US stock futures jumped in the pre-market session today on the news that the Democrats and Republicans in the Senate have reached an agreement regarding the size and structure of the anticipated fiscal stimulus package. The decision was reached after several days of heated discussions regarding the scope of the relief package.

The House Democrats also demanded on building a mechanism for moderating who gets what help, which stalled the negotiations initially.

The Senate Majority Leader Mitch McConnell said early on Wednesday that he has ‘good news’ for the American people.

A bipartisan agreement between the Dems and the GOP will be voted on in Senate later today, which would clear the way for the biggest stimulus package in US history.

"At last, we have a deal. […] It will inject trillions of dollars into the economy as fast as possible to help American workers, families, small businesses, and industries make it through this disruption."

White House economic adviser Larry Kudlow said that:

“The toll package here comes to roughly $6 trillion. Two trillion direct assistance, roughly four trillion in Federal Reserve lending power. Again, will be the largest Main Street financial package in the history of the United States.”

Kudlow also emphasised that the US was heading for a rough period, but that it is going to be ‘only weeks or months, not years’. The economic adviser to the President stressed on the expectation for a quick recovery due to the massive liquidity that is currently being provided to the economy.

The aggregate stimulus package would amount to roughly 30 per cent of the US yearly GDP. The expanded government spending and the looser monetary policy are going to increase drastically the budget deficit, which was already expected to surpass $1 trillion even before the outbreak of the coronavirus.

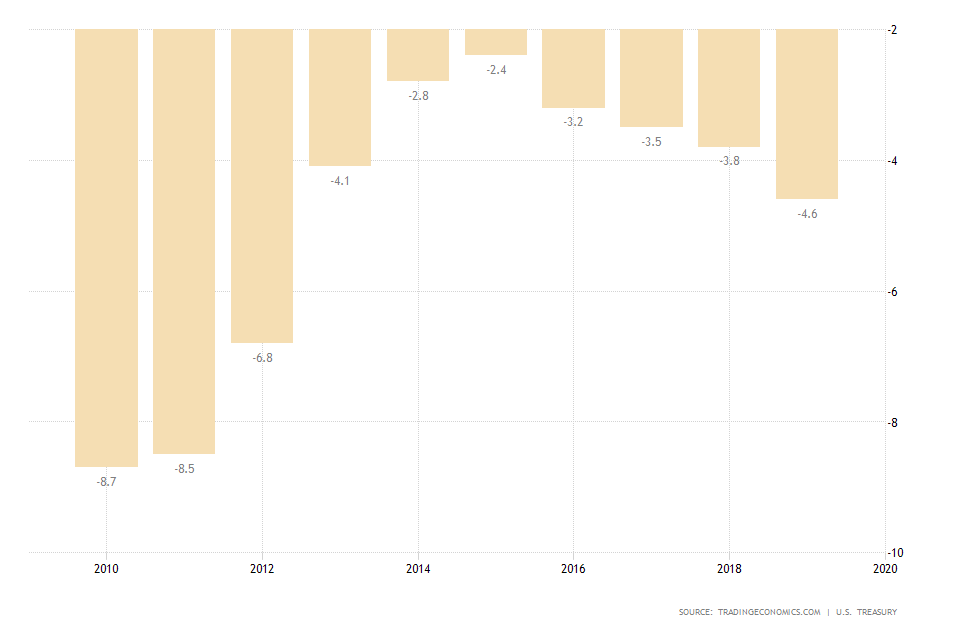

In comparison, the government budget deficit in 2019 was equal to 4.6 per cent of the country’s Gross Domestic Product.

Investors anticipated the decision as the economic downturn is quickly accelerating due to the imposed national measures for social distancing.

The DOW and the S&P 500 generated massive gains yesterday on investors’ expectations for a stimulus package, which Donald Trump would have to sign once it gets passed in Senate.

The Senate deal is the latest step in the organisation of the US relief package, which is presently employing both fiscal and monetary policies.

It is hoped that the near negative interest rates; bolstered asset-purchasing program, reduced taxes and increased government spending are going to comprise a sufficiently comprehensive mechanism for reducing the negative impact of the COVID-19 fallout, and for steering the economy out of recession.

Mitch McConnell referred to the combined effort as a ‘Wartime level of investment’.

Meanwhile, the announcement of the enormous relief package brought about the end of the dollar’s strengthening run. The demand for the greenback surged drastically over the past several weeks as investors globally scrambled for safe havens.

However, the now considerably bolstered liquidity in the US economy’s circulation is going to decrease the value of the greenback in the midterm. The increased money supply means that the competitiveness of the currency is going to diminish, which subsequently is going to reduce the demand for the currency amongst foreign investors.

The EURUSD managed to break out above the significant support level at 1.07800 and is currently consolidating in a tight range. The pair's bullish momentum is likely to increase in the following days as the euro begins to surpass the dollar as the go-to haven for international traders and investors.

If, however, the pair falls back below the aforementioned support and the regression channel's middle boundary, that would be a piece of evidence that the prevailing market uncertainty is still weighing down on the centralised currency.