The Board of Directors of the Reserve Bank of Australia is scheduled to meet this week on Tuesday, in order to assess the most recent economic changes and decide whether to implement any changes to its current monetary agenda.

The prevailing market forecasts project a reduction in the interest rate with 25 basis points to 0.75 per cent; however, it remains to e seen whether Phillip Lowe, the Governor of the RBA, and his colleagues are going to implement such a course of action.

The Australian growth rate went through a soft patch recently, and both economic analysts and RBA officials seem to agree that the downside risks to the economy have increased during the last quarter.

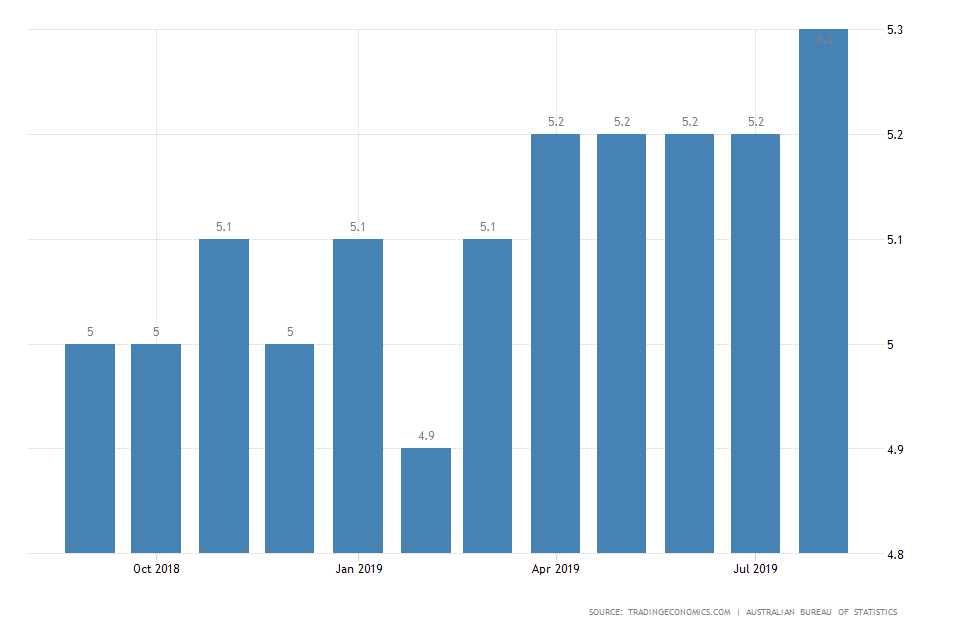

The unemployment rate edged up to 5.3 per cent in August from 5.2 per cent in July. This was the first recorded rise in the overall unemployment since April 2019, and investors worry that the labour market is suffering more and more from heightened global trade tensions.

