Industrial Activity in the Eurozone Likely to Continue Seesawing in March

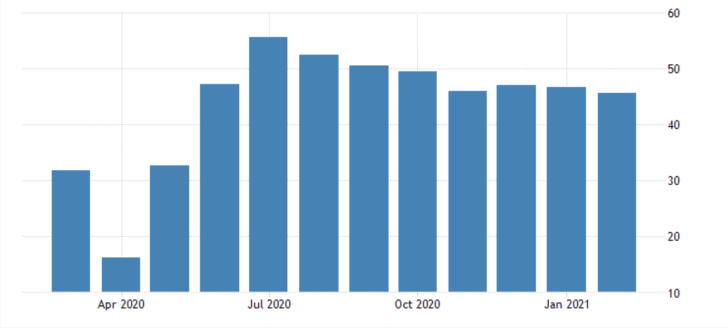

This week's most important economic releases will be the publication of Germany and France's industry numbers for March. As usual, the Markit institute is scheduled to post data for the services and manufacturing sectors of the two biggest economies in the Euro Area.

In France, the services PMI is expected to drop marginally by 0.1 per cent, whereas manufacturing is projected to increase by 0.3 per cent. In contrast, German manufacturing is anticipated to advance by just 0.1 per cent.

Unsurprisingly, the German services PMI data is likely to garner the most interest out of the four components. It typically represents the most accurate marker of industrial stability in the Eurozone. The consensus forecasts project a marginal increase of 0.7 per cent from February's 45.7 per cent.

The slow and bumpy road to recovery in the Eurozone continues to be stymied by various factors residing outside of the economic sphere. The recent vaccine tribulations exacerbated tensions and are likely to impede the already poor sentiment in the Euro Area.

The uneven recovery, which is especially apparent in the two industrial sectors in France and Germany, compelled the ECB to accelerate the rate of its asset purchase programme recently in a bid to strengthen industrial activity.

All of this uncertainty in the French and German industrial sectors is unlikely to cushion the blows to the euro, which continues to retreat against the recuperating dollar.

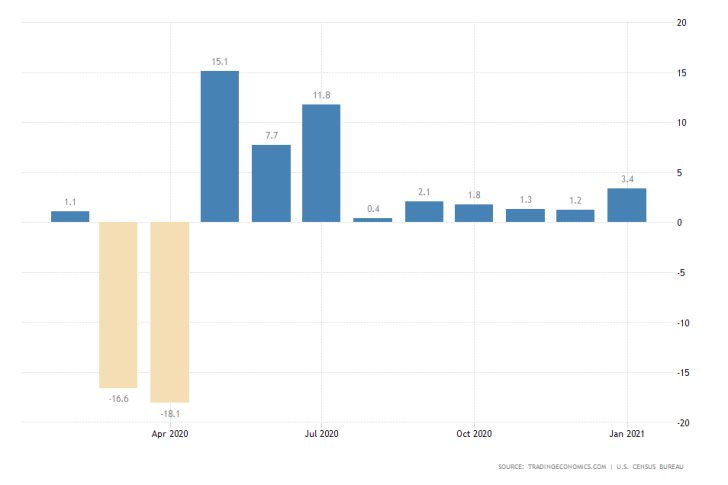

U.S. Durable Goods Orders Expected to Decrease in February

Even though the American economy is performing comparatively better than the countries in the EU bloc, its own industry is not yet completely immune to ripples in global demand.

On Wednesday, the Census Bureau in the U.S. is scheduled to publish the latest durable goods orders data for February. According to the preliminary market forecasts, a much smaller expansion of 0.9 per cent will be recorded for the previous month compared to January's massive uptick of 3.4 per cent.

Such a downwardly revised performance will not be detrimental to the broader recovery efforts in the U.S. The contraction will not be so surprising at all, given the recently observed rebound in consumption.

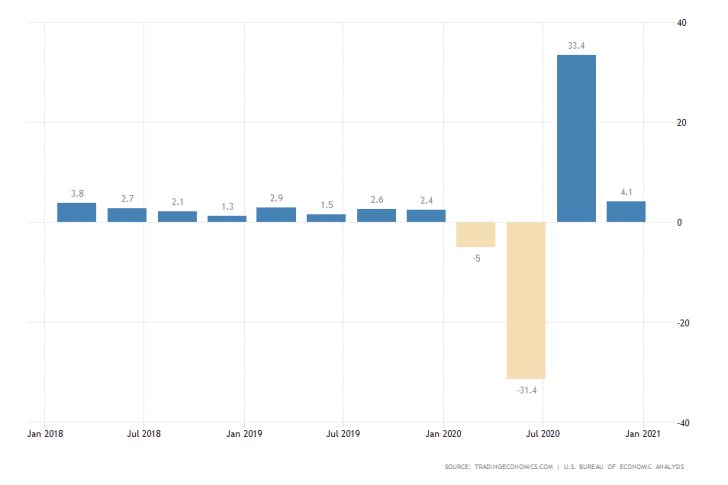

No GDP Growth Rate Surprises Expected in the U.S. for Q4 of 2020

On Thursday, the Bureau of Economic Analysis is scheduled to post the Final Gross Domestic Product (GDP) numbers in the U.S. for the last quarter of 2020. The preliminary market forecasts anticipate no surprise revisions.

Therefore, the final growth rate is likely to remain unchanged at 4.1 per cent, which would underpin the end of the initial coronavirus blow to the underlying economic activity.

If these projections are indeed realised, such a performance will represent good news for the gaining dollar. Given the prominence of the industrial and economic releases in the Eurozone and U.S., the EURUSD is most likely to register heightened volatility over the next five days.

As can be seen on the 4H chart below, the pair's underlying sentiment remains prevailingly bearish despite a minor bullish consolidation. The price action appears to be forming a major triangle, anticipating an eventual breakdown below the pattern's lower boundary. This will signify the likely continuation of the broader downtrend's development.

The recent rebound from the 100-day MA (in blue) and the emergence of a bearish crossover on the MACD indicator both substantiate these forecasts for future price depreciation.

Other Prominent Events to Watch for:

Monday - FED Chair Powell Speaks.

Tuesday - FED Chair Powell Testifies; UK Unemployment Rate; BOE Governor Bailey Speaks; BOJ Monetary Policy Meeting Minutes.

Wednesday - UK y/y CPI; UK Services and Manufacturing PMI Data; US Flash Manufacturing PMI; FED Chair Powell Testifies; US Crude Oil Inventories; ECB President Christine Lagarde Speaks.

Thursday - BOJ Governor Kuroda Speaks; Switzerland SNB Policy Rate Decision; BOC Governor Macklem Speaks; ECB President Christine Lagarde Speaks; BOE Governor Bailey Speaks; Day 1 EU Economic Summit.

Friday - UK m/m Retail Sales; German Ifo Business Climate; Euro Summit.