U.S. Labour Market Expected to Continue Recouping

This week's economic calendar looks relatively uneventful, with only a few events potentially set to stir some extra volatility. The March Non-Farm Payrolls in the U.S., scheduled for release on Friday, is undoubtedly the most significant one.

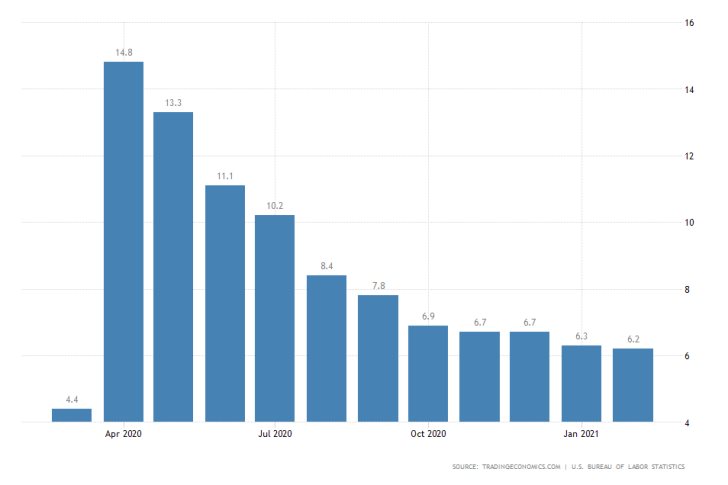

According to the preliminary forecasts, headline unemployment is projected to drop moderately to 6.0 per cent - the lowest level since the beginning of the coronavirus crisis. This contraction of 0.2 per cent from a month prior would likely be predicated on the solid pickup in U.S. economic activity.

The labour market is also expected to have added 633 thousand new jobs in March, which would massively outstrip the 379 thousand jobs that were recorded over the previous month.

This underlying trend of robustly improving employment conditions is elicited by the consistent efforts of the Federal Reserve in cushioning the coronavirus fallout. Moreover, the American Rescue Plan, which is advanced by President Biden and his administration, is already proving effective in boosting the vaccination efforts.

Communities across the country are struggling because of COVID-19 — but help is here. The American Rescue Plan provides funding to ramp up vaccinations, safely reopen schools, lift up small businesses, and move forward.

— President Biden (@POTUS) March 25, 2021

That is why, on Friday, markets would be expecting to see more evidence pointing to the acceleration of this trend of improving labour market conditions.

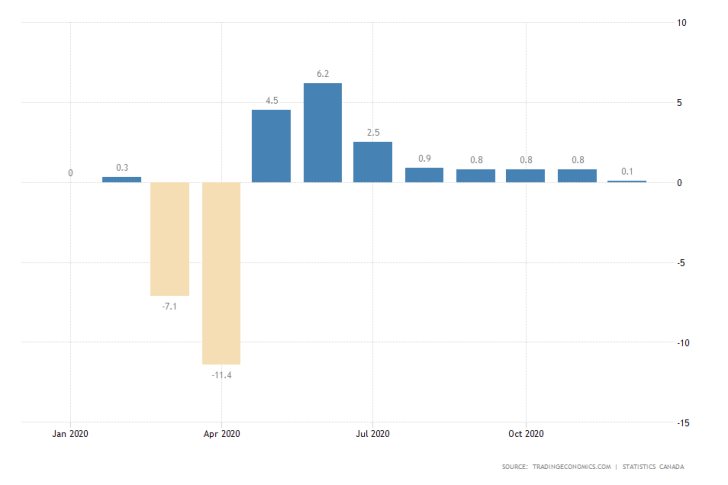

Canada's Muted Pace of Economic Growth Likely to Persist in January

On Wednesday, Statistics Canada is scheduled to publish the Gross Domestic Product numbers for the month of January. The Canadian economy is likely to continue growing at an extremely moderate pace, following the 0.1 per cent expansion that was recorded in December.

These projections are based on the weakened price stability that was observed recently, despite improving labour market conditions over the same period. The bumpy Canadian recovery is clearly going through a slow patch.

That is why the Canadian dollar, which started diving recently, is likely to continue depreciating over the short run.

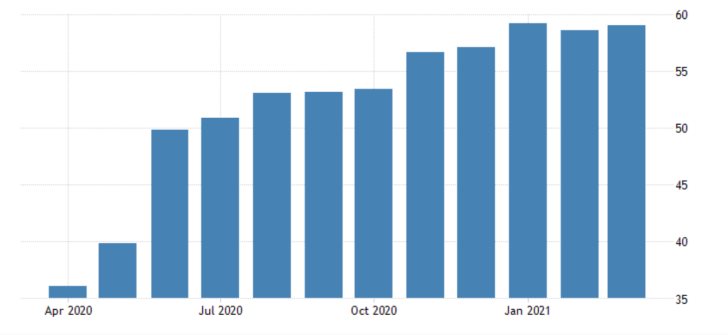

U.S. Manufacturing to Benefit from Increased Consumption Globally

On Thursday, the Institute for Supply Management (ISM) is set to deliver the U.S. manufacturing PMI numbers for March. The consensus forecasts point to a likely uptick of 0.2 index points to a new high of 61.0 points.

Factory activity and new orders are driven by recuperating global consumption, which is good news for industrial activity worldwide. Strengthening U.S. manufacturing numbers would resonate with FED's expectations for sustained economic recovery, thereby confirming FED Chair Powell's projections.

The expectations for robust employment and industry numbers this week are likely to strengthen the rallying greenback even more. In contrast, the loonie is probably going to be weakened by muted growth data.

As can be seen on the 4H chart below, the USDCAD continues to advance in a strong bullish trend. The underlying price action consolidated above the Support Area, with an upper boundary at 1.26000, and looks poised to continue appreciating.

This can be inferred from the recent breakout above the 200-day MA (in orange), which confirms the strong bullish sentiment in the market.

Other Prominent Events to Watch for:

Tuesday - Germany m/m CPI Preliminary; US CB Consumer Confidence.

Wednesday - China Manufacturing PMI; UK q/q GDP Final.

Thursday - Australia m/m Retail Sales; OPEC-JMMC Meetings.