ECB to Potentially Rethink its PEPP Timing Given Rising Inflation

The Governing Council of the European Central Bank is scheduled to meet on Thursday and deliberate on its current monetary policy stance. The bank is expected to maintain an accommodative stance by virtue of keeping the near-negative Main Refinancing Interest Rate unchanged at 0.00 per cent.

Traders and investors would be eager to see whether the ECB decides to recalibrate its Pandemic Emergency Purchase Programme (PEPP). At its last meeting, the Council decided to preserve the total purchasing envelope at 1.850 billion euros at least until the end of March 2022.

Europe needs to keep combatting the pandemic, President Christine @Lagarde tells @CNBCClosingBell. The ECB can expand its measures if needed, however pressing on with the recovery fund and vaccinations is now top priority. Read the full interview https://t.co/sh4SWqw6Q3 pic.twitter.com/Cw4L65lPHB

— European Central Bank (@ecb) April 12, 2021

The Council also expects "purchasing under the PEPP over the next quarter to be conducted at a significantly higher pace" based on "a joint assessment of financing conditions and the inflation outlook".

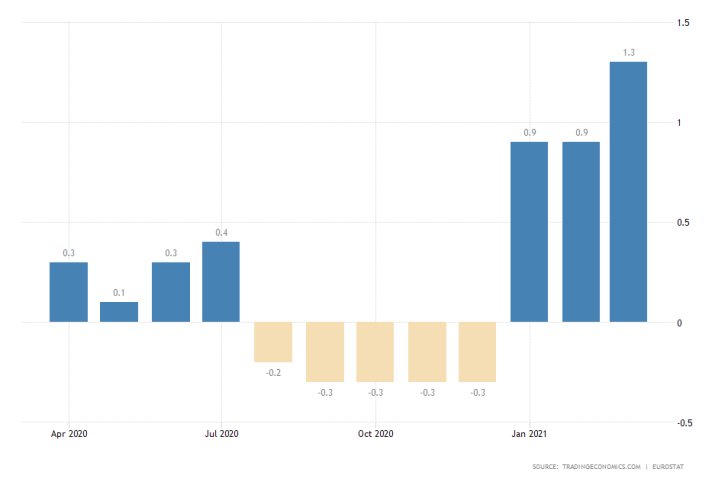

The effort is proving successful as headline inflation in the Eurozone has risen by 0.4 per cent over the previous month, underpinning a noticeable improvement in price stability. The trend of rising prices is likely to continue in April, thereby driving demand closer to ECB's medium-term goals.

With inflation on the rise and financial conditions improving, though at an uneven pace, the Governing Council now has more incentives to rethink the pace of the set of measures that it is currently implementing.

A potentially optimistic-sounding policy statement of the ECB could strengthen the euro, which gained significant ground against the dollar last week. Expect heightened volatility on the EURUSD pair around the time of the decision's publication.

Johnson & Johnson Expected to Beat Last Year's Performance Despite Vaccine Woes

The earnings season is continuing this week, with several notable releases set to shake the stock market. First up will be Johnson & Johnson, the U.S. pharmaceuticals giant, scheduled to post earnings data on Tuesday before the market open.

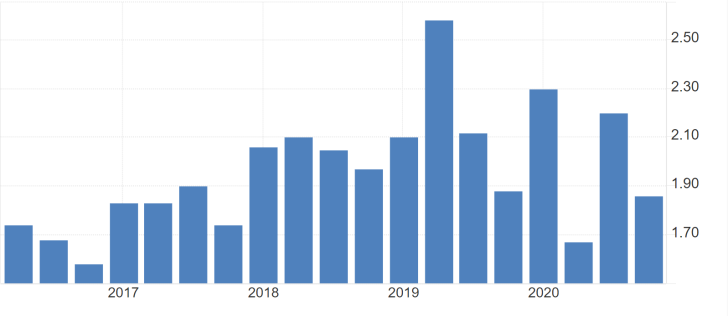

According to the preliminary market forecasts, the company is expected to publish Earnings per Share (EPS) of $2.31 for the first quarter of 2021. If realised, this performance would exceed marginally the $2.30 EPS that were posted for the same period last year.

The company has had a rollercoaster of a 2020 with several hits and misses, and company executives would be hoping for a good start to the new year. The EPS data will be published in an already volatile market, as Johnson & Johnson's vaccine is currently being scrutinised over its safety.

The Struggles of Netflix's Share Price Likely to Persist in the Near Future

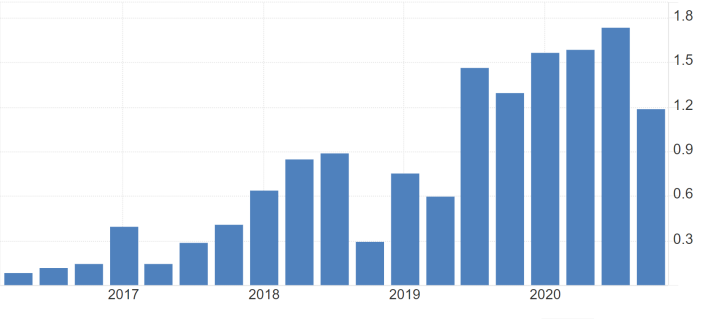

The streaming giant is also anticipated to release its EPS numbers for Q1 on Tuesday after the market close. The initial forecasts are quite optimistic as the company is expected to deliver earnings of $2.98 for the first quarter, which, if realised, would be the strongest quarterly performance on record. In contrast, Netflix posted EPS of $1.61 for the same period last year.

Even still, it should be noted that the company's performance has felt short of the consensus forecasts on each occasion over the last four quarters, which raises the likelihood of it failing to meet the expectations for a fifth consecutive time.

This could jolt Netflix's share price, which is already struggling to continue advancing higher, as it has been range-trading over the past several weeks. As can be seen on the 4H chart below, the stock is currently contained within two swing extremes.

Following its recent rebound from the psychologically significant support level at 500.00, the share price has resumed developing a pattern that closely resembles a Bearish Bat outline. This is a type of reversal pattern that typically is taken to signify a likely dropdown.

If the current upswing is exhausted around 571.00, which is where the Bearish Pattern should be completed, this would signal the likely emergence of such a dropdown. Its first major target would likely be the psychological support at 500.00.

Netflix failing to deliver earnings of $2.98 for Q1 could potentially serve as a catalyst for such a bearish rebound.

Other Prominent Events to Watch for:

Monday - Coca-Cola Co. reporting BMO.

Tuesday - New Zealand CPI q/q; RBA Meeting Minutes; UK Unemployment Rate; ECB Bank lending survey; Lockheed Martin Corp. reporting BMO; Harley-Davidson Inc. reporting BMO.

Wednesday - Australia Retail Sales m/m; UK CPI y/y; BOE Governor Bailey Speaks; Canada CPI m/m; BOC Overnight Rate Decision; Nasdaq Inc. reporting BMO.

Thursday - American Airlines Group Inc. reporting BMO; AT&T Inc. reporting BMO; Intel Corp. reporting AMC.

Friday - French and German Services and Manufacturing PMI; UK Manufacturing and Services PMI; US Flash Manufacturing PMI; American Express Co. reporting BMO.