The BOE is Expected to Reinforce its QE Program Amidst Growing Social Discords

The Monetary Policy Committee (MPC) of the Bank of England is meeting this Thursday to deliberate on its current monetary policy stance.

The Committee would almost certainly maintain its near-negative Official Bank Rate at 0.10 per cent, thereby will follow suit to other major central banks that have already done the same.

The consensus forecasts expect all of the Committee's nine members to vote unilaterally in favour of preserving the BOE's accommodative stance, in order to cushion the impact of the coronavirus fallout.

In light of the recent trends that are currently being observed across the financial world, the BOE is also expected to enhance its asset-purchasing facility with another 100 billion pounds' worth of UK government bond and sterling non-financial investment-grade corporate bond purchases.

The overall scope of BOE's QE program is thus anticipated to reach £745 billion in the open market. The Bank would thus likely become the next important central bank following the FED and the ECB to adopt an even looser monetary policy stance to foster economic recovery.

At any rate, the MPC's decision this Thursday is probably going to be predicated by heightened volatility due to factors that are external to the BOE's financial sphere of influence.

The British society is currently striving to reconcile with its colonial and racist past, which marked the rise and fall of the British Empire, as civil unrest increases.

The Black Live Matter (BLM) protests have turned global, which represents yet another challenge for Boris Johnson's government. His cabinet is already receiving backlash from the public due to its indecisive response to the coronavirus crisis and its overall Brexit strategy.

Hence, the underlying volatility on all currency pairs containing the pound is likely to jump this week, given all of these developments coupled with the BOE's highly important meeting.

The US Retail Sales Are Anticipated to Seesaw in June on Robust Consumers' Demand

Crucial retail data in the US is scheduled for release this Tuesday. The prevailing market forecasts project a sharp rebound from the record low that was registered in April due to the coronavirus fallout.

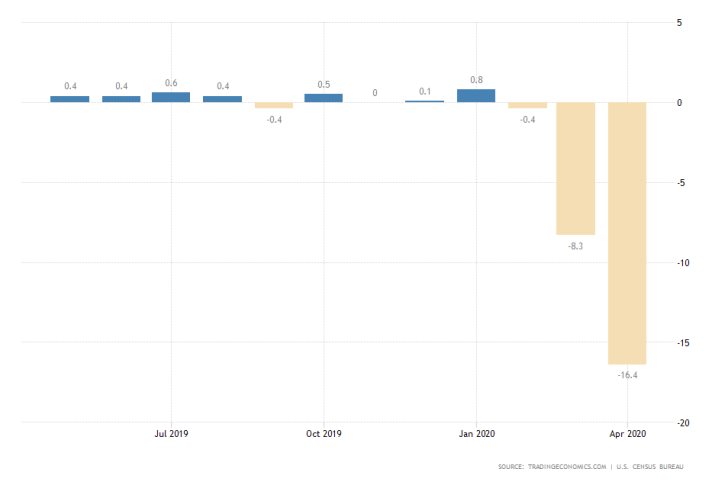

Last month's crushing slump to -16.4 per cent culminated during the height of the US lockdown, when many pubs, bars, shopping centres, restaurants, and others, were closed down by authorities in a bid to curtail the spread of the virus.

As the US economy started to reopen in May gradually, the overall consumer sentiment began to stabilise as well. This underscores the forward-looking expectations for a sudden jump in retail sales to 7.4 per cent.

Such a massive seesaw effect in retail sales is likely to be evoked by the drastic differences between the underlying economic indicators in the US.

On the one hand, the marginal improvement of the labour market conditions is a necessary prerequisite for heightened consumer spending.

On the other, subdued inflationary pressures highlight the shattered price stability, which is promptly turning into a major impediment for the industry outlook as the prospects of deflation continue to rise.

Overall, the primary economic outlook concerning the US economy remains muted with looming risks tilted to the downside. Nevertheless, the prevailingly optimistic expectations for a sharp rise in retail sales could provide momentary relief.

Consequently, the US dollar could be strengthened at least temporarily in the immediate aftermath following the release of the retail data tomorrow.

The Australian Unemployment Rate Likely to Have Deepened in May

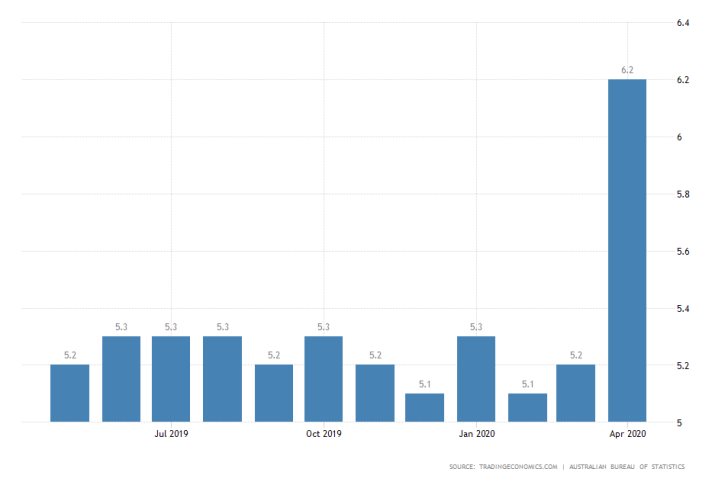

The Australian Bureau of Labour Statistics (ABS) is scheduled to release its latest labour force survey this Thursday. The headline unemployment rate is anticipated to have risen by 0.8 per cent in May to 7.0 per cent.

The underlying labour market conditions are thus likely to continue deteriorating following the 1 per cent surge in the rate from a month prior.

Australia's economy is finding it difficult to weather the coronavirus crisis due to the country's dependence on trade, and especially on Chinese imports and exports. The protracted road to recovery in the world's second-largest economy means that the underlying risks to growth in Australia remain tilted to the downside.

Due to all of this, the Australian dollar is likely to remain pressured this week. The underlying fundamentals would probably weigh down on the Aussie, as it retreats against other major currencies throughout the week.

Given the significance of the first two segments from today's 'Markets' entry, the price action on the GBPUSD pair is likely to register the most substantial changes this week.

As can be seen from the hourly chart below, the pair has continued to depreciate as per our previous projections. The current consolidation range that is developing around the major support level at 1.25000 is going to elucidate the future behaviour of the price action.

Other Prominent Events to Watch for this Week:

Tuesday – BOJ Monetary Policy Statement in Japan; Claimant Count Change in the UK; FED Chair Powell Testifies in the US.

Wednesday – CPI y/y change in the UK; CPI m/m change in Canada; FED Chair Powell Testifies in the US.

Thursday – q/q GDP change in New Zealand; SNB Monetary Policy Assessment in Switzerland; Unemployment Claims in the US.

Friday – Core Retail Sales m/m in Canada.