RBA Not Yet Confronted by Soaring Inflation

In what looks like it's going to be a relatively uneventful week, the policy meeting of the Monetary Policy Committee (MPC) of the Reserve Bank of Australia on Tuesday seems poised to be the most significant event.

The Committee is expected to maintain the near-negative Cash Rate unchanged at 0.10 per cent. The RBA still has some leeway in its policy prospects given that the country is not grappling with soaring inflation, unlike other developed economies.

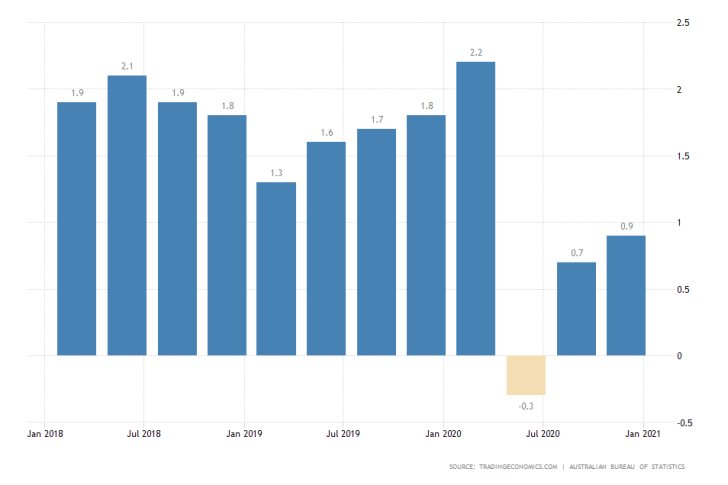

Headline inflation in Australia on a quarter over quarter basis remains relatively subdued, as can be seen on the graph above. The main inflation rate was revised upwardly to 0.9 per cent in the three months leading to December, which underscores the still comparatively moderate pickup in consumer prices.

The MPC is thus expected to maintain its dovish stance as the general economic pickup continues to unfold. The latter is underpinned by a strong rebound in the Australian labour market that was recorded recently.

Canada's Unemployment Expected to Shrink Deeper in March

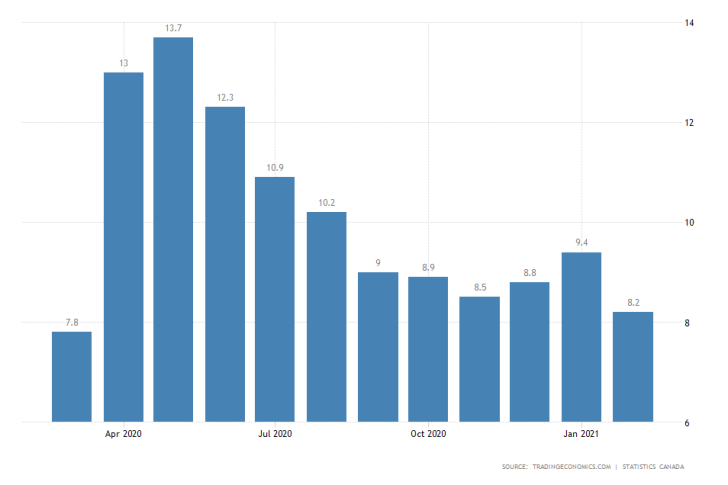

While on the question of unemployment, on Friday, Statistics Canada is scheduled to post the latest employment numbers in the country. According to the preliminary forecasts, Canada's unemployment rate is projected to fall moderately by 0.2 per cent.

The anticipated contraction from February's 8.2 per cent to 8.0 per cent in March would underpin the lowest unemployment level since the beginning of the coronavirus crisis and a definite sign of economic stabilisation.

The Canadian labour market is also projected to have added an additional 90 thousand jobs in March, representing a more moderate expansion than the 259 thousand jobs added a month prior.

The pace of economic recovery in Canada is also going faster than initially anticipated. The rate of economic growth beat expectations in January, representing yet another indication of the robust pickup in global activity.

Another Rebound in U.S. Services PMI Forecasted

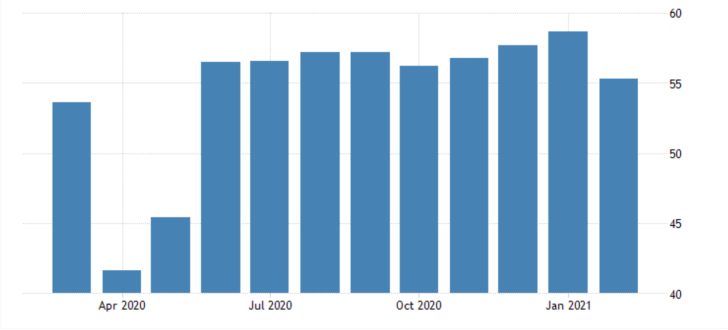

The services sector of the U.S. industry is expected to seesaw upwardly from the minor dip that was observed in February. The Institute for Supply Management (ISM) is set to deliver the latest non-manufacturing PMI numbers tomorrow.

The initial market forecasts project another rebound to 58.3 index points from the more moderate expansion of 55.3 index points that was recorded a month prior.

The recuperating industry in the U.S. walks hand in hand with the expanding labour market, which represents a necessary prerequisite for the likely continuation of the industrial stabilisation in the near future.

Given the policy decision of the RBA in Australia and the publication of these industrial numbers in the U.S., the most significant impact is likely to be reflected on the AUDUSD pair.

Even still, it should also be mentioned that because of the Easter Monday celebrations in Europe, liquidity levels are likely to drop at the outset of the new week, creating a volatile and unpredictable trading environment.

As can be seen on the 4H chart below, the pair continues to be heading lower within the boundaries of a massive descending channel. The price action appears to be consolidating between the major support level at 0.76000 and the 50-day MA (in green), which acts as a floating resistance.

While the MACD indicator seems to be underscoring some resurgence in short-term bullish momentum, the prevailing market sentiment remains ostensibly bearish. The AUDUSD is likely to continue depreciating as the greenback gets increasingly stronger.

Other Prominent Events to Watch for:

Wednesday - US Crude Oil Inventories; US FOMC Minutes Release.

Thursday - FED Chair Powell Speaks;