The Federal Open Market Committee met on Wednesday and expectedly decided to maintain the Federal Funds rate unchanged from its previously near-negative value of 0.25 per cent.

FOMC followed in the footsteps of the ECB by deciding to loosen up its monetary policy even more, in order to accommodate faster recovery by bolstering the credit lines it extends to American businesses and households.

The Committee maintained its somewhat cautionary stance from its previous meeting. Jerome Powell and his colleagues announced their decision to ramp up FED's asset purchasing programs with ambiguously sounding rhetoric in the post-decision statement.

"To support the flow of credit to households and businesses, over coming months the Federal Reserve will increase its holdings of Treasury securities and agency residential and commercial mortgage-backed securities at least at the current pace to sustain smooth market functioning, thereby fostering effective transmission of monetary policy to broader financial conditions"

No specifics were provided as regards the scope or timing of this increase, which is most certainly intended to allow the FOMC to preserve a certain degree of flexibility. The Committee's somewhat vague comments would enable it

to reaffirm its stance in the future if need be.

Moreover, the Committee published its economic projections for the period until June 2022, which expound upon the likely shape and breadth of the expected recovery.

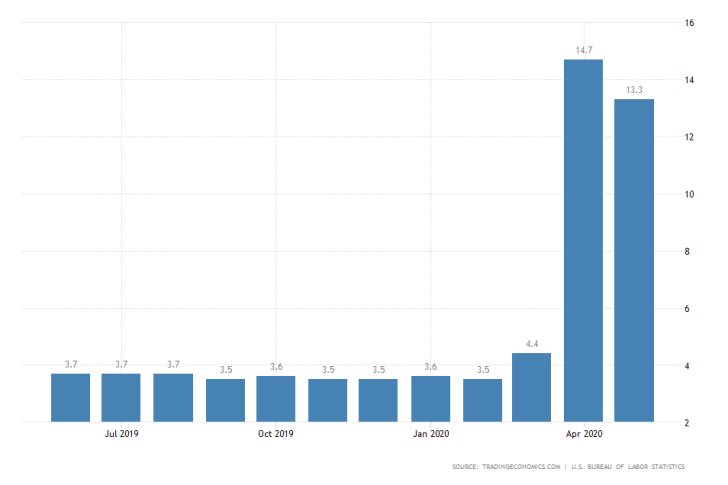

The overall unemployment rate is expected to rise to 9.3 per cent in 2020, and then to gradually diminish to 6.5 per cent in 2021 to 5.5 per cent in 2020.

Headline inflation is anticipated to increase only marginally in 2020 to 0.8, which is the result of the coronavirus restrictions and the ripples in the energy market. A more sizable surge is projected for 2021 when the rate is expected to top 1.6 per cent, followed by a 0.1 per cent hike in 2022.

That is why the Committee expects the key interest rate to be kept low at 0.1 per cent throughout Q2 of 2022, due to this subdued rise in inflation and protracted stabilisation of the labour market.

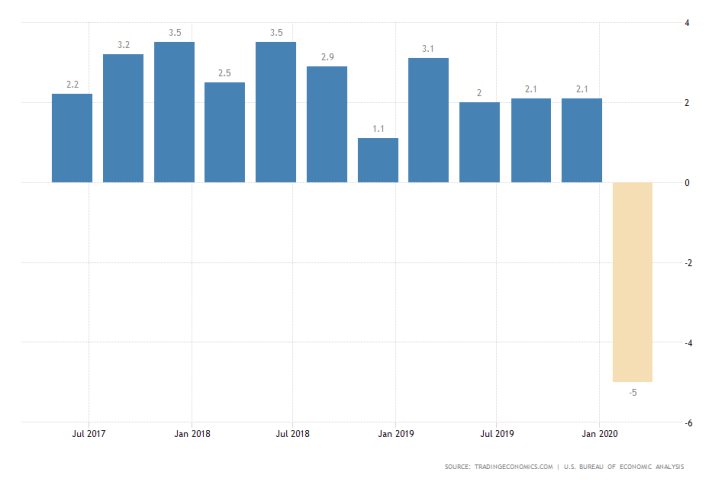

The most concise evidence reflecting on the extent of the coronavirus fallout on the American economy is derived from FOMC's projections of the GDP growth rate.

A sizable contraction of 6.5 per cent in 2020 is expected to be followed by a sharp rebound of 5.0 per cent the next year. In June of 2022, the GDP growth rate is projected to normalise at 3.5 per cent. These numbers underpin the seesaw effect of the coronavirus hit.

Overall, FOMC's economic projections provide encouraging news as regards the timing of the anticipated economic recovery.

However, the economic models that envisage muted inflation through the second quarter of 2020 are going to pressure the dollar, which has had a tough time following the initial shock from the coronavirus crisis.

Weaker price stability in the US is bad news for the greenback, which continues to lose its global appeal as a safe harbour for international investors.

Nevertheless, there is some hope in the short run. As can be seen on the 4H EURUSD chart below, the single currency is struggling with the major resistance level at 1.14000, which is leading to the establishment of a Distribution range.

The pair might be due for a short-term bearish correction, driven by the already falling bullish momentum.