JPMorgan Chase & Co. To Narrow the Gap with the S&P 500

The highly anticipated earnings season reflecting on the biggest corporations' quarterly performance in the U.S. begins this week with reports from the most prominent companies in the banking sector.

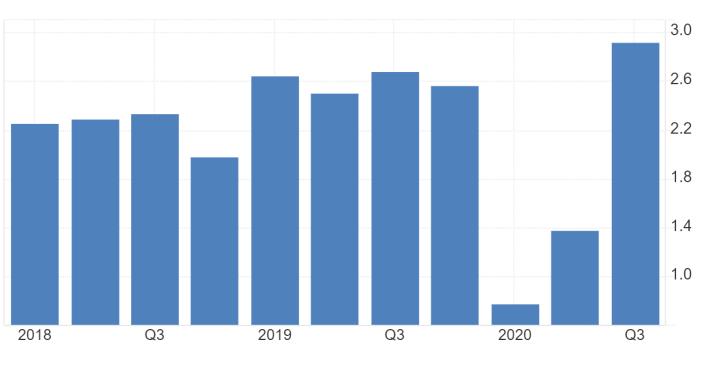

JPMorgan Chase & Co. is scheduled to deliver its earnings data for the three months to December 2020, this Friday before the market open. According to the consensus forecasts, the banking sector's best-performing flagship is expected to report earnings per share of $2.62.

JPMorgan and Chase recorded EPS of $2.57 in Q4 2019, which means that the company is actually projected to have outperformed itself on a yearly basis despite the pandemic situation.

Seeing as how the only time the company's performance failed to exceed the preliminary expectations was in the immediate aftermath of the coronavirus crash, JPMorgan Chase stands in a pretty good place in relation to consistent growth.

Minor Improvements Expected at the U.S. Retail Sector

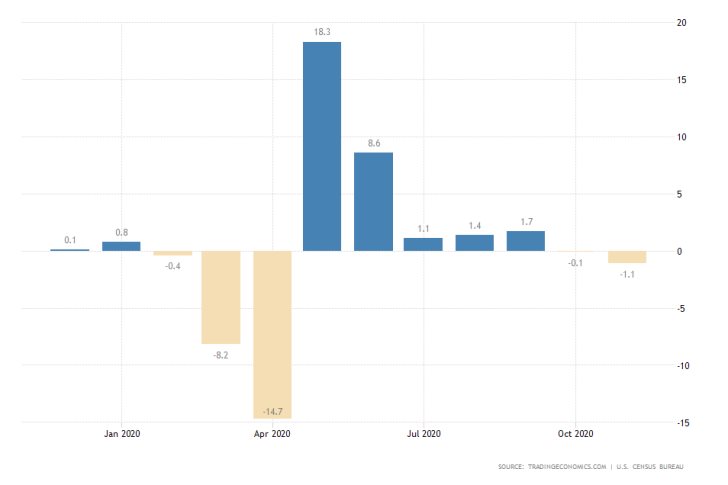

The most significant economic release this week is going to be the publication of the U.S. retail sales data by the Census Bureau, which is also taking place on Friday.

Following on the 1.1 per cent contraction of sales recorded in November, the initial market forecasts project a corresponding rebound to have taken place in December; thereby, net sales are anticipated to cap the year at the breakeven 0.00

Although the U.S. labour market shrunk sizably in December, the corresponding expansion of manufacturing output for the same period could also underpin growth in the retail sector.

Citigroup Also Expected to Finish 2020 on a High Note

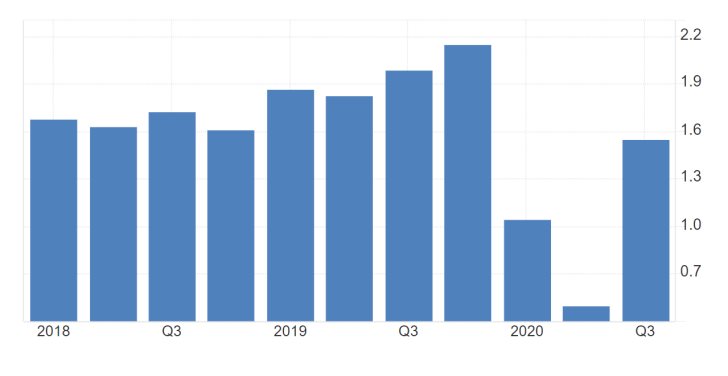

Similarly to JPMorgan Chase, Citigroup, another leading U.S. financial institution, is scheduled to report quarterly earnings before the market opens on Friday.

According to the early market forecasts, the firm is expected to deliver earnings per share of $1.29 vs the $1.90 recorded for the same period last year.

The massive slump in Citigroup's projected yearly performance underpins the comparatively more detrimental impact that the coronavirus fallout has had on the bank's operations when contrasted against JPMorgan.

Both companies continue to rely on the accommodative monetary policy stance of the FED for pain relief during these perilous times for the financial industry. The historically low yields in the U.S. have impeded the greenback, but at the same time, the massive amount of liquidity that was unleashed in the wake of the initial crash has supported the continuous operations of companies like Citigroup.

Meanwhile, banking stocks have to close the gap with other-industry stocks, as shown in the 4H comparison chart below. JPMorgan shares come closest to the S&P 500 average from amongst other banking stocks but still fall short of the index.

Wells Fargo and Citigroup have also managed to gain significant ground in the fourth quarter but are lagging behind other bluechip stocks.

Other Prominent Events to Watch for:

Monday - BOE Governor Bailey Speech.

Wednesday - ECB President Lagarde Speaks; Monthly CPI in the US.

Thursday - FED Chair Powell Speech; Delta Airlines Reporting BMO; BlackRock Inc. Reporting BMO.

Friday - Monthly Manufacturing Production in the UK.; Reporting BMO; Wells Fargo & Co. Reporting BMO.