ECB to Continue Monitoring Inflationary Developments in June

Top-tier economic events are once again in the economic calendar, which is likely to cause heightened volatility on higher-risk securities. This entails exciting trading opportunities on U.S. stocks!

On Thursday, the Governing Council of the European Central Bank (ECB) is scheduled to deliberate on its current monetary policy. According to the preliminary forecasts, the Council is almost certainly going to maintain the near-negative Main Refinancing Rate unchanged at 0.000 per cent.

The Pandemic Emergency Purchasing Programme (PEPP) would continue with the same envelope of 1850 billion euros at least until March 2022. Purchases are expected to be continually conducted at the same significantly higher pace until the end of the current quarter.

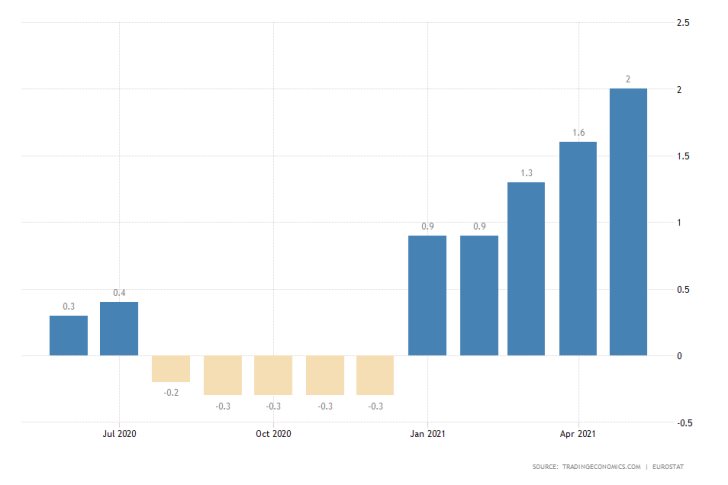

ECB's massively accommodative policy stance is already proving effective as price stability is improving. Headline inflation is presently converging towards the Bank's longer-term target at 2.0 per cent.

This trend is also being observed in the Eurozone industry, which is on track to fast and stable recovery. The EU stock market is also being impacted positively by this trend.

Therefore, the June policy meeting of the ECB is likely to bolster the euro and stocks in the short term as the Bank underlines the important role its policy direction plays in cushioning the fallout from the coronavirus stage.

BOC is Ahead of the ECB in Terms of Fostering Price Stability

The Governing Council of the Bank of Canada is also set to convene this week, on Wednesday. It, too, is expected to keep its near-negative Overnight Rate unchanged at 0.25 per cent.

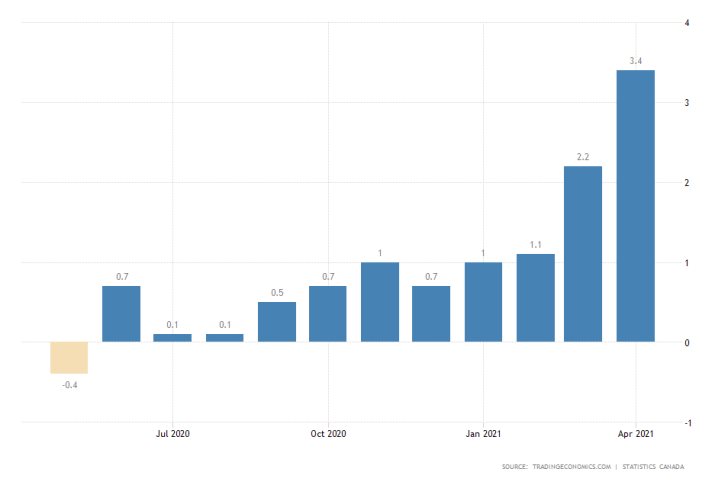

Headline inflation in Canada accelerated to 3.4 per cent in April, as prices in North America are generally on track to continue rising faster than in other developed economies.

That is why BOC's Council has more reasons to adopt a more hawkish rhetoric compared to the ECB, potentially weakening the Canadian dollar. The Loonie continues to flex its muscles against the greenback, which is likely to experience higher volatility this week, too, following the release of the latest U.S. inflation data.

U.S. Inflation Expected to Slow Down for the First Time in Eight Months

In probably the most widely anticipated economic release from this week, the Bureau of Labour Statistics (BLS) in the U.S. is scheduled to post the consumer prices data for May. The report will be published on Thursday.

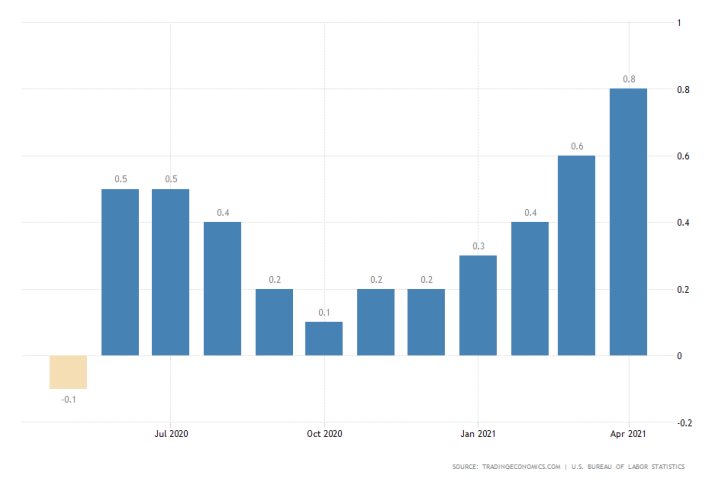

The initial forecasts project a 0.4 per cent fall in the CPI index, compared to the 0.8 per cent expansion that was recorded in April. If they are realised, this would be the first time consumer prices would depreciate in eight months.

This is significant because investors are already getting concerned with soaring inflation, and such a momentary break would represent a much-needed respite for the surging prices.

Moreover, it would mean that FED's earlier estimations for a conversion of headline inflation towards the 2.0 per cent target level in the mid-term would likely be realised.

If the growth pace of consumer prices does indeed decrease in May, this would mean that the underlying recovery in the U.S. is not yet threatened by a surging debt bubble, which would be good news for the dollar.

Given the U.S. CPI numbers and the BOC meeting this week, the USDCAD pair is likely to develop the most significant price movements over the next several trading days.

As can be seen on the 4H chart below, the price action of the pair is clearly transitioning from one market stage into another. In particular, the USDCAD is behaving exactly as per the expectations of the Wyckoff Cycle theory.

The preceding Markdown was followed by the current Accumulation range, which, in turn, is likely to be inherited by a new Markup. The current range-trading sentiment is confirmed by the ADX indicator.

An eventual breakout above the Accumulation's upper boundary (at 1.21350) would likely entail the beginning of such a Markup.

Other Prominent Events to Watch for:

Tuesday - Japan q/q GDP Growth Rate; EU q/q GDP Growth Rate.

Wednesday - China m/m CPI.

Friday - G7 Meeting; UK m/m GDP Growth Rate; U.S. Preliminary Michigan Consumer Sentiment Index.