The most significant determinant for the direction of the global markets this week will be the quarterly earnings reports of the biggest technological companies in the world. Those would undoubtedly cause an upsurge in volatility on higher-risk assets, which would likely have a reciprocal impact on safe havens. Have a look at our previous analysis of gold to learn more about the current state of the security.

Traders need to pay special attention to the quarterly reports by Big Tech throughout the week, as any surprises could cause sudden upsurges of adverse volatility across different markets.

First in line to report is Facebook, whose share price was affected recently by persisting controversy concerning the company's policy of user data protection and handling. The social media giant is set to report on Monday after the market close.

Microsoft and Google's parent company Alphabet will post their earnings numbers on Tuesday after the market close in what looks poised to be the most action-packed day of the week.

Arguably, the best-performing company since the beginning of the coronavirus crash last year, Apple, will report on Wednesday. The exact timing is not yet specified. And to cap it all off, Amazon, the biggest retailer in the world, will deliver its quarterly report on Thursday after the market close.

The weekly comparison chart above demonstrates the performance of Big Tech's share prices against the Nasdaq Composite since before the beginning of the pandemic. The Covid-inspired stock crash in early-2020 comprised a small dent in a broader rally, which appears to be strengthening.

Apple's stock continues to be the best performer, while Facebook has fallen behind Microsoft and Alphabet.

ECB Will Not Risk Jeopardising the Tentative Recovery of the Euro Area

The Governing Council of the European Central Bank, chaired by Christine Lagarde, is meeting on Thursday to deliberate on the current monetary policy stance of the bank.

The Council will almost certainly maintain the near-negative Main Refinancing Interest Rate unchanged at 0.00 per cent in a bid to continue accommodating growth as Europe tries to steer out of the pandemic crisis.

Economic activity has been recovering, but the main challenge remains steering the economy safely out of the pandemic crisis. Policy support should not end prematurely.

— Christine Lagarde (@Lagarde) October 14, 2021

Read my statement for today’s International Monetary and Financial Committee (IMFC) https://t.co/6741rAWLV9

Eurozone's underlying recovery continues to be fragile, which is why any policy intervention at the present rate would be considered premature.

U.S. Growth Expected to Seesaw in the Third Quarter

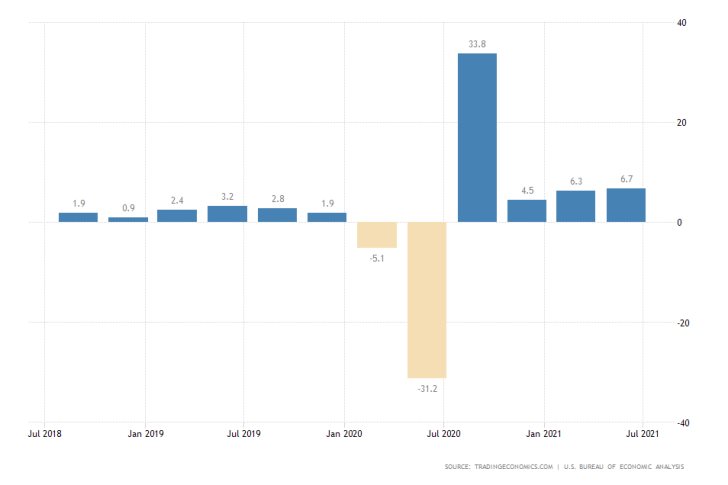

Also on Thursday, the U.S. Bureau of Economic Analysis is scheduled to release the advance GDP growth rate numbers for the third quarter. Since this will be the first GDP report for the period, its impact will likely be the most significant.

According to the preliminary forecasts, the U.S. economy is expected to expand by 2.6 per cent in the three months leading to September. This would mark a sizable dropdown from the 6.7 per cent growth rate that was observed over the previous quarter.

Despite the steadily growing factory activity in the U.S., demand remains tentative. The labour market has expanded at a slower pace compared to market forecasts, underpinning the projections for an overall decline in the recovery pace.

All of this implies the likely continuation of the recently observed dollar depreciation. As can be seen on the 4H chart below, the EURUSD has already begun developing a new bullish trend following the completion of the preceding downtrend.

This was underpinned by the emergence of a Falling Wedge at the dip of the latter, which signified the bullish rebound. Presently, the price action is consolidating between the 23.6 per cent Fibonacci retracement level at 1.16153 and the 38.2 per cent Fibonacci at 1.16716.

The strong support area below the former is elucidated by the crossover between the 100-day MA (in blue) and 50-day MA (in green). Meanwhile, the prominence of the latter is underscored by its convergence with the 200-day MA (in orange).

Other Prominent Events to Watch Out for:

Monday - Germany MoM ifo Business Climate.

Tuesday - U.S. MoM CB Consumer Confidence; Visa Inc. Reporting AMC.

Wednesday - Australia QoQ Inflation Rate; U.S. MoM Durable Goods Orders; Canada BOC Interest Rate Decision; Japan MoM Retail Sales; Boeing Co Reporting BMO; Coca-Cola Co. Reporting BMO; Ford Motor Co. Reporting TAS; Mcdonald's Corp. Reporting BMO; eBay Inc. Reporting AMC; Spotify Technology SA Reporting BMO.

Thursday - Japan BOJ Interest Rate Decision; Japan MoM Unemployment Rate; Japan MoM Preliminary Industrial Production; Starbucks Corp. Reporting AMC; Caterpillar Reporting TAS.

Friday - Germany QoQ Preliminary GDP Growth Rate; Canada MoM GDP Growth Rate; U.S. Treasury Currency Report; U.S. UoM Revised Consumer Sentiment; Eurozone MoM Inflation Rate; Eurozone Preliminary QoQ GDP Growth Rate.