Early on Tuesday morning, the Board of Governors of the Reserve Bank of Australia decided to lower the interest rate in the country with 25 basis points. Thus, the rate is now at 0.75 per cent, which is a notable decrease from the previous level of 1 per cent.

This is the third reduction of the rate for the RBA in 2019, which is driven mostly by the deteriorating global trade outlook, causing central banks to adopt increasingly more accommodative monetary stands.

The Board’s monetary statement began with a commentary on the current state of the global economy, by arguing that the outlook for future growth remained reasonable despite the observed heightened risks to the downside.

“The US-China trade and technology disputes are affecting international trade flows and investment as businesses scale back spending plans because of the increased uncertainty.” [source]

This statement demonstrates the determination of the RBA, alongside other major central banks, to tackle this apparent decline in investments worldwide by lowering the respective interest rates in order to stimulate the economic activity.

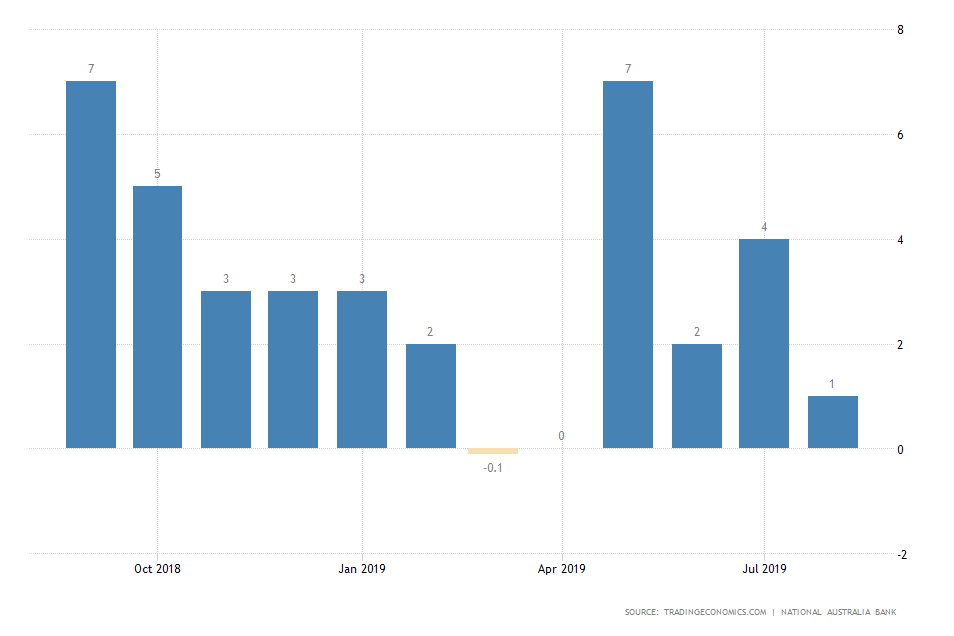

The waning investment rates can be exemplified by the above chart, which demonstrates the steadily deteriorating business confidence index in Australia.

Ultimately, RBA’s decision to cut the interest rate at the present moment seems to resonate with Jerome Powell’s remarks from earlier this year, when he argued that central banks lower their respective rates as an insurance measure.

The eventual settlement of the trade war between China and the US is going to have an overwhelmingly positive impact on global trade, which in turn is going to negate the prevailing uncertainty.

Consequently, as the downside risks to growth start to lessen gradually, central banks are expected to react by raising their respective interest rates.

There is no other evident reason to justify prolonging the current trend of monetary easing, apart from the aforementioned trade uncertainty.

The Australian economy remains vulnerable to outside pressures, due to its heavy reliance on FDI and trade, particularly with China.

Nevertheless, internal economic factors continue to demonstrate encouraging data, in spite of the observed soft patch in growth from the previous quarter. In the monetary statement, it was further argued that:

“The Australian economy expanded by 1.4 per cent over the year to the June quarter, which was a weaker-than-expected outcome. A gentle turning point, however, appears to have been reached with economic growth a little higher over the first half of this year than over the second half of 2018. The low level of interest rates, recent tax cuts, ongoing spending on infrastructure, signs of stabilisation in some established housing markets and a brighter outlook for the resources sector should all support growth.”

Thus, the Australian dollar tumbled with 0.67 per cent against the US dollar, following the release of the monetary policy statement. Yet the pair corrected some of the losses after the price reached a critical support level at 0.66730.