U.S. Unemployment Expected to Edge Higher in February

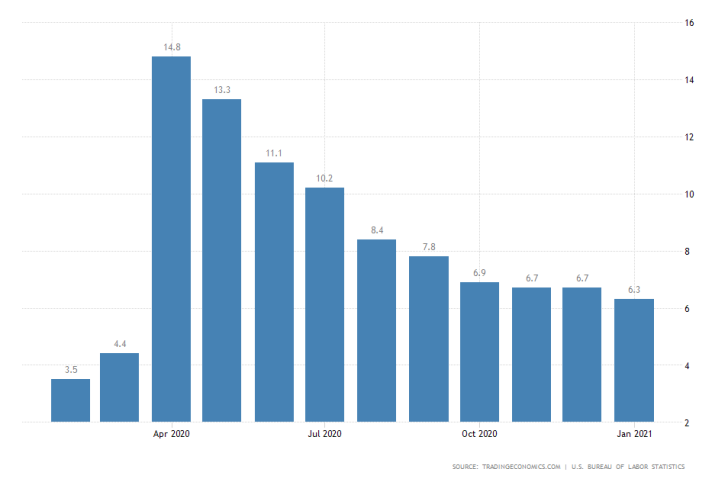

This week's most important economic publication will be the February Non-Farm Payrolls in the U.S., which will be released on Friday. According to the preliminary forecasts, the U.S. unemployment rate will rise by 0.1 per cent to 6.4 per cent.

This will mark a minor deterioration from a month prior, and the first time the labour market is contracting in over nine months. Headline unemployment remains above FED's long-term goals.

The pace of jobs creation, in contrast, is anticipated to pick up markedly from January, which will be welcoming news. The consensus forecasts project 133 thousand jobs to have been created over the last thirty days, which will exceed January's 49 thousand new job openings.

The American economy is in a growth mode at present, which is likely to foster stronger labour market conditions in the future. Employment is thus expected to continue rising throughout the remainder of the first quarter, despite the mixed expectations for February.

The rising yield of the U.S. 10-Year Treasury Note is evocative of this economic stabilisation, as investors become more confident and continue to pursue higher-risk assets.

RBA to Preserve the Near-Negative Rates

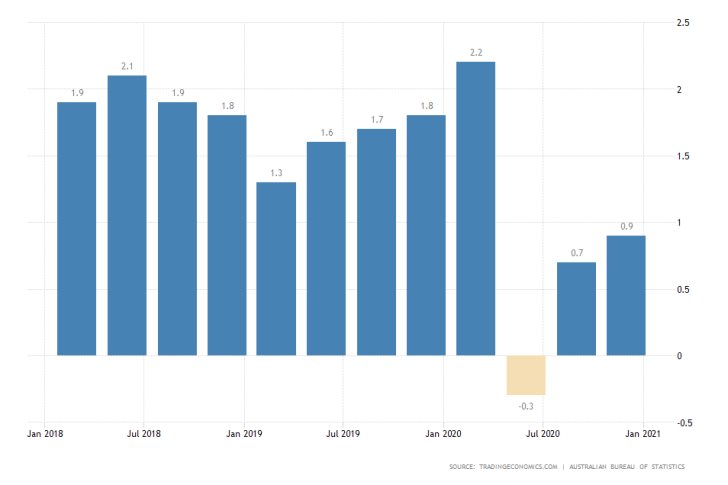

The Governing Council of the Reserve Bank of Australia is meeting on Tuesday to deliberate on its current monetary policy stance. The Council is almost certainly going to maintain the 0.10 per cent Cash Rate unchanged.

The economic situation in Australia is improving, though many hurdles remain. Headline unemployment fell to 6.4 per cent in January, demonstrating stabilisation of the labour market. Meanwhile, inflation remains subdued at 0.9 per cent, way below RBA's 2.0 per cent target level.

The Governing Council of the RBA is thus likely to follow in the footsteps of the RBNZ, which refrained from scaling up its asset purchase facility last week. Though, RBA is expected to maintain its already accommodative monetary policy stance.

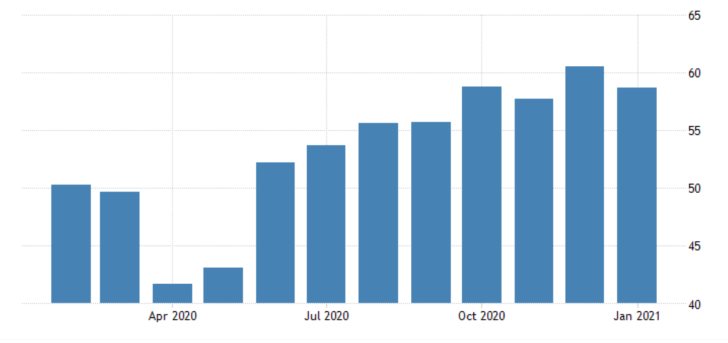

U.S. Manufacturing Expected to Remain on a Level in February

On Monday, the Institute for Supply Management (ISM) is scheduled to publish the latest manufacturing PMI data in the U.S. for February.

According to the initial market forecasts, the index is expected to remain unchanged at the same 58.7 index points that were recorded a month prior. These projections are compiled in spite of the recently observed pick up in new orders for manufactured goods.

The manufacturing and unemployment numbers that are scheduled for release this week are likely to boost the volatility on all currency pairs involving the greenback. Meanwhile, RBA's monetary policy decision is going to affect the value of the Aussie.

The Australian dollar recently broke a fresh record-peak and looks due for a correction, whereas the greenback is currently recuperating. All of this entails a likely bearish correction on the AUDUSD, as can be seen on the daily chart below.

The underlying selling pressure is steadily rising while the price action is currently testing the strength of the 50-day MA (in green) as a floating support. Given that the price action already broke down below the major support at 0.78000, the next crucial target is encompassed by the 0.76000 major support.

Other Prominent Events to Watch for:

Monday - UK Final Manufacturing PMI; Canada Manufacturing PMI; ECB President Lagarde Speaks.

Tuesday - Canada m/m GDP; Germany m/m Retail Sales; EU Preliminary m/m CPI.

Wednesday - Australia q/q GDP; UK Annual Budget Release; ADP Non-Farm Employment Change; US ISM Services PMI; US Crude Oil Inventories; RBNZ Governor Orr Speaks.

Thursday - OPEC-JMMC Meetings; FED Chair Powell Speaks; Australia m/m Retail Sales; EU m/m Retail Sales.