Second Chance for the U.S. Labour Market

GBPUSD's latest upswing is owing to the temporary dollar weakness amidst disappointing GDP numbers in the U.S. and hit-and-miss earnings data for Q2. Check out our comprehensive analysis of the cable for more information.

The most significant economic release this week will be the unemployment data in the U.S. As per usual, the Bureau of Labour Statistics (BLS) is scheduled to post the latest Non-Farm Payrolls (NFP) numbers on the first Friday of the new month.

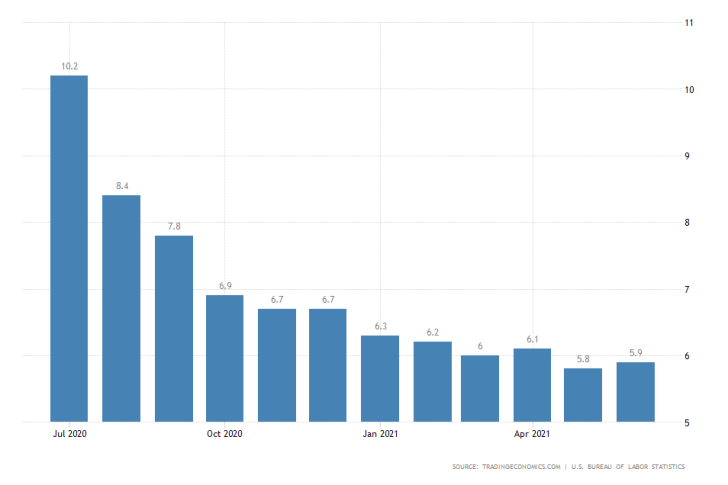

The labour market is expected to have recuperated in July after headline unemployment remained above market expectations in July. According to the consensus forecasts, the unemployment rate is projected to have decreased by 0.3 per cent to 5.6 per cent last month.

If realised, this would be the best performance since the beginning of the coronavirus crisis, and a welcoming development following the disappointing GDP data for the second quarter.

Such a performance could help the reeling dollar in the short term.

BOE Meets Amidst Tightening Pandemic Conditions

On Thursday, the Monetary Policy Committee (MPC) of the Bank of England is meeting to deliberate on its current policy stance. The Bank is almost certainly going to preserve the near-negative Official Bank Rate unchanged at 0.10 per cent.

The Committee would also have to take into account the worsening pandemic conditions in the UK. The delta variant is spreading fast, and hospital admissions are rising for all age groups except those aged 5-14 years.

Hospital admissions increased in all age groups except those aged 5 to 14 years in the week ending 25 July 2021.

— Office for National Statistics (ONS) (@ONS) July 30, 2021

Hospital admissions of those aged 15 to 24 years have reached their highest rate since the start of the pandemic https://t.co/6dmljCML1q pic.twitter.com/k3mnq0XnPS

Expect heightened volatility outbursts on Thursday, as there could be discord amongst the Committee. According to the market forecasts, one member of the nine-persons Committee is expected to vote in favour of bolstering the asset purchase facility.

This dovishness could likely hurt the sterling in the short term.

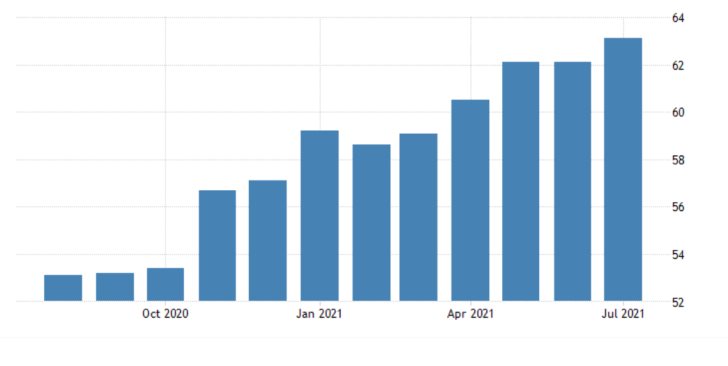

U.S. Manufacturing Expected to Rise Marginally

The Institute for Supply Management (ISM) in the U.S. is set to post the latest manufacturing PMI data on Monday. According to the preliminary forecasts, the index is projected to rise from 60.06 index points to 60.08.

Despite these forecasts for a minimal improvement, such a performance could still have a positive impact on the struggling greenback.

As can be seen on the daily chart below, the price action of the GBPUSD looks poised to test the 61.8 per cent Fibonacci retracement level at 1.3989 next. This pair would take centre stage over the next several days owing to the U.S. NFP data and BOE's policy decision.

The major resistance level at 1.3989, in addition to its close proximity to the psychologically significant threshold at 1.40, represents the last Fibonacci barrier. This is why a bearish correction is likely to spring up from it.

A potential dropdown could fall as low as the 38.2 per cent Fibonacci retracement level at 1.3829.

Other Prominent Events to Watch for:

Monday - Germany MoM Retail Sales.

Tuesday - Australia RBA Cash Rate Decision; New Zealand QoQ Unemployment Rate.

Wednesday - U.S. MoM ISM Services PMI; Australia MoM Retail Sales; EU MoM Retail Sales.

Thursday - Australia RBA Gov. Lowe Speaks; Australia MoM Trade Balance.

Friday - Canada MoM Unemployment Rate.