ECB to Maintain its Near-Negative Interest Rate

The rally of the dollar continues at full speed. Demand for the greenback remains elevated because of the escalating war in Ukraine. Investors and traders seek lower-risk securities and easily convertible currencies. You can read more about that from our latest EURUSD analysis.

Arguably the most important economic release this week will be the interest rate decision of the European Central Bank. According to the market forecasts, Christine Lagarde and her colleagues are expected to maintain the near-negative Main Refinancing Rate unchanged at 0.00 per cent.

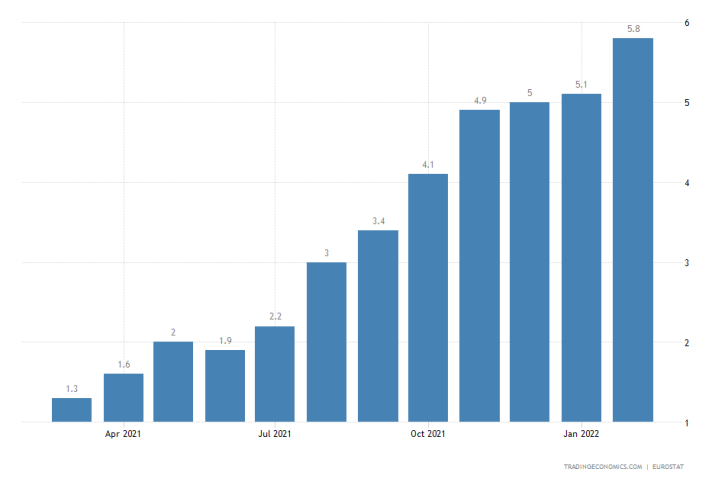

Even so, the ECB can adopt a slightly more hawkish policy stance, similarly to the Federal Reserve from last week. The primary reason for this is soaring inflation, which topped 5.8 per cent last month. The Monetary Policy Committee (MPC) of the ECB will meet on Thursday.

U.S. Consumer Prices Expected to Continue Growing

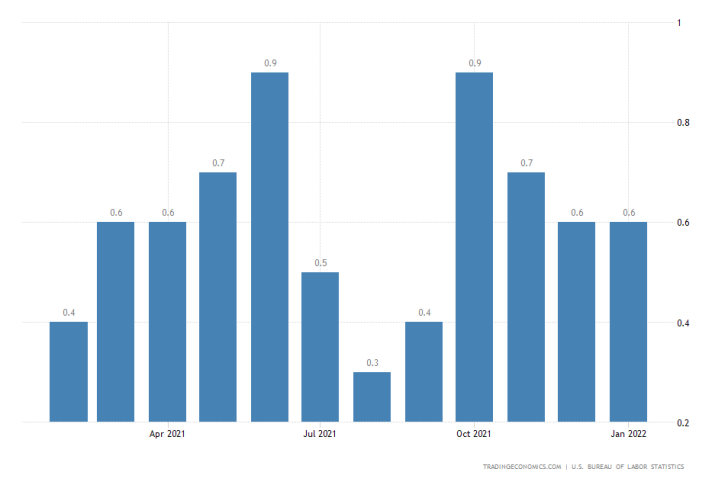

Again on Thursday, the U.S. Bureau of Labour Statistics (BLS) will post the latest consumer price index (CPI) numbers. According to the preliminary forecasts, inflation is expected to grow by 0.8 per cent in February. This would measure a marginal 0.2 per cent increase from the 0.6 per cent inflation growth rate that was recorded a month prior.

The remaining logistical bottlenecks and supply chain disruptions owing to the war in Ukraine are causing a substantial increase in consumer prices across the world. Nevertheless, Fed Chair Jerome Powell remains confident that supply pressures will gradually ease by the end of the year, allowing prices to normalise partially.

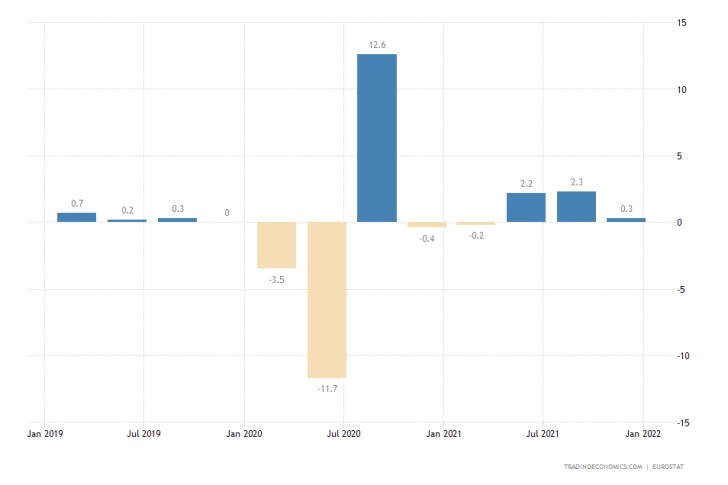

No Changes Anticipated in Eurozone's GDP Growth Rate

Eurostat will release the revised GDP growth rate data for the last three months of 2021 on Tuesday, with no changes anticipated from the preliminary 0.3 per cent reading.

This could provide some temporary respite for the euro, though the single currency continues to be reeling against the dollar. The strength of the greenback can be observed on the daily USDCAD chart below.

The USDCAD appears to be establishing a Pennant pattern with its bottleneck concentrating between the 23.6 per cent Fibonacci retracement level at 1.27411 and 38.2 per cent Fibonacci at 1.26013.

Pennants represent a classic consolidation pattern, which indicates a temporary break in an established trend. This means that a decisive breakout above the Pennant's upper limit and 23.6 per cent Fibonacci would indicate the probable continuation of the rally.

Before this can happen, however, the price action may drop to the major support level at 1.26500, underpinned by the 100-day MA (in blue). This is also where the lower border of the pennant can be found. The 38.2 per cent Fibonacci, which is about to be crossed by the 200-day MA (in orange), represents a deeper probable support.

Other Prominent Events to Watch Out for:

Tuesday - Japan QoQ GDP Growth Rate.

Wednesday - China MoM Inflation Rate.

Friday - Canada MoM Unemployment Rate; U.S. MoM Preliminary UoM Consumer Sentiment.