Joe Biden's Inauguration Speech on Thursday Takes the Spotlight

In a week filled with major economic events and releases, the most significant one is going to be Joe Biden's inauguration speech on Thursday. He will officially step up into office and become the 46th U.S. president, and Mr Biden will have to address looming issues right from the get-go of his stay at Washington.

The recent upheaval at Capitol Hill shows that the very foundations of American democracy are at peril, and the democratic leader, as he said himself, would have to bridge the gaps between a divided nation.

Tensions are running high as the organisers of the event fear that QAnon rioters might jeopardise Biden's inauguration event, which is why security will be placed at high alert.

Meanwhile, the coronavirus pandemic continues to be deepening in the U.S., which shifts the focus away from other major problems for the new administration, such as the Iran nuclear deal; the situation in the Middle East; North Korea's nuclear ambitions; Russia's cyber-meddling into U.S. internal affairs; the trade war with China; the bubbling budget deficit, and many others.

With so many issues at hand, Joe Biden will have to make important decisions with far-reaching consequences from his first day at the Oval Office, which is bound to set the tone for the global capital markets in the weeks and months to come.

ECB Has to Resolve the Issue of Persistently Subdued Inflationary Pressures in the Euro Area

The Governing Council of the European Central Bank is scheduled to meet this Thursday to deliberate on its monetary policy stance's appropriateness in light of the latest economic developments.

The Council will almost certainly keep the Main Refinancing Rate unchanged at 0.00 per cent, which isn't at all that surprising given the subdued performance of the national economies within the Euro Area.

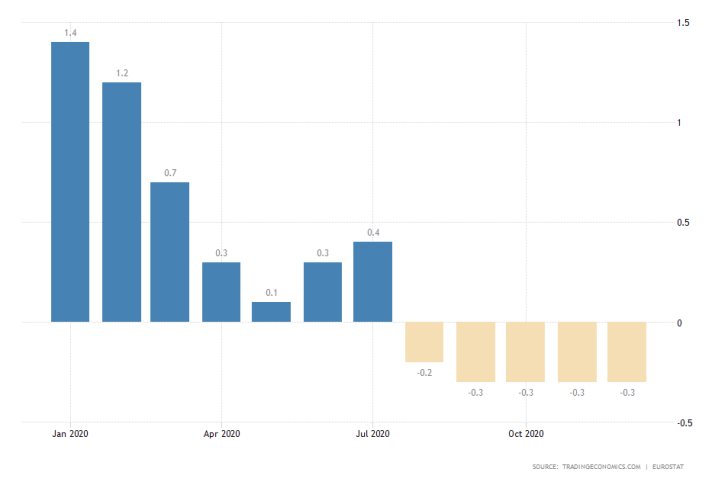

The persistently subdued inflation rate in the Euro Area, which has been negative since August 2020, continues to pose the most significant threat for the bloc's price stability.

It remains to be seen whether the Council would decide to broaden the scope of its Pandemic Emergency Longer-Term Refinancing Operations (PELTROs), akin to what was decided during the previous meeting of the ECB.

Netflix Against the Odds

Amidst the political strife and major banks meetings this week, the earnings season in the U.S. is also running with full steam. And it is Netflix that is due to report its quarterly earnings for the last three months of 2020 on Tuesday.

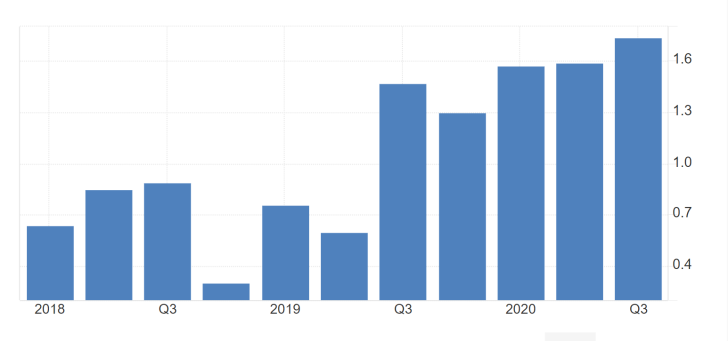

The consensus forecasts anticipate the streaming service to report Earnings Per Share of $1.38, which would be only slightly better than the $1.30 EPS that was recorded over the same period a year prior.

Netflix has been consistently underperforming in the last four quarters by failing to reach the initial market forecasts, which is why investors feel ill at ease at the moment. That is so because this year the streaming giant would also have to grapple with the deepening impact of the coronavirus fallout.

Meanwhile, given the significance of the first two segments of this analysis, the 4H chart below examines the latest behaviour of the EURUSD. As can be seen, the price action behaved exactly as anticipated by our previous analysis of the pair, in that, it continued to plunge after the conclusion of the Dead Cat Bounce pattern.

The price action is currently testing the major support level at 1.20700, potentially prompting a minor bullish pullback. The underlying momentum remains ostensibly bearish, as demonstrated by the MACD indicator, while the Bollinger Bands underpin rising volatility.

Other Prominent Events to Watch for:

Tuesday - Harmonized Index of Consumer Prices y/y Germany; ECB Bank Lending Survey; Bank of America Reporting BMO; Goldman Sachs Group Inc. Reporting BMO.

Wednesday - BOC Interest Rate Decision; CPI y/y U.K.; Morgan Stanley Reporting TAS.

Thursday - Australia Unemployment Rate; BOJ Policy Rate Decision; CPI q/q New Zealand.

Friday - French Services and Manufacturing PMI Data; German Services and Manufacturing PMI Data; British Flash Services and Manufacturing PMI Data; Canada Retail Sales Data m/m; U.S. Flash Manufacturing PMI Data;