BOE Next in Line to Deliberate on its Monetary Policy Stance

The Bank of England is the next major central bank set to meet and deliberate on its current monetary policy stance.

The Monetary Policy Committee (MPC) of the BOE is scheduled to meet this Thursday, and the prevailing market forecasts anticipate the Committee to stay on its current course, similarly to what the ECB and the BOC did last week.

The consensus forecasts do not project any changes to the Official Bank Rate, which is currently at 0.10 per cent. All nine members of the MPC are expected to vote against the notion of changing the interest rate at the present moment.

Meanwhile, the Committee would have to decide whether or not to scale up its Asset Purchase Facility in order to cushion the continuous impact of the coronavirus fallout.

Pumping more liquidity into the economy might be met with some backlash by the public, which is why Deputy Governor of the BOE Ben Broadbent recently had to defend the accommodative monetary policy stance of the Bank.

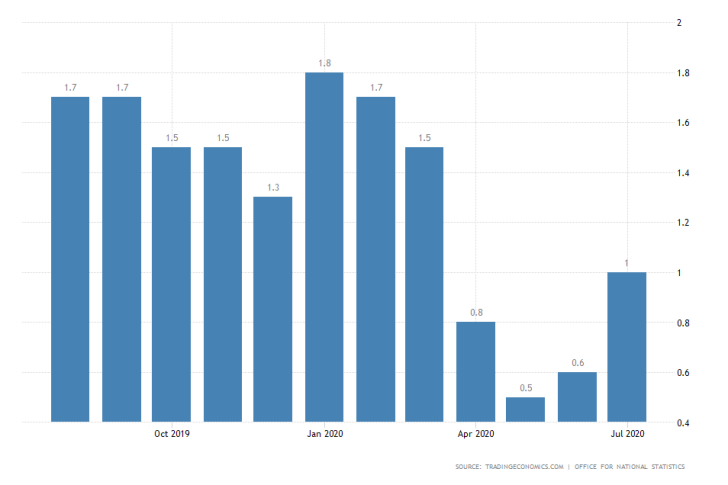

The economic prospects for growth continue to be subdued in the UK, despite the surprising jump in inflation in July. The baseline projections of the BOE project the inflation rate to recoil below 1 per cent in August, which would mean weakened price stability in Q3.

The drop in prices is expected to be resulting from the falling energy prices in the third quarter. Hence, the MPC should weigh in on whether this deterioration warrants further monetary intervention by the Bank in order to stave off future disruptions in the overall price stability.

THE FOMC Set to Contextualise Jerome Powell's Recent Statements

The Federal Open Market Committee of the Federal Reserve is going to meet a day before the MPC of the BOE. This Wednesday, the FOMC is set to fulfil the promises of Jerome Powell, FED Chair, from his recent speech at the Jackson Hole Symposium.

Chiefly, the FED is expected to outline its revised inflationary expectations as the US economy continues to recover. The market forecasts anticipate the near-negative Federal Funds Rate to be maintained unchanged at 0.25 per cent.

At the same time, the possibility of the FOMC deciding to broaden its quantitative easing (QE) programme remains very probable, as the Committee looks willing to risk spurring high inflation in a bid to promote maximum employment.

At any rate, the decisions of the FED and the BOE are bound to stir heightened volatility on the GBPUSD pair. As it is about to be seen below, the cable is currently trading close to a major support level, but the two monetary policy decisions could incite the creation of a new directional swing.

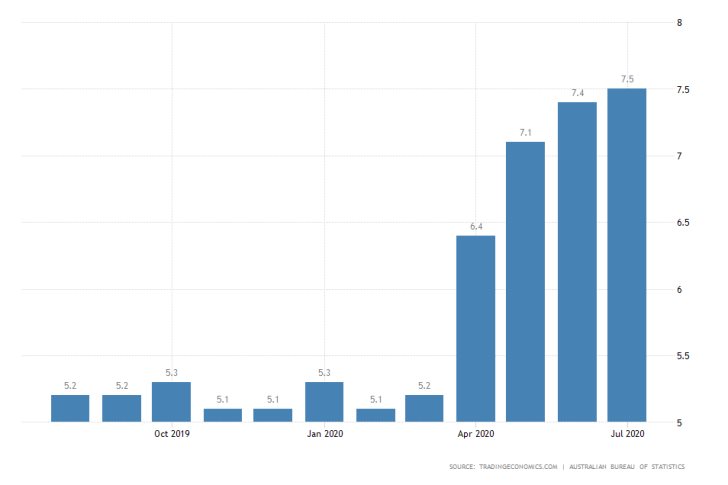

The Australian Unemployment Rate Expected to Jump for the Sixth Consecutive Time in August

The Australian Bureau of Statistics (ABS) is scheduled to release the most recent labour market data in Australia on Thursday. According to the initial market forecasts, the unemployment rate is likely to jump from 7.5 per cent, which were recorded in July, to 7.7 per cent in August.

If the consensus forecasts are realised, this will mark the sixth monthly appreciation of the Australian unemployment rate, which would be inlined with the downbeat forecasts of the RBA for protracted and uneven recover.

The anticipated deterioration of employment conditions in Australia is partly due to the recent surge of COVID-19 cases in Melbourne, in the state of Victoria.

The resurgence of cases prompted local authorities to reintroduce stricter containment measures, which, in turn, was reflected on the bigger-than-expected economic crunch in the second quarter.

As was alluded to above, the GBPUSD pair is likely to garner the most interest from traders this week, owing to the significance of the monetary policy meetings of the BOE and the FED.

As can be seen on the daily chart below, the cable is nearing the major support level at 1.27400. The underlying price action is currently consolidating just above the support, but the expected upsurge in volatility from the two policy decisions is likely to affect the prevailing market sentiment.

For the time being, the longer-term market bias remains ostensibly bullish, which can be inferred from the Ichimoku Cloud indicator. Nevertheless, the recently recuperating dollar could change this.

Other Prominent Events to Watch for This Week:

Wednesday – Yearly CPI change in the UK; Core Retail Sales in the US; Crude Oil Inventories in the US.

Thursday – quarterly GDP Reading in New Zealand; Monetary Policy Statement of the BOJ; Unemployment Claims Change in the US.

Friday – Retail Sales in the UK; Core Retail Sales in Canada; Preliminary Consumer Sentiment in the US.