Another Robust NFP Report Expected for November

The top-tier economic releases next week are bound to cause an upsurge in volatility in an already sensitive market. The newest coronavirus variant coupled with geopolitical tensions is likely to bolster the adverse fluctuations on the EURUSD. You can read more about the current sentiment of the pair from our latest comprehensive analysis.

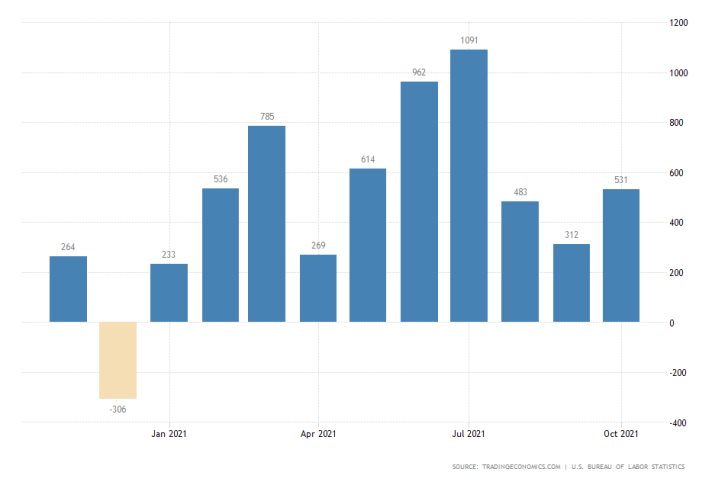

The most influential economic release over the next five days will undoubtedly be the November U.S. non-farm payrolls, which, as per usual, are scheduled for publication on the first Friday of the new month.

According to the market forecasts, the U.S. labour market will add another 528 thousand new jobs, similarly to the robust performance that was recorded a month prior. Headline unemployment is also expected to drop marginally by 0.1 per cent to 4.5 per cent, reaching a new multi-year low.

If the expectations are realised, this will represent yet another solid performance of the recuperating U.S. economy following the better-than-expected factory activity numbers that were released last week.

Consumption in the U.S. also increased significantly last month, representing another indication of a steadily expanding labour market.

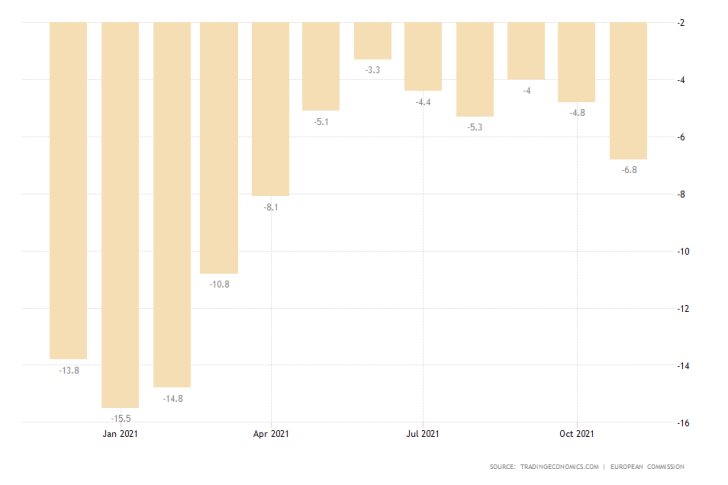

Eurozone Consumer Confidence Likely to Remain Subdued

On Monday, Eurostat will publish the November consumer confidence numbers for the Euro Area. It is expected that the index will remain unchanged at -6.8 per cent from the previous month.

The economic situation in the Eurozone continues to be strained owing to a mixture of contributing factors. Investors are scared by the newest coronavirus variant, which is already causing a selloff in stocks and other higher-risk assets, in addition to the volatile political situation in Ukraine.

Consumer confidence is thus likely to remain subdued despite a sizable rebound in German industrial activity and the better-than-expected GDP numbers in the Eurozone for the third quarter.

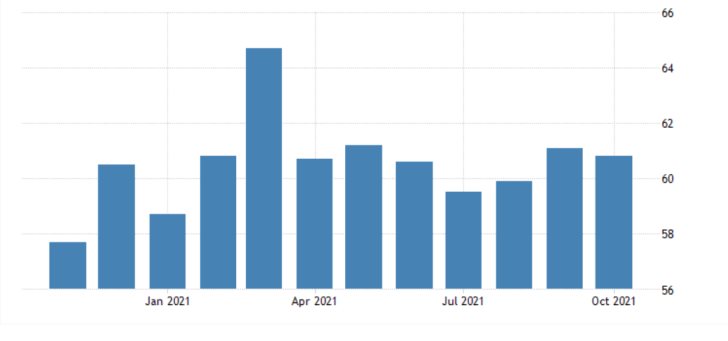

A Marginal Drop in U.S. ISM Manufacturing Projected

On Wednesday, the Institute for Supply Management (ISM) will post its own reading of the U.S. manufacturing output recorded in November. The consensus forecasts point to a likely depreciation of the index to 59.9 points from 60.8 index points.

This could add to the still tentative depreciation of the dollar, which commenced last Friday before the close of the weekly session. It was prompted by the aforementioned spread of a new Covid-19 variant. This makes it possible for a reversal on the currently trending EURUSD.

As can be seen on the daily chart below, the underlying downtrend of the pair is represented as a regression channel. The massive selling pressure is demonstrated by the Stochastic RSI indicator, which continues to be threading in its oversold extreme.

Nevertheless, the possibility for a reversal is illustrated by the emergence of a Bullish Engulfing after the recently observed Hammer candlestick from the lower limit of the channel. The correction could first head towards the 23.6 per cent Fibonacci retracement level at 1.14406, just above the middle line of the channel.

Other Prominent Events to Watch Out for:

Monday - U.S. MoM Preliminary Home Sales; U.S. FED Chair Jerome Powell Speaks; EU MoM Industrial Confidence; Germany MoM Inflation Rate.

Tuesday - China MoM Manufacturing PMI; Canada MoM GDP Growth Rate; U.S. FED Chair Powel Testifies; U.S. CB Consumer Confidence; U.S. Treasury Secretary Yellen Speaks; Germany MoM Unemployment Rate.

Wednesday - Australia QoQ GDP Growth Rate; UK BOE Governor Andrew Bailey Speaks; U.S. Fed Chair Powell Testifies; U.S. Treasury Secretary Yellen Speaks; Germany MoM Retail Sales.

Thursday - OPEC-JMMC Meetings.

Friday - EU MoM Retail Sales; U.S. MoM ISM Services PMI; Canada MoM Unemployment Rate.