U.S. Jobs Data Expected to Boost the Recuperating Greenback

Despite some temporary ripples, the U.S. dollar continues to be strengthening. To understand how this week's NFP numbers will affect the recuperating greenback, have a look at our detailed EURUSD analysis.

The most significant event this week will be the release of the U.S. Non-Farm Payrolls for June. As usual, the labour force data will be published on the first Friday of the new month.

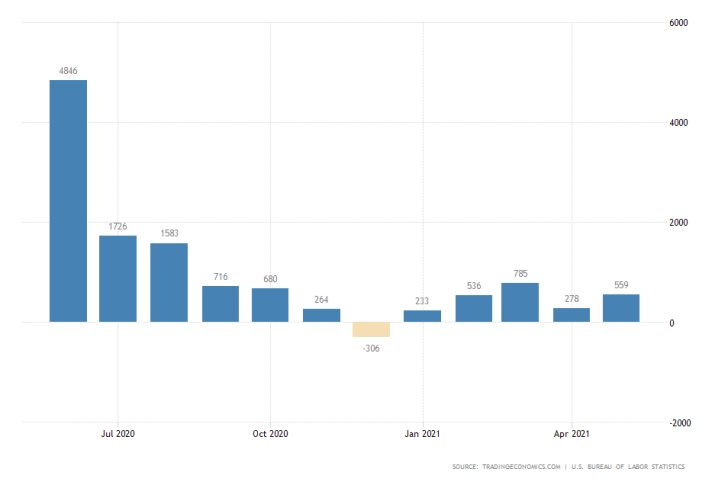

According to the preliminary market forecasts, the number of employed persons is expected to surge by 700 thousand. This will measure a sizable increase from the 559 thousand jobs that were created a month prior.

If these projections are realised, this would have a positive effect on the headline unemployment rate. The latter is expected to decrease marginally by 0.1 per cent, falling to 5.7 per cent.

The U.S. economy is recovering thanks in large part to FED's accommodative policy stance, which allows for the labour market to continue stabilising. This trend looks poised to remain active following FED Chair Jerome Powell's reassuring remarks from last week.

He calmed markets by demonstrating that inflation is not yet a major impediment to recovery, which is why FED's QE programmes could continue supporting jobs creation. All of this is good news for the dollar.

Could OPEC Jolt Oil Prices?

On Thursday, OPEC will be convening yet again, which would likely lead to volatility outbursts in the energy market. These could have a make-it-or-break-it effect on the rallying price of crude oil.

Two gatherings will take place then - the 181st Meeting of the OPEC Conference and the 18th OPEC and Non-OPEC Ministerial Meeting. Similarly to what happened last time, market experts expect to see more conformity amongst members to production adjustments.

The SG noted that dialogue and cooperation continue to be instrumental in #OPEC’s work to support a secure and stable supply of energy for the benefit of producers, consumers and the global economy at large.

— OPEC (@OPECSecretariat) June 24, 2021

This conformity to the plans for production cuts greatly reduces the possibility for future supply gluts, which is what caused crude's massive rally over the last several months. However, it remains to be seen whether OPEC would comment on the surging oil prices.

The market could interpret any such remarks as an early sign that OPEC might try to cap the rally. This, in turn, would represent a huge selling signal, potentially causing another correction. That is why this week's meetings would likely cause volatility to upsurge significantly.

U.S. Manufacturing Expected to Slide Marginally in June

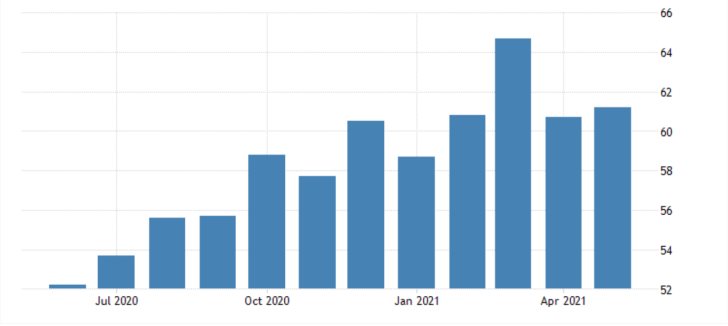

There is one other prominent event that could affect the U.S. dollar this week. This is the ISM manufacturing data, which is also scheduled for publication on Thursday.

According to the consensus forecasts, the ISM index is projected to decrease marginally by 0.2 per cent. This would mean a depreciation to 61.0 index points from the 61.2 points that were recorded in May.

The projected depreciation of the index is not very significant, which is why the greenback is unlikely to be affected greatly by the data.

Owing to the significance of the economic releases in the U.S. and the OPEC meeting this week, the USDCAD pair is likely to register the most significant price action this week. That is so because of the Loonie's dependence on the price of crude oil.

As can be seen on the 4H chart below, the pair started developing a new Markup, as we forecasted last time. This happened after the price managed to break out above the Accumulation range, as postulated by the Wyckoff Method.

Due to the aforementioned strengthening of the dollar, the price is likely to continue appreciating in the near future, though the correction could fall as low as the 61.8 per cent Fibonacci retracement level beforehand.

Several factors substantiate the expectations for future gains. The Bollinger Bands are tightening, which indicates diminished adverse volatility for the time being.

Meanwhile, the underlying bearish momentum is waning, as indicated by the MACD indicator. Finally, all of this happens as the price action is consolidating above the 38.2 per cent Fibonacci retracement level.

Other Prominent Events to Watch Out for:

Tuesday - U.S. CB Consumer Confidence; Germany Preliminary YoY CPI; ECB President Christine Lagarde Speech.

Wednesday - China MoM Manufacturing PMI; EU YoY Flash CPI Estimate; Canada MoM GDP; U.S. MoM Chicago PMI; U.S. MoM Pending Home Sales; U.S. Crude Oil Inventories; UK QoQ GDP.

Thursday - Germany MoM Final Manufacturing PMI; BOE Governor Bailey Speaks; Australia MoM Trade Balance; Germany YoY Retail Sales;