The ECB Has to Decide Whether to Increase the Scope of Its Asset Purchase Facility

The Governing Council of the European Central Bank is scheduled to meet this Thursday, and the markets are expecting the aftermath of the meeting to heighten further the underlying volatility that is already affecting the price of the euro.

The Main Refinancing Rate in the Eurozone is currently at 0.000 per cent, and the market forecasts do not expect any changes to the interest rate to be made on Thursday. However, the Council is very likely to scale up its QE programs.

Major central banks are anticipated to fall in line with the recent remarks of FED Chair Jerome Powell, who at the Jackson Hole symposium stated that he expects to see near-negative interest rates remain unchanged in the foreseeable future.

Thereby, Christine Lagarde and her colleagues at the ECB might decide to pump up more liquidity into the economy to address the newest threat of another major downturn by the end of the year, similarly to what the RBA did.

The ECB sounded very optimistic during its previous meeting expecting to see a robust recovery. Since then, however, the economic conditions have changed considerably, which could prompt the Council to action.

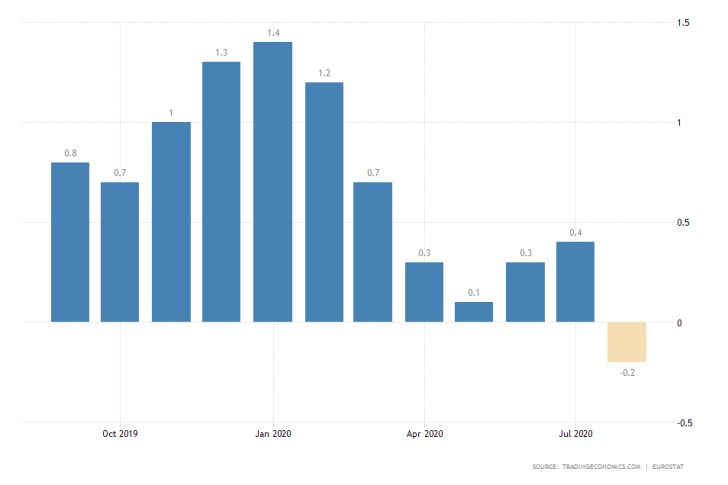

The primary concern for the Eurozone is price stability. The Consumer Price Index fell to – 0.2 per cent in August, which means that the countries in the Euro Area are currently facing the real threat of deflation.

Employment conditions too, have been deteriorating steadily since March, and the labour market is currently struggling with a 7.9 per cent unemployment.

Thus, the ECB might decide to broaden the scope of its Pandemic Emergency Purchase Programme (PEPP), which currently has a total envelope of 1.350 billion euros, in order to cushion the adverse impact of the coronavirus crisis on the weakened price stability in the Eurozone.

Such actions would likely support the reeling euro, which started falling last week.

US Inflation Expected to Wane in August

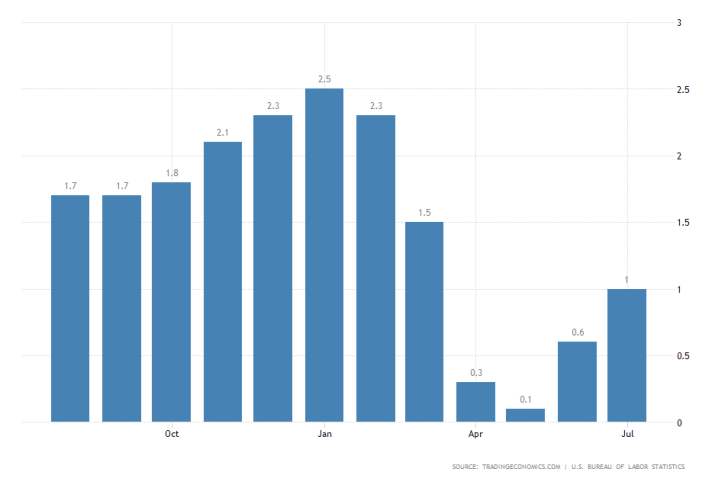

The Bureau of Labor Statistics is scheduled to release the CPI numbers for August this Friday. The initial market forecasts anticipate the Consumer Price Index to depreciate by 0.3 per cent. This would mean that inflation would fall to 0.7 per cent from the 1.0 per cent that was recorded in July.

The seesaw depreciation of the inflation rate could be attributed to two prime reasons. Firstly, the US consumer confidence fell in August which correlates to lesser consumer spending. The latter is bad for the overall price stability in the country.

Secondly, crude oil futures started plummeting, which means that weaker energy prices can no longer support stronger inflation.

Both of these developments are going to contribute to an expected fall in inflation, which is encapsulated by FED's baseline scenario for economic stabilisation into 2021. Even still, the news is likely to cause a momentary disruption in the greenback's recuperation.

The Bank of Canada to Stay on Course in September

The Monetary Policy Committee (MPC) of the BOC is scheduled to meet this Wednesday to deliberate on the recent economic developments in Canada, and potentially to adjust its underlying monetary policy.

Similarly, to the ECB case above, the consensus forecasts do not project any likely changes to the BOC's Overnight Rate. The latter is currently at 0.25 per cent. Accordingly, any potential changes to the current monetary policy stance could be made in a case that the Committee decides to ramp up its asset purchase facility.

Due to the two monetary policy decisions this week, the EURCAD pair is likely to experience heightened volatility.

As can be seen on the daily chart below, the EURCAD rebounded from the major resistance level at 1.58500 yet again, and is currently consolidating just below the 23.6 per cent Fibonacci retracement level at 1.55755.

This minor consolidation could be a precursor to a continued dropdown, given that the price action also broke down below the 50-day MA (in blue) after having already crossed below the 30-day MA (in green) and the 10-day MA (in red).

The major support level at 1.54000 encompasses the next target level for the currently developing downtrend.

Other Prominent Events to Watch for:

Monday – Bank holidays in the US and Canada, resulting in low liquidity in the markets.

Tuesday – NAB Business Confidence in Australia.

Wednesday – Yearly CPI in China.

Thursday – Monthly PPI in the US; Unemployment Claims in the US; Crude Oil Inventories in the US; BOC Governor Tiff Macklem speaks in Canada; ECB President Christine Lagarde speaks.

Friday – Eurogroup meetings.