Earlier today, the Governing Council of the Reserve Bank of Australia met, and expectedly decided to maintain the near-negative interest rate unchanged at 0.25 per cent.

The Bank also announced that it would be scaling up its asset purchases facility in the secondary market due to unfavourable yields of the 3-year Australian Government Securities (AGS).

"The yield on 3-year Australian Government Securities (AGS) has been consistent with the target of around 25 basis points. The yield has, however, been a little higher than 25 basis points over recent weeks. Given this, tomorrow the Bank will purchase AGS in the secondary market to ensure that the yield on 3-year bonds remains consistent with the target."

In the monetary policy statement, the Bank also quite expectedly commented on the recent spike of COVID-19 cases in the state of Victoria, which compelled local authorities to reimpose more strident containment restrictions.

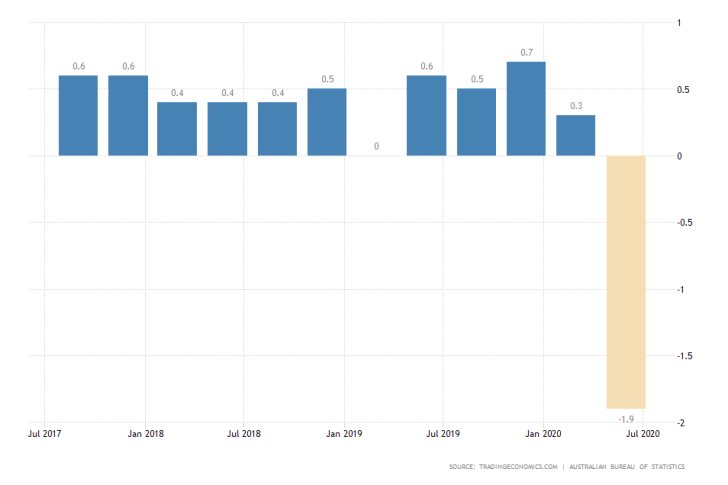

As fears of a second epidemic wave continue to rise, so does the negative outlook on an already tentative recovery process. Council members expect to observe muted inflationary pressures, low GDP output and sub-optimal employment conditions over the next couple of years, according to a baseline scenario.

These forecasts for a protracted and uneven recovery imply that the historically low Cash Rate is most probably going to be kept for as long as the economy needs to rebound and achieve inflation around 2 per cent coupled with maximum employment.

Hence, the RBA is likely to keep the Cash Rate at its current 0.25 per cent level over the next couple of years, which would necessitate the continuation of the already accommodative monetary policy.

The Governing Council also did not fail to acknowledge Australia's dependency on robust foreign trade for sustained recovery, chiefly with its biggest trade partner China, but it also expressed certain optimism concerning the initial response of the economy to the downturn.

"International trade remains weak, although there has been a strong recovery in industrial activity in China over recent months. […] the downturn is not as severe as earlier expected and a recovery is now underway in most of Australia. This recovery is, however, likely to be both uneven and bumpy, with the coronavirus outbreak in Victoria having a major effect on the Victorian economy."

Meanwhile, the Australian dollar looks ready to begin correcting its earlier gains, as we argued in our latest analysis. The AUDCAD formed a minor retracement following the previous downswing, and the underlying market sentiment is already starting to discount these changes by turning ostensibly bearish.

The Ichimoku Cloud indicator on the 4H chart below demonstrates this waning bullish bias, which is giving way to growing bearish bias. Moreover, the currently developing divergence, as postulated by the MACD indicator, supports the prevailing expectations for the establishment of an even bigger correction.