U.S. Employment Expected to More Than Double in May

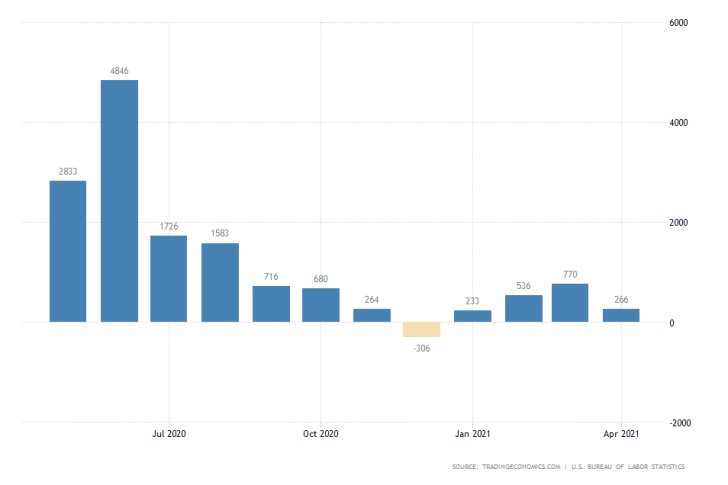

This week's most prominent market event will be the release of the May Non-Farm Payrolls in the U.S. As per usual, the data will be published on the first Friday of the month.

According to the preliminary forecasts, 670 thousand new jobs are projected to have been created last month, marking a noticeable rebound from the 266 thousand new payrolls recorded in April.

If the preliminary forecasts are met, this would mean that the American economy is once again on track to a stable recovery. This wasn't quite the case last time when the NFP data for April fell way below the massive initial forecasts for more than 1 million new jobs.

Headline unemployment is thus expected to have contracted in May, falling to 5.9 per cent from April's 6.1 per cent. This would be the lowest level of unemployment since the beginning of the coronavirus crisis.

Such a performance would generally be good news for the shaken greenback, which failed to recuperate noticeably last week. It was sidelined amidst growing uncertainty in higher-risk assets, and structural growth in demand for commodities.

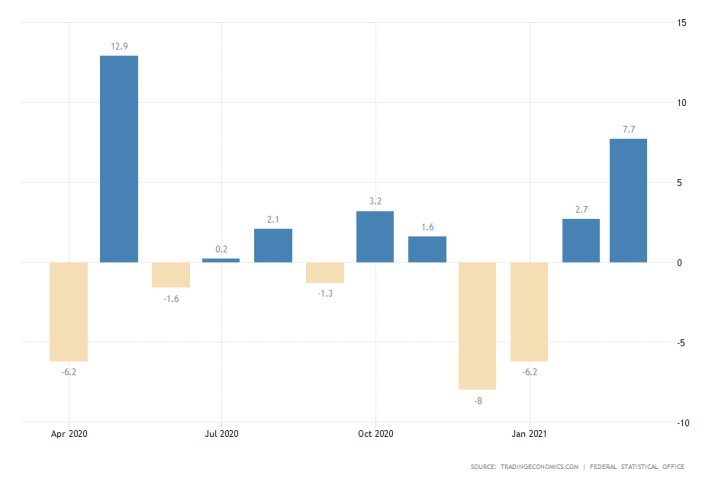

German Retail Sector Likely to Seesaw

On Wednesday, Destatis is scheduled to post the latest retail sales numbers in Germany. The consensus forecasts are for a seesaw reversal from last month's positive rebound.

In March, the retail sector had its strongest monthly performance since last May, partly inspired by ongoing industry growth. This positive trend was already reflected by German stocks.

Nevertheless, the expectations for another drop in sales is likely to momentarily stave off this enthusiasm, potentially exerting extra bearish pressure on the euro in the short term.

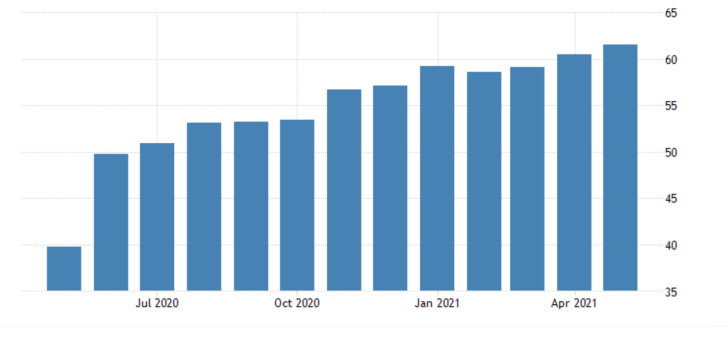

U.S. Manufacturing to Continue Growing at a Record Pace

American industrial growth is expected to accelerate at a record-breaking pace in June, with regards to the manufacturing sector. The Institute for Supply Management (ISM) is scheduled to post the latest numbers on Tuesday.

According to the early market forecasts, the rate of expansion of the sector is projected to reach 61.2 index points, up from the 60.7 index points that were recorded in May.

Such a performance would likely boost the value of the greenback, which is already expected to strengthen this week on the forecasts for robust payrolls data. That is why a correction on the EURUSD this week seems conceivable.

As can be seen on the daily chart below, the pair is currently consolidating in range after having managed to penetrate above the psychologically significant threshold at 1.20000. The upper boundary of said range is underpinned by the major resistance level at 1.22400, while its lower limit can be found at the 1.21500 support.

Even though the price action rebounded from the 20-day MA (in red) last Friday and bullish bias remains active, the pair is likely to continue fluctuating between these two boundaries over the next couple of weeks.

However, if the pair manages to break down below 1.21500 decisively, potentially because of the aforementioned fundamentals, the emerging correction could then slip towards the 1.20670 support. The latter is underpinned by the 40-day MA (in yellow).

Other Prominent Events to Watch for:

Monday - Chinese Manufacturing PMI.

Tuesday - RBA Cash Rate Decision; OPEC-JMMC Meetings; German Final Manufacturing PMI; Canada m/m GDP; BOE Governor Bailey Speaks.

Wednesday - Australia q/q GDP.

Thursday - U.S. m/m ISM Services PMI; Australia m/m Retail Sales; BOE Monetary Policy Meeting Hearings.

Friday - Canada m/m Unemployment Rate.