Arguably the most important event for the week ahead, The Monetary Policy Committee of the Reserve Bank of New Zealand is going to hold a meeting early on Wednesday morning to deliberate on the country’s interest rate policy.

The decision is coming after a series of muddled economic data releases and heightened global tensions, which puts the RBNZ in a tight spot to protect its long-term economic goals in this volatile and uncertain environment.

After the last meeting, which was held on the 8th of May, the Committee reached an expected (you can read more about the situation in the country prior to the last meeting here) agreement to lower the interest rate level with 0.25 basis points to 1.50 per cent. The Monetary Committee was compelled to take such a course of action because of several crucial reasons:

“Global economic growth has slowed since mid-2018, easing demand for New Zealand’s goods and services.[…] Employment is near its maximum sustainable levels. However, the outlook for employment growth is more subdued and capacity pressure is expected to ease slightly in 2019. Consequently, inflationary pressure is projected to rise only slowly.” [source]

Conversely, the RBNZ is expecting to boost aggregate demand and support faster-paced economic growth with a more accommodative monetary policy, which addresses the most recent changes in the underlying conditions. However, economic data has shown mixed signals since the adjustment of the interest rate policy.

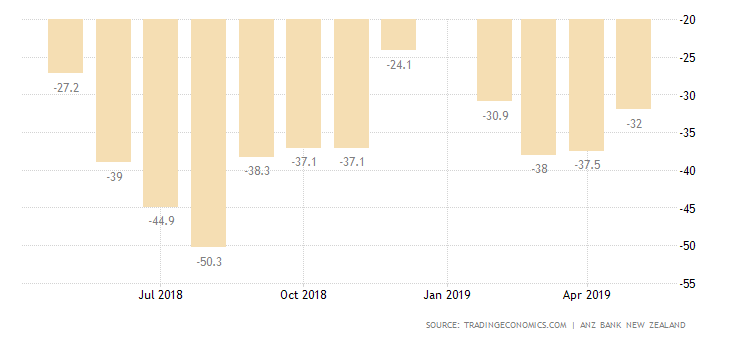

On the one hand, business confidence has improved noticeably, which means that investors are weighing on the future success of the lower rates and their expected positive impact on future economic growth.

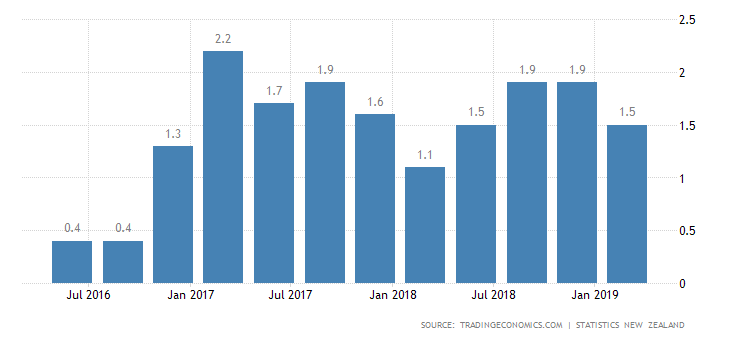

On the other hand, inflation has decreased from 1.9 per cent to 1.5 per cent, which misses the RBNZ's expectations of slight growth in the near-term, and instead measured a sharp turn in the opposite direction. A decreased price stability could potentially have detrimental effects on the monetary policy in the medium-term, which might necessitate even more rousing changes of the interest rate to support the price setting and boost consumer spending.

Meanwhile, unemployment has decreased with 0.1 per cent to 4.2, which could partially be attributed to the improved business confidence and increased investment levels in the economy, but at the same time, it does not provide a lot of reasons for enthusiasm amongst investors, as employment remains at its maximum sustainable level.

Overall, the general expectations are for the RBNZ to maintain the interest rate at the current level of 1.50 per cent and investors are gearing up to hear the remarks of the Monetary Policy Committee in regards further possible cuts in the rate by the end of 2019.

However, the announcement of surprising cuts as soon as Wednesday is not entirely out of the picture, as the RBNZ might interpret the fall in the underlying inflation as a disturbing sign of the inadequacies of the current monetary policy, and hence, decide to implement even more accommodative stance.

Regardless of whether the Monetary Policy Committee decides to lower the rate on Wednesday or keep it at the current level, but elaborate on potential cuts by the end of the year, the most likely outcome is for the NZD to experience specific pressures following the release of the RBNZ's monetary policy statement.

Consequently, the resulting volatility after the end of the meeting should be significant enough to test the strength of the major level of 0.65916 of the NZDUSD pair.