European Industry Still Plagued by Pandemic Fallout

This is poised to be another action-packed week ahead with prominent releases from the U.S. and Europe's industries. On Friday, all eyes will be focused on Germany's Services PMI data for February.

The initial forecasts project yet another minor contraction in industrial activity for the Eurozone's biggest economy. Germany's Services PMI index is expected to fall by 0.2 per cent from January's downwardly revised 46.7 per cent, bottoming at 46.5 per cent this month.

The continuous strain that is being exerted on the German services industry from the coronavirus pandemic is still being exacerbated by the country's rigid containment measures. The German government is compelled to maintain those restrictions as the number of cases remains high despite the vaccine rollout.

Such a contraction in Germany's Services PMI would result in more woes for the shaken euro. The single currency recuperated last week; however, a more sizable recovery is still on the line.

Expectations for Another Big Hit on Britain's Retail Sector

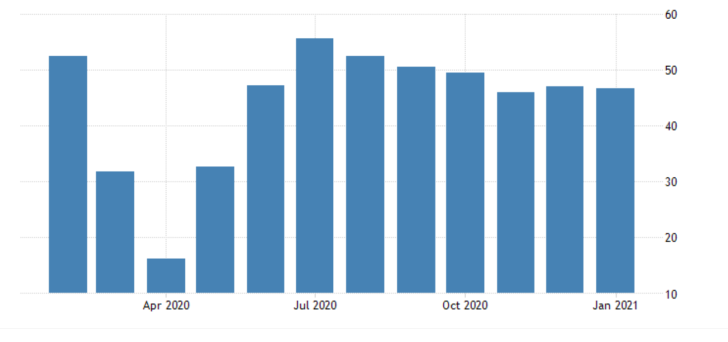

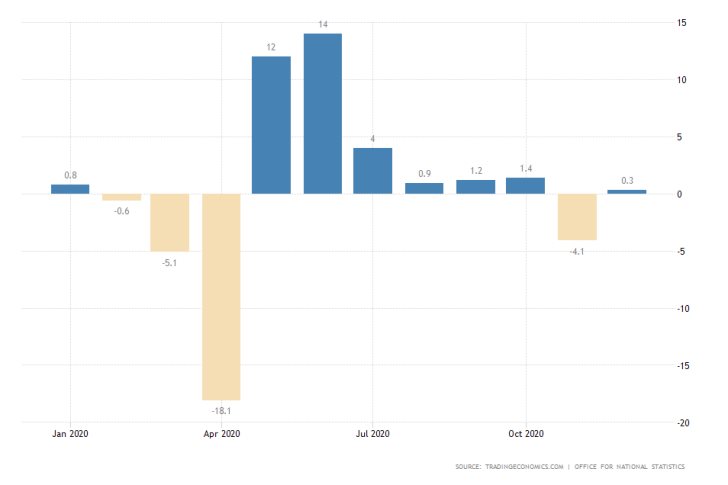

Again on Friday, the Office for National Statistics in the UK is scheduled to post the latest retail sales findings for January. According to the initial market forecasts, the retail sector is likely to shrink drastically by 2.6 per cent.

This would mark the second-largest plunge since the nearly 20 per cent tumble that was recorded in April last year. If these expectations are realised, this will represent a sharp downturn for the British economy, which recently delivered better-than-expected GDP numbers for December.

The reason for such a probable U-turn in the British retail sector once again has to do with the unrelenting pandemic condition in Western Europe. The British government, too, is forced to maintain tight restrictions, which weighs heavily on demand.

The U.S. Retail Sector is on the Polar Opposite

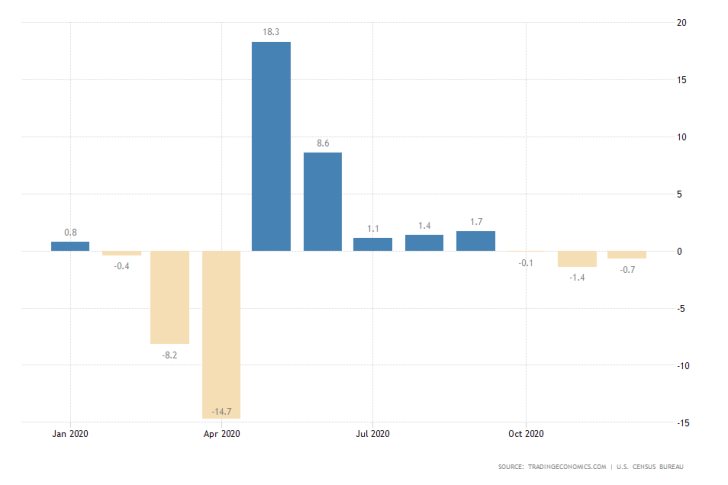

Things look starkly different on the other side of the Atlantic, where the U.S. Census Bureau is projected to post quite robust retail data for the same period on Wednesday.

Market experts expect to see a positive rebound of 1.1 per cent from January's contraction of 0.7 per cent. The upsurge in demand comes in spite of the weaker-than-expected growth of the American economy in December, and it has to do with heightened stimulus optimism.

Such a performance would help the relenting dollar during these difficult times for the currency. As can be seen on the 4H chart below, the EURUSD rose last week and is currently nearing an important make-it-or-break-it point at the 1.21600 resistance.

The price action managed to break out above the downwards sloping channel's boundaries and is currently consolidating above the 100-day MA (in blue).

Despite the bearish crossover in the underlying momentum, as represented by the MACD indicator, the price action looks poised to test the strength of the aforementioned resistance, currently converging with the 200-day MA (in purple).

Such a test would determine whether the recent downtrend is still relevant or the euro would continue recuperating in the near future. Given the examined fundamental factors, another bearish rebound from 1.21600 seems more plausible.

Other Prominent Events to Watch for:

Tuesday - RBA Meeting Minutes; EU Preliminary Q4 GDP.

Wednesday - UK CPI y/y; CAD CPI m/m; FOMC Meeting Minutes.

Thursday - Australia Unemployment Rate; ECB Meeting Minutes.

Friday - French and German Industry numbers; British industry numbers;