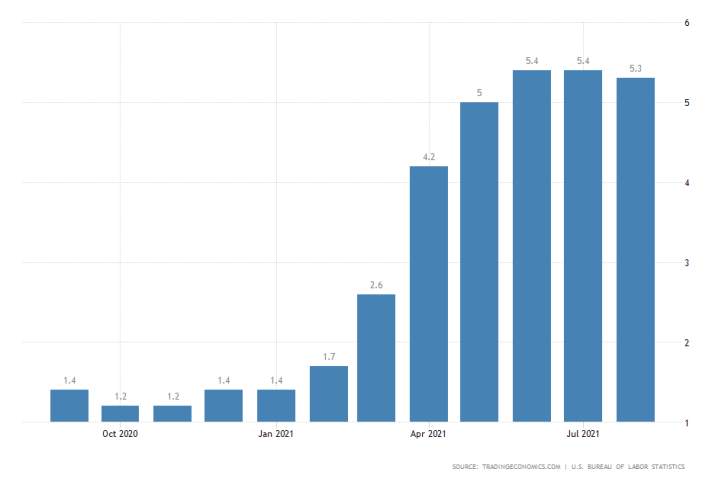

At its previous meeting, Jerome Powell and his colleagues from the FOMC said that they "will aim to achieve inflation moderately above 2 per cent for some time so that inflation averages 2 per cent over time and longer-term inflation expectations remain well-anchored at 2 per cent".

Given that inflation eased marginally in August by 0.1 per cent, the FOMC is unlikely to adopt a more hawkish stance at the present rate. This is further warranted by the fact that global consumption also took a sharp dive over the same period.

The Committee would therefore most probably keep its accommodative stance, but it remains to be seen whether a slightly more optimistic Powell would help the dollar to continue strengthening in the short term.

Slightly More Hawkish BOE to Deliberate on Thursday

The Monetary Policy Committee (MPC) of the Bank of England is meeting on Thursday. According to the preliminary market forecasts, the MPC would keep the Official Bank Rate unchanged at 0.10 per cent.

Unlike the FED, however, the outlook is a bit more optimistic. One member of the 9-members Committee is expected to vote in favour of dialling back BOE's asset purchase facility, continuing the more hawkish stance the bank adopted in August.

Back then, the Committee observed that:

"After the MPC’s previous meeting, the number of Covid cases continued to rise but has subsequently shown signs of falling back […]. The majority of remaining domestic Covid restrictions have now been lifted. Faster indicators of household spending have been broadly flat, at close to pre-Covid levels."

Since then, economic conditions in Britain have continued to improve. Headline inflation advanced in the direction of BOE's projections while the unemployment rate shrank sizably.

BOJ to Remain Committed to Negative Rates

The third major bank to deliberate on its underlying monetary policy this week is the Bank of Japan. Market analysts do not project any changes to the Policy Rate, which remains negative at -0.10 per cent.

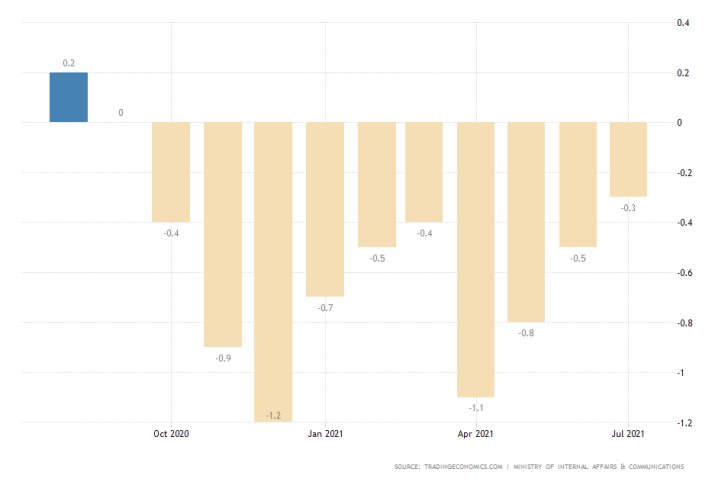

This massively accommodative stance is largely necessitated by the fact that Japanese inflation, unlike the U.S. and UK, remains well below BOJ's goals. Even though last month consumer prices rose to their highest level this year, headline inflation remains negative at -0.3 per cent.

Not even the accelerated growth rate over the last quarter is enough to offset the negative impact of subdued prices.

This stark contrast between the leading economic indicators in Japan and Britain would likely lead to heightened volatility outbursts on the GBPJPY throughout the week.

As can be seen on the 4H chart below, the price action reversed from the 23.6 per cent Fibonacci retracement level at 151.984 before the close of last weeks' trading session. It then broke down below the 100-day MA (in orange) and the 38.2 per cent Fibonacci at 151.451.

The next target for the newly emerging downtrend naturally is the 23.6 per cent Fibonacci at 150.588. However, a potential rebound from said level could lead to a breakout above the Wedge's upper limit and a subsequent retest of one of the two support-turned-resistances.

Other Prominent Events to Watch for:

Tuesday - Australia Monetary Policy Minutes.

Thursday - Germany and UK Flash Services and Manufacturing PMI; Canada MoM Retail Sales; U.S. Flash Manufacturing and Services PMI.

Friday - Germany ifo Business Climate; U.S. FED Chair Powell.