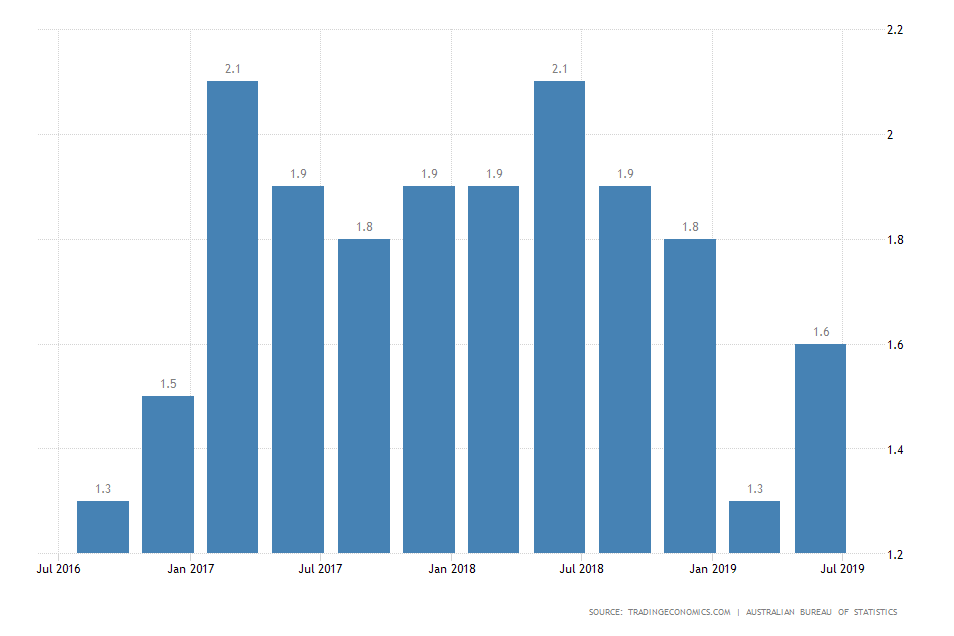

Inflation, too, is going through turbulent times, as the seasonally adjusted rate increased to 1.6 per cent in July from the recorded 1.3 per cent in the previous period. Prior to that, the inflation rate tumbled from 1.8 per cent in the quarter ending in January 2019.

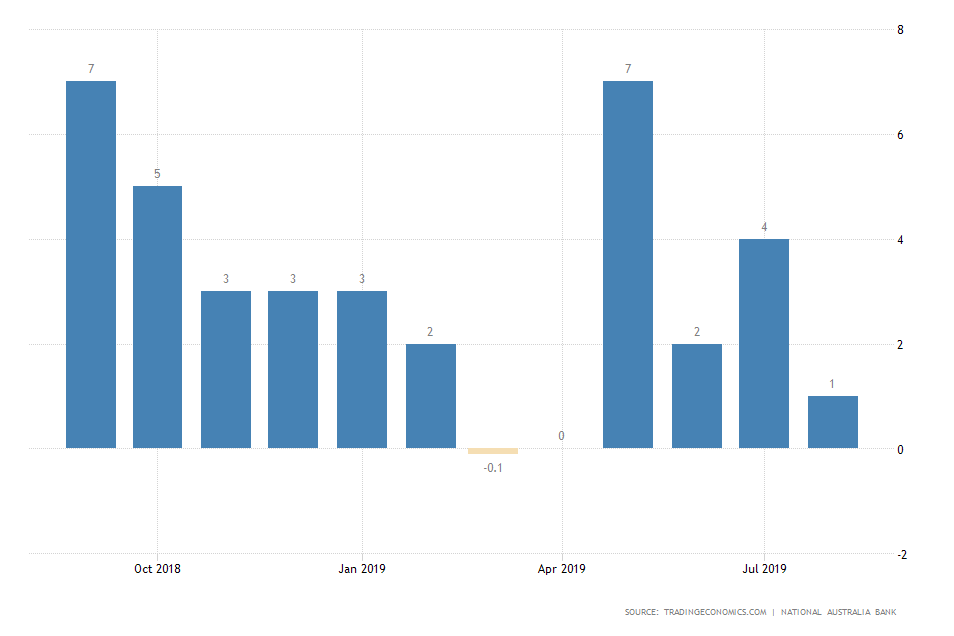

The investment rate has been gradually waning in Australia, leading to distorted price stability and bewildered local businesses.

Consequently, the business confidence index tumbled to 1 in August 2019, which is way below the long-term average of 6. This gloomy outlook on the Australian economic prospects manifests the fears of investors, which currently weigh in heavily on the subdued growth.

On the whole, a likely reduction in the interest rate would be justified, given the evident need for stimulating the economic activity.

Nevertheless, Philip Lowe has recently argued that the observed moderation of the growth rate is not expected to impede the long-term economic expansion, which could potentially deter the Board from reducing the interest rate at the present moment.

Instead, the RBA might decide to wait and see how the international geopolitical circumstances develop next. You can read more about Governor Lowe’s views here.

“The main message on the global economy is that while it is still growing reasonably well, the risks are increasingly tilted to the downside. The main source of these downside risks is geopolitical developments in many parts of the world. These developments are creating considerable uncertainty, and this uncertainty is causing businesses to reconsider their spending plans. This is making the international environment more challenging for us.” [source]

Meanwhile, the AUDUSD continues to trade in a narrow range, just above the major support level at 0.67420. If the RBA does indeed cut the interest rate on Tuesday, the price of the pair is more than likely to break below that level.

Alternatively, if the central bank decides to abstain from changing anything in its monetary agenda, this decision would deliver a much bigger market surprise which could potentially send the AUD/USD trading in the opposite direction.