RBNZ Likely to Remain Dovish as New Zealand's Recovery Remains Uneven

The February meeting of the Reserve Bank of New Zealand's Monetary Policy Committee (MPC) on Wednesday looks poised to be the most prominent event taking place this week.

The Committee is expected to maintain its near-negative Official Cash Rate unchanged at 0.25 per cent, as economic conditions have not lifted significantly since its previous meeting.

The positive news for the MPC is that New Zealand has managed to curtail the spread of coronavirus to a large extent while vaccination of the general public continues at full speed. However, that alone is not enough for the Committee to adopt a more hawkish outlook.

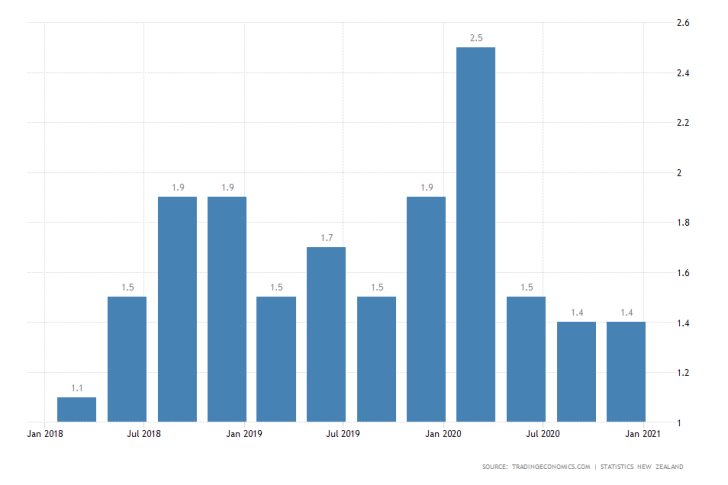

Inflation remains subdued at 1.4 per cent, as measured for 2020's fourth quarter, which is way below the desired 2.0 per cent target level. RBNZ's accommodative monetary policy stance needs to be preserved in order for prices to pick up. High energy prices in Q1 are supporting this process.

Meanwhile, the New Zealand dollar continues to be rallying as global investors' demand for riskier assets continues to affect the currency favourably. The kiwi has been rising steadily since the beginning of the new year against most other majors.

British Labour Market Conditions Continue to Tighten

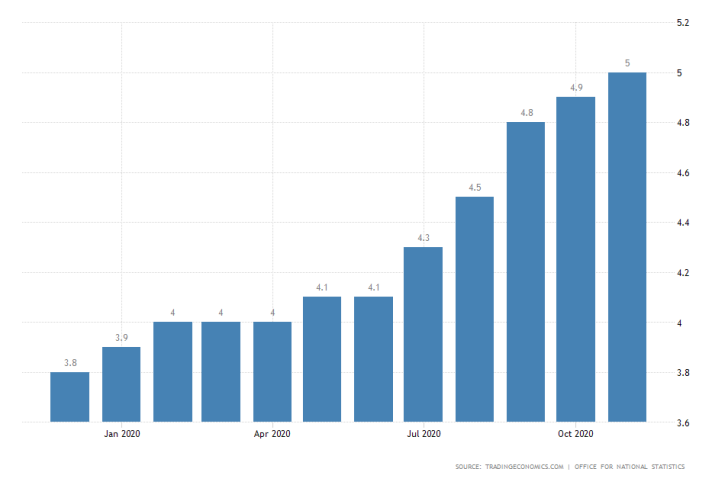

On Tuesday, the Office for National Statistics in the UK is scheduled to post the unemployment rate statistics for December. According to the preliminary market expectations, headline unemployment is likely to rise to 5.1 per cent.

Such a performance would mark the sixth consecutive month of increasing unemployment, measuring the highest level in over five years.

Traders will be interested to see the number of people claiming unemployment benefits as an indication of how employment conditions are likely to change next. If the reported number is higher than November's 7 thousand claimants, this would be bad for the pound.

Meanwhile, the sterling continues to be performing exceptionally well, with the GBPUSD currently probing a major psychological resistance. This represents a significant make-it-or-break-it level, and Tuesday's data could potentially tip the scales in either direction.

U.S. Industry Orders Projected to Seesaw in January

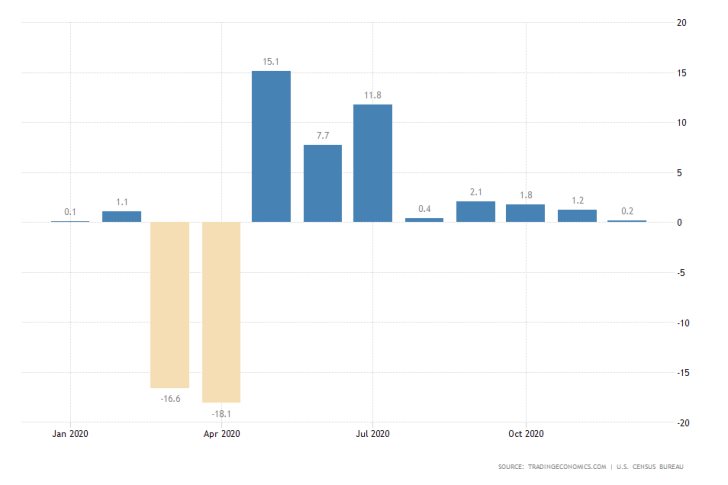

The Census Bureau in the U.S. is scheduled to publish the durable goods orders for January on Thursday, which is going to elucidate the rate of industrial stabilisation in the country.

A sizable rebound in the number of orders is expected to be reported for the first month of the new year following the major disappointment that was recorded in December. Back then, the total number of orders grew only marginally by 0.2 per cent.

According to the consensus forecasts, the index would grow by 1.3 per cent over the previous month, seesawing from the last dip. Such a performance would correlate with the recently observed rebound in retail sales for the same period.

The data will prove very important for the U.S. dollar, as the greenback continues to struggle against other major currencies. Given the durable goods data in the U.S. and RBNZ's rate decision a day earlier, the NZDUSD pair is likely to be affected quite noticeably by this week's events.

As can be seen on the daily chart below, the pair finds itself in a very strong bullish trend. The underlying price action is about to test the upper boundary of an Ascending Triangle pattern, which typically tends to entail likely trend continuation.

A breakout above the psychologically significant resistance at 0.73000 will substantiate such expectations, whereas a bearish rebound from it will give greenback bulls some level of optimism.

Other Prominent Events to Watch for:

Monday - German ifo Business Climate; New Zealand Retail Sales q/q; ECB President Lagarde Speaks; UK PM Boris Johnson Speaks.

Tuesday - FED Chair Powell Testifies; US CB Consumer Confidence; BOC Gov. Macklem Speaks.

Wednesday - FED Chair Powell Testifies; US Crude Oil Inventories.

Thursday - New Zealand Final ANZ Business Confidence; Australia Private Capital Expenditure q/q; US Preliminary GDP q/q; AirBnb Inc. Reporting AMC; Moderna Inc. Reporting BMO.

Friday - US Chicago PMI; Switzerland q/q GDP.