Another Decrease in the Pace of U.S. Jobs Creation Expected

The undergoing dollar strengthening that began last week is expected to carry over the next five days, which, in turn, is likely to have a major impact on all higher-risk assets. Check out our latest ETHUSD analysis to get a better sense of the impact of this heightened volatility on the crypto market.

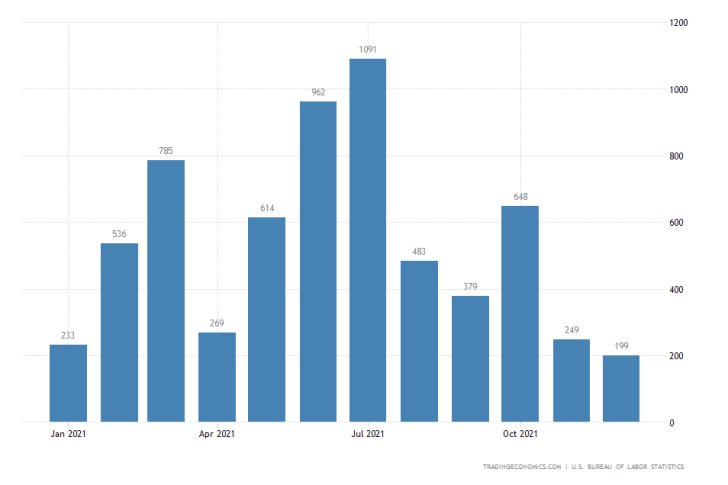

The U.S. non-farm payrolls data for January, which as per usual, is scheduled for release by the Bureau of Labour Statistics (BLS) on the first Friday of the new month, will likely be the most important trading event taking place this week.

The labour market is expected to have added 166 thousand new jobs last month, which would mark the weakest performance in over a year and a moderate decline in the pace of jobs created from a month prior.

Nevertheless, the overall rate of economic expansion continues to outstrip earlier projections, and the Federal Reserve remains fairly optimistic regarding the likelihood of a rate hike as early as March.

Alphabet and Amazon Next in Line to Post their Quarterly Earnings

Google's parent company is scheduled to deliver its quarterly performance for the three months ending in December on Tuesday after the market close, whereas the biggest online retailer in the world would report after the market close on Thursday.

There’s famous, and then there’s Internet Famous 📱 Check out the latest items to go viral https://t.co/AbZVR9Rfxt

— Amazon (@amazon) January 29, 2022

Alphabet is expected to announce earnings per share (EPS) of $26.69, which, if realised, would beat the $22.3 EPS that were reported for the same quarter last year. As regards Amazon, investors' preliminary forecasts point to a probable slump of $3.88 to be reported for Q4, measuring a sizable dropdown from the $14.09 EPS that were posted last year.

So far, the earnings season as a whole has been beating the preliminary forecasts, underlining the resilience of the stock market in the face of growing global uncertainty.

The European Central Bank to Meet on Thursday

Last but not least, the Governing Council of the ECB, chaired by Christine Lagarde, will meet on Thursday to deliberate its current policy stance. Even though the nearly-negative Main Refinancing Rate is expected to be kept unchanged at 0.000 per cent, the ECB, like the FED last week, now has more reasons to adopt a more hawkish stance.

Banks lent more money to euro area firms in December 2021, reversing a slowdown since April 2021. The annual growth rate of loans rose to 4.2%, with the largest contributions coming from banks in Germany and France. More statistics in the press release https://t.co/C5qq6cK5DG pic.twitter.com/I0Hie3VW5T

— European Central Bank (@ecb) January 28, 2022

Eurozone industrial activity improved in December, while broader economic sentiment has been steadily recuperating over the last few months. That is why ECB's decision on Thursday could potentially help the reeling euro strengthen against the rallying greenback, at least temporarily.

As can be seen on the 2H chart below, the EURUSD finds itself in a strong downtrend, elucidated by the descending channel. Even still, a minor bullish pullback may be due soon, given the bullish crossover on the MACD indicator.

If the price action manages to penetrate above the 20-day MA (in red) and middle line of the channel, the pullback could then be extended towards the 23.6 per cent Fibonacci retracement level at 1.12069.

This Fibonacci threshold is currently converging with the upper limit of the channel, which makes it less likely for a decisive breakout above the two to take place anytime soon.

Moreover, the 100-day MA (in blue) and 50-day MA (in green), which serve as floating resistances, are threading near the channel's upper border, making it an even more prominent turning point.

Other Prominent Events to Watch Out for:

Monday - Eurozone Preliminary QoQ GDP Growth Rate; Germany MoM Inflation Rate; Alibaba Group Holding Ltd. reporting BMO.

Tuesday - Australia RBA Cash Rate Decision; Canada MoM GDP Growth Rate; U.S. MoM ISM Manufacturing PMI; U.S. JOLTS Jobs Openings; New Zealand QoQ Unemployment Rate; Germany MoM Retail Sales; PayPal Holdings Inc. reporting AMC.

Wednesday - OPEC-JMMC Meetings; Eurozone Preliminary MoM Inflation Rate.

Thursday - UK BOE Rate Decision; U.S. MoM ISM Services PMI.

Friday - Canada MoM Unemployment Rate; Eurozone MoM Retail Sales;

BMO - Before Market Open; AMC - After Market Close